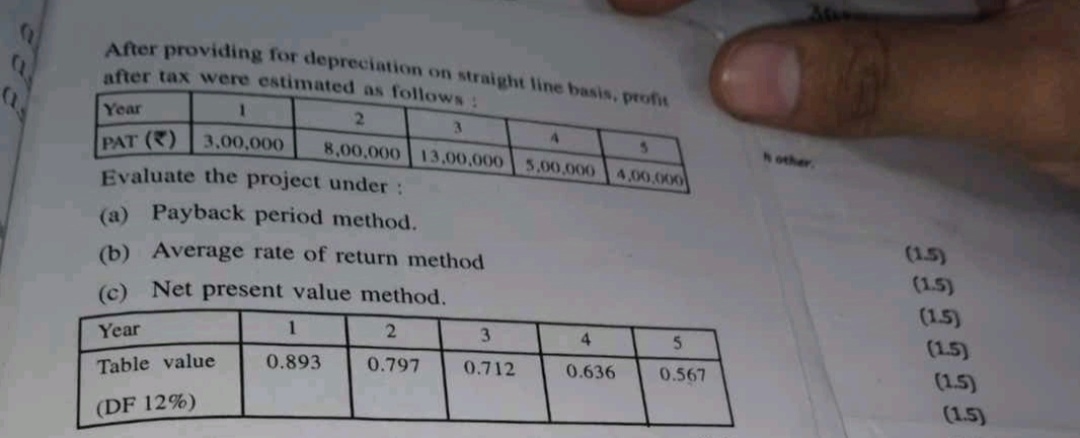

Evaluate the project under: (a) Payback period method. (b) Average rate of return method. (c) Net present value method.

Understand the Problem

The question is asking to evaluate a project based on three different financial assessment methods: payback period method, average rate of return method, and net present value method using provided profit after tax (PAT) figures and discount factors (DF).

Answer

Payback Period: 3.2 years, ARR: 26.4%, NPV: ₹-1,24,100.

Answer for screen readers

-

Payback Period: 3.2 years

-

Average Rate of Return (ARR): 26.4%

-

Net Present Value (NPV): ₹-1,24,100

Steps to Solve

-

Calculate Payback Period

The payback period is the time required to recover the initial investment. For this calculation, we assume an initial investment of ₹25,00,000 (based on the sum of profits).

- Cumulative cash flow for each year:

- Year 1: ₹3,00,000

- Year 2: ₹3,00,000 + ₹8,00,000 = ₹11,00,000

- Year 3: ₹11,00,000 + ₹13,00,000 = ₹24,00,000

- Year 4: ₹24,00,000 + ₹5,00,000 = ₹29,00,000

The payback period occurs between Year 3 and Year 4.

Calculation for exact payback in Year 4: $$ \text{Payback Time} = 3 + \frac{\text{Remaining to recover}}{\text{Cash flow in Year 4}} $$ $$ = 3 + \frac{1,00,000}{5,00,000} = 3 + 0.2 = 3.2 \text{ years} $$

- Cumulative cash flow for each year:

-

Calculate Average Rate of Return (ARR)

The ARR is calculated using the average annual profit and the initial investment.

-

Total profit over 5 years: $$ \text{Total PAT} = 3,00,000 + 8,00,000 + 13,00,000 + 5,00,000 + 4,00,000 = 33,00,000 $$

-

Average annual profit: $$ \text{Average Annual PAT} = \frac{33,00,000}{5} = 6,60,000 $$

-

ARR Formula: $$ \text{ARR} = \left( \frac{\text{Average Profit}}{\text{Initial Investment}} \right) \times 100 $$ $$ = \left( \frac{6,60,000}{25,00,000} \right) \times 100 = 26.4% $$

-

-

Calculate Net Present Value (NPV)

NPV is calculated by discounting the cash flows using the provided discount factors.

-

NPV calculation: $$ \text{NPV} = \sum (\text{PAT in Year n} \times \text{DF for Year n}) - \text{Initial Investment} $$

-

Calculate each year's contribution:

-

Year 1: $$ 3,00,000 \times 0.893 = 2,67,900 $$

-

Year 2: $$ 8,00,000 \times 0.797 = 6,37,600 $$

-

Year 3: $$ 13,00,000 \times 0.712 = 9,25,600 $$

-

Year 4: $$ 5,00,000 \times 0.636 = 3,18,000 $$

-

Year 5: $$ 4,00,000 \times 0.567 = 2,26,800 $$

-

Total discounted cash flow: $$ \text{Total Discounted Cash Flow} = 2,67,900 + 6,37,600 + 9,25,600 + 3,18,000 + 2,26,800 = 23,75,900 $$

-

NPV: $$ \text{NPV} = 23,75,900 - 25,00,000 = -1,24,100 $$

-

-

Payback Period: 3.2 years

-

Average Rate of Return (ARR): 26.4%

-

Net Present Value (NPV): ₹-1,24,100

More Information

These calculations indicate that while the project has a reasonable payback period and a high ARR, the negative NPV suggests that it may not be a worthwhile investment at a 12% discount rate.

Tips

- Forgetting to subtract the initial investment when calculating NPV can lead to inaccurate conclusions.

- Incorrectly calculating cumulative cash flows can misrepresent the payback period.

- Not using the correct discount factors for each year can affect the NPV accuracy.

AI-generated content may contain errors. Please verify critical information