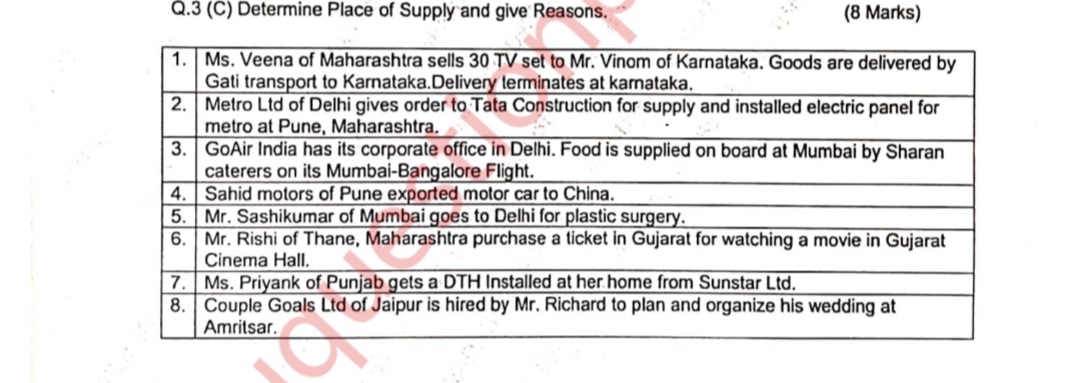

Determine Place of Supply and give Reasons.

Understand the Problem

The question requires determining the place of supply based on various scenarios provided, along with reasons for each determination.

Answer

1. Karnataka, 2. Maharashtra, 3. Mumbai, 4. Outside India, 5. Delhi, 6. Gujarat, 7. Punjab, 8. Punjab.

- Karnataka - Goods delivered there. 2. Maharashtra - Installation location. 3. Mumbai - Catering done there. 4. Outside India - Exported goods. 5. Delhi - Service received there. 6. Gujarat - Location of the cinema. 7. Punjab - Installation location. 8. Punjab - Event location.

Answer for screen readers

- Karnataka - Goods delivered there. 2. Maharashtra - Installation location. 3. Mumbai - Catering done there. 4. Outside India - Exported goods. 5. Delhi - Service received there. 6. Gujarat - Location of the cinema. 7. Punjab - Installation location. 8. Punjab - Event location.

More Information

The place of supply impacts whether a transaction is intra-state or inter-state, influencing GST application.

Tips

Ensure the correct identification of supplier and recipient locations to determine the correct place of supply.

Sources

- How to Determine Place Of Supply of Service Under GST - ClearTax - cleartax.in

- Place of Supply of Goods - ClearTax - cleartax.in

AI-generated content may contain errors. Please verify critical information