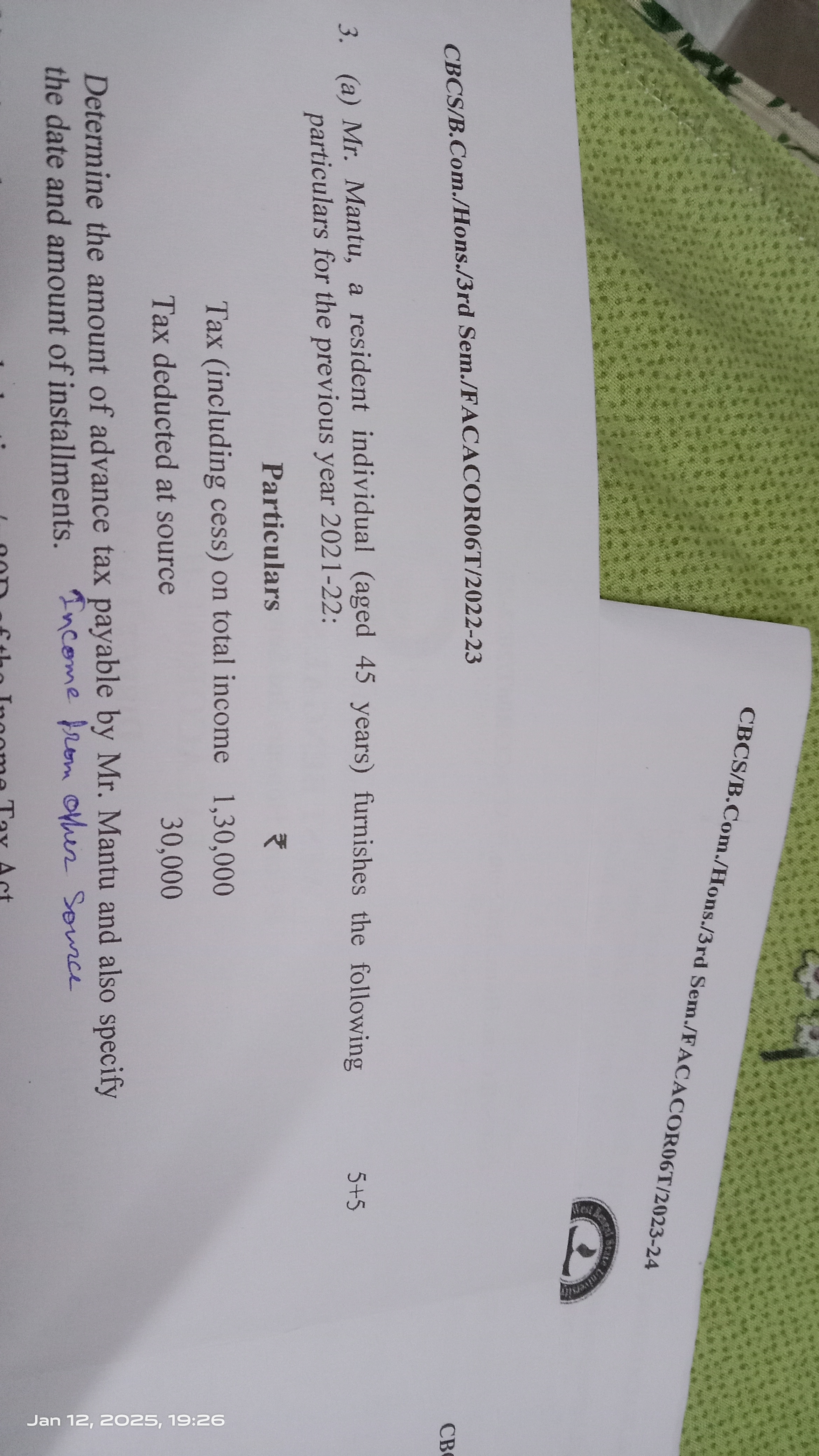

Determine the amount of advance tax payable by Mr. Mantu and also specify the date and amount of installments.

Understand the Problem

The question is asking to calculate and determine the amount of advance tax payable by Mr. Mantu for the previous financial year based on the provided income and tax details.

Answer

Advance tax payable by Mr. Mantu is ₹0; he will receive a refund of ₹30,000. No installments are required.

Answer for screen readers

Mr. Mantu's advance tax payable is ₹0, and he has a refund of ₹30,000 due to TDS.

Steps to Solve

-

Understanding the Income and Tax Details

Mr. Mantu's total income for the previous financial year is ₹1,30,000, and the tax deducted at source (TDS) is ₹30,000.

-

Calculate Taxable Income

In this case, calculate the amount of taxable income. The entire income is considered, as no deductions are mentioned:

- Taxable Income = Total Income = ₹1,30,000

-

Determine the Income Tax Rate

Assume that the applicable income tax slabs for individuals are as follows (Note: adjust based on the actual tax slabs for the financial year):

- Up to ₹2,50,000: 0%

- From ₹2,50,001 to ₹5,00,000: 5%

- From ₹5,00,001 to ₹10,00,000: 20%

- Above ₹10,00,000: 30%

Since Mr. Mantu's income is less than ₹2,50,000, no tax is applicable, and he will be eligible for a refund.

-

Calculate Advance Tax Payable

Total income is less than the exemption limit:

- Total Tax Liability = 0 (because ₹1,30,000 < ₹2,50,000)

- Advance Tax Payable = Total Tax Liability - TDS

[ \text{Advance Tax Payable} = 0 - 30,000 = -30,000 ]

Therefore, Mr. Mantu will get a refund of ₹30,000.

-

Specify the Date and Amount of Installments

Advance tax payments are typically done in four installments by specified dates:

- 1st Installment: By June 15 (15% of advance tax liability)

- 2nd Installment: By September 15 (45% of advance tax liability)

- 3rd Installment: By December 15 (75% of advance tax liability)

- 4th Installment: By March 15 (100% of advance tax liability)

Since Mr. Mantu's advance tax payable is negative, there is no requirement for any installments.

Mr. Mantu's advance tax payable is ₹0, and he has a refund of ₹30,000 due to TDS.

More Information

As Mr. Mantu's income was below the taxable limit, he is not required to pay any advance tax and can claim the entire TDS as a refund.

Tips

- Miscalculating taxable income by including exempted amounts. To avoid this, ensure you know the income tax slabs and exemptions clearly.

- Assuming TDS needs to be subtracted from advance tax when it’s actually a refund situation. Remember to compare total tax liability against TDS.

AI-generated content may contain errors. Please verify critical information