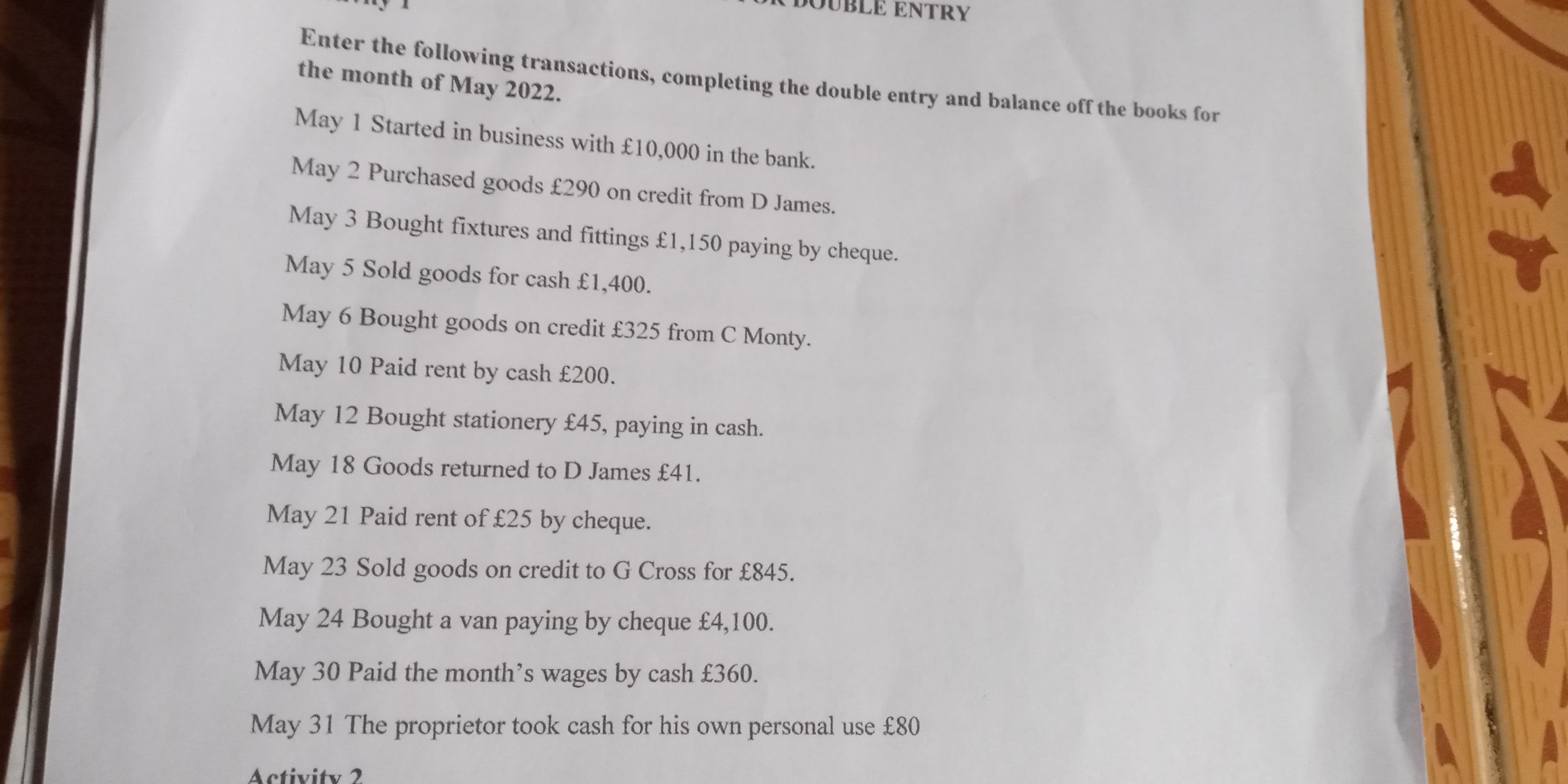

Enter the following transactions, completing the double entry and balance off the books for the month of May 2022. May 1 Started in business with £10,000 in the bank. May 2 Purchas... Enter the following transactions, completing the double entry and balance off the books for the month of May 2022. May 1 Started in business with £10,000 in the bank. May 2 Purchased goods £290 on credit from D James. May 3 Bought fixtures and fittings £1,150 paying by cheque. May 5 Sold goods for cash £1,400. May 6 Bought goods on credit £325 from C Monty. May 10 Paid rent by cash £200. May 12 Bought stationary £45, paying in cash. May 18 Goods returned to D James £41. May 21 Paid rent of £25 by cheque. May 23 Sold goods on credit to G Cross for £845. May 24 Bought a van paying by cheque £4,100. May 30 Paid the month's wages by cash £360. May 31 The proprietor took cash for his own personal use £80.

