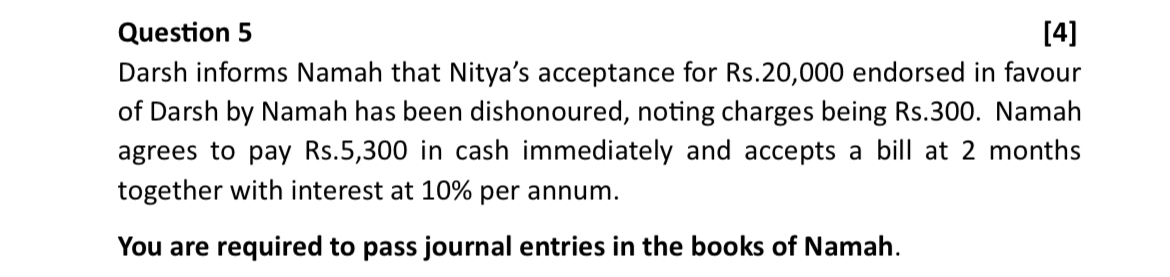

Darsh informs Namah that Nitya’s acceptance for Rs.20,000 endorsed in favour of Darsh by Namah has been dishonoured, noting charges being Rs.300. Namah agrees to pay Rs.5,300 in ca... Darsh informs Namah that Nitya’s acceptance for Rs.20,000 endorsed in favour of Darsh by Namah has been dishonoured, noting charges being Rs.300. Namah agrees to pay Rs.5,300 in cash immediately and accepts a bill at 2 months together with interest at 10% per annum. You are required to pass journal entries in the books of Namah.

Understand the Problem

The question is asking for journal entries related to a financial transaction involving dishonoured acceptance and a payment arrangement between Namah and Darsh. We will outline the necessary journal entries reflecting cash payment and the acceptance of a bill.

Answer

The journal entries for Namah's transactions involve the acknowledgment of dishonoured acceptance, cash payments, and accepting a bill for the remaining amount with interest calculation.

Answer for screen readers

The journal entries in the books of Namah are as follows:

-

When the acceptance is dishonoured:

Dr. Loss on dishonour of acceptance Rs. 300 Cr. Bill Receivable Rs. 20,000 -

Cash payment:

Dr. Darsh (Creditor) Rs. 5,300 Cr. Cash Rs. 5,300 -

Bill acceptance (remaining amount plus interest):

Dr. Bills Payable Rs. 14,333.33 Cr. Darsh Rs. 14,333.33

Steps to Solve

- Record the dishonour of acceptance

When the acceptance is dishonoured, we need to record the dishonour charges incurred. The entry will involve debiting the dishonour charges and crediting the bill receivable amount.

- Journal Entry:

Dr. Loss on dishonour of acceptance Rs. 300

Cr. Bill Receivable Rs. 20,000

- Cash payment entry

Namah pays Rs.5,300 in cash immediately, which will be recorded in the journal. This entry reflects a reduction in cash due to the payment made.

- Journal Entry:

Dr. Darsh (Creditor) Rs. 5,300

Cr. Cash Rs. 5,300

- Record the bill accepted for the remaining amount and interest

Namah accepts a bill for the remaining balance, which will be calculated including interest for 2 months at 10% per annum.

-

Calculate interest for Rs. 20,000 at 10% per annum for 2 months: [ \text{Interest} = \frac{20,000 \times 10 \times 2}{100 \times 12} = Rs. 333.33 ]

-

Total bill amount accepted: [ \text{Total Bill} = (20,000 - 5,300) + 333.33 = 14,000 + 333.33 = Rs. 14,333.33 ]

-

Journal Entry:

Dr. Bills Payable Rs. 14,333.33

Cr. Darsh Rs. 14,333.33

The journal entries in the books of Namah are as follows:

-

When the acceptance is dishonoured:

Dr. