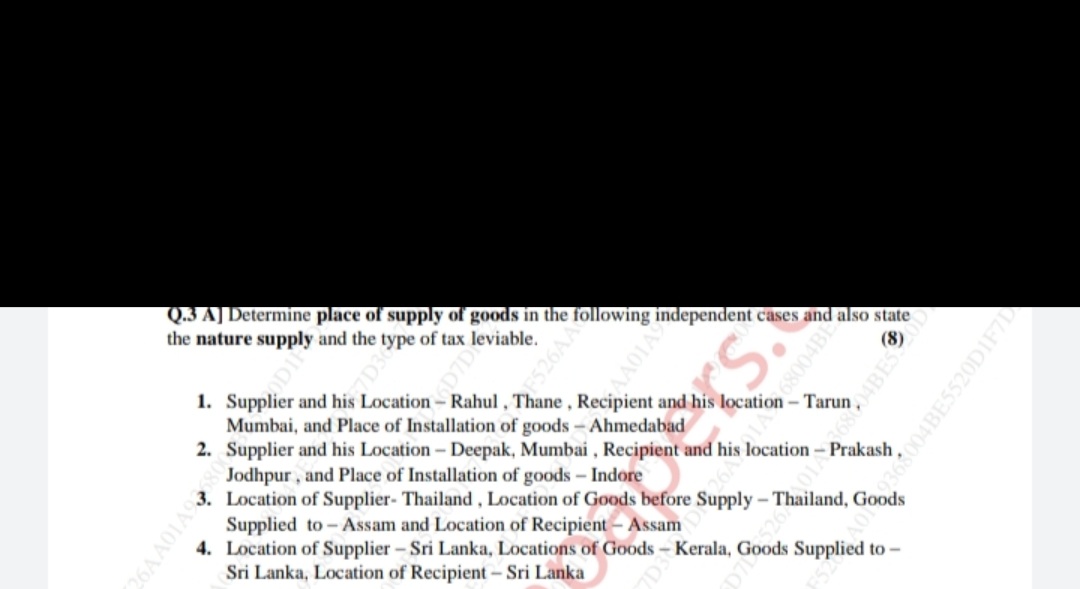

Determine the place of supply of goods in the following independent cases and also state the nature of supply and the type of tax leviable.

Understand the Problem

The question is asking to determine the place of supply of goods in various independent cases, identify the nature of supply, and specify the type of tax that is applicable for each case.

Answer

["1. Ahmedabad; Inter-state; IGST.","2. Indore; Inter-state; IGST.","3. Assam; Import; Customs duty\/IGST.","4. Sri Lanka; Export; No Indian GST."]

- Ahmedabad; Inter-state; IGST. 2. Indore; Inter-state; IGST. 3. Assam; Import; Customs duty/IGST. 4. Sri Lanka; Export; No Indian GST.

Answer for screen readers

- Ahmedabad; Inter-state; IGST. 2. Indore; Inter-state; IGST. 3. Assam; Import; Customs duty/IGST. 4. Sri Lanka; Export; No Indian GST.

More Information

The GST framework is designed to clearly distinguish between inter-state and intra-state transactions via the place of supply, ensuring the right tax is levied.

Tips

Confusing the recipient's location with the place of supply or neglecting the installation location can lead to incorrect tax application.

Sources

- Place of Supply of Goods - ClearTax - cleartax.in

- [PDF] CHAPTER 7: Place of Supply - CMA Vipul Shah - vipulshah.org