Understand the Problem

The question is asking for the completion of a double-entry bookkeeping exercise by entering a series of transactions for the month of May 2022. It requires the user to balance the books based on the provided transactions.

Answer

The balances for May 2022: Bank Balance = £4,040, Total Assets = £5,295, Total Liabilities = £574, Owner’s Equity = £4,721.

Answer for screen readers

The final balances for May 2022 are:

- Bank Balance: £4,040

- Total Assets: £5,295

- Total Liabilities: £574

- Owner’s Equity: £4,721

Steps to Solve

-

Record Opening Balance

Start with the initial capital in the bank account:

- Bank: £10,000

- Capital: £10,000

-

Record Purchases on Credit (May 2)

Bought goods on credit from D James:

- Goods: £290 (Increase in inventory)

- Creditor (D James): £290

-

Record Fixtures and Fittings Purchase (May 3)

Bought fixtures and fittings, paying by cheque:

- Fixtures: £1,150 (Decrease in bank)

- Bank: £8,850 (Decrease)

- Asset (Fixtures): £1,150 (Increase)

-

Record Cash Sale (May 5)

Sold goods for cash:

- Cash: £1,400 (Increase in bank)

- Sales Revenue: £1,400

-

Record Credit Purchase (May 6)

Bought goods on credit from C Monty:

- Goods: £325 (Increase in inventory)

- Creditor (C Monty): £325

-

Record Rent Payment (May 10)

Paid rent in cash:

- Rent: £200 (Decrease in bank)

- Bank: £8,650 (Decrease)

-

Record Stationery Purchase (May 12)

Bought stationery, paying in cash:

- Stationery: £45 (Decrease in bank)

- Bank: £8,605 (Decrease)

-

Record Goods Return to D James (May 18)

Goods returned to D James:

- Goods: £41 (Decrease in inventory)

- Creditor (D James): £41 (Decrease)

-

Record Rent Payment (May 21)

Paid rent by cheque:

- Rent: £25 (Decrease in bank)

- Bank: £8,580 (Decrease)

-

Record Credit Sale to G Cross (May 23)

Sold goods on credit to G Cross:

- Sales Revenue: £845 (Increase in sales)

- Debtor (G Cross): £845

- Record Van Purchase (May 24)

Bought a van, paying by cheque:

- Van: £4,100 (Increase in assets)

- Bank: £4,480 (Decrease)

- Record Wages Payment (May 30)

Paid wages in cash:

- Wages: £360 (Decrease in cash)

- Bank: £4,120 (Decrease)

- Record Proprietor's Draw (May 31)

The proprietor took cash for personal use:

- Draw: £80 (Decrease in cash)

- Bank: £4,040 (Decrease)

- Calculate and Balance Off Accounts

To balance the books, calculate the closing balances of all accounts:

- Total bank balance: £4,040

- Total creditors: £290 (D James) + £325 (C Monty) - £41 (D James return) = £574

- Total assets = Fixtures + Stationery + Van = £1,150 + £45 + £4,100 = £5,295

- Owner’s Equity = Assets - Liabilities = £5,295 - £574 = £4,721

The final balances for May 2022 are:

- Bank Balance: £4,040

- Total Assets: £5,295

- Total Liabilities: £574

- Owner’s Equity: £4,721

More Information

Double-entry bookkeeping ensures that every transaction is recorded in at least two accounts, maintaining a balance between total assets and total liabilities plus owner’s equity. This practice provides accuracy and accountability in financial reporting.

Tips

- Overlooking Transactions: Ensure each transaction is recorded; missing any can lead to imbalances.

- Misclassifying Expenses and Revenues: Be cautious with categories; clearly differentiate between assets, liabilities, revenues, and expenses.

- Arithmetic Errors: Verify calculations at each step to avoid mistakes in balances.

AI-generated content may contain errors. Please verify critical information