Design a swap that will net a bank, acting as intermediary, 50 basis points per annum. Make the swap equally attractive to the two companies and ensure that all foreign exchange ri... Design a swap that will net a bank, acting as intermediary, 50 basis points per annum. Make the swap equally attractive to the two companies and ensure that all foreign exchange risk is assumed by the bank.

Understand the Problem

The question is asking to design a financial swap transaction that benefits both Company X and Company Y while involving a bank as an intermediary. The goal is to make the swap attractive to both companies and ensure that all foreign exchange risks are managed by the bank.

Answer

The swap design involves Company X paying 6% on yen and Company Y paying 9.1% on USD, netting the bank 0.5%.

Answer for screen readers

Design a financial swap where Company X pays 6% on yen to Company Y, and Company Y pays 9.1% on USD to Company X. The bank earns 0.5% as an intermediary.

Steps to Solve

-

Identify Borrowing Needs

Company X needs to borrow USD at a fixed interest rate and Company Y needs to borrow yen. -

Analyze Interest Rates

-

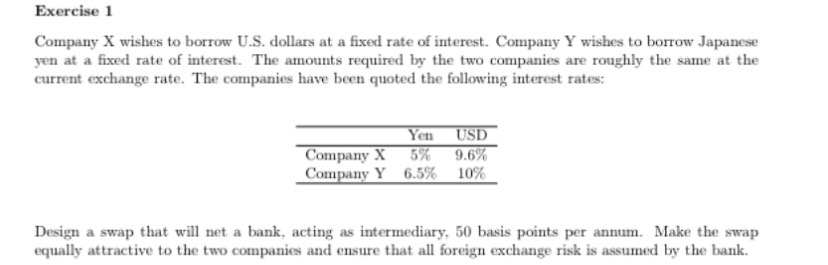

Company X's borrowing rates:

- Yen: 5%

- USD: 9.6%

-

Company Y's borrowing rates:

- Yen: 6.5%

- USD: 10%

-

Determine Potential Savings

Calculate the difference in the interest rates for both companies to see how a swap can benefit both:

- Company X can potentially save by borrowing in yen at 5% and lending at 6.5%.

- Company Y can save by borrowing in USD at 10% and lending at 9.6%.

-

Design the Swap

To avoid foreign exchange risk, the bank serves as an intermediary and facilitates a swap where:

- Company X pays Company Y interest at 6% on the amount in yen. (This takes into account the bank's fee of 0.5%.)

- Company Y pays Company X interest at 9.1% on the amount in USD.

-

Evaluate Attractiveness

Ensure both companies see an advantage from the swap:

- Company X would effectively pay 9.1% in USD vs. 9.6%.

- Company Y would effectively pay 6.0% in yen vs. 6.5%.

Design a financial swap where Company X pays 6% on yen to Company Y, and Company Y pays 9.1% on USD to Company X. The bank earns 0.5% as an intermediary.

More Information

In this swap arrangement, both companies achieve a reduction in their respective borrowing costs through exploiting the different interest rates available to them, while the bank earns a fee for facilitating the transaction.

Tips

- Not considering the bank's fee when calculating the final interest rates for each company.

- Misunderstanding that the swap should neutralize foreign exchange risks, requiring careful analysis.

AI-generated content may contain errors. Please verify critical information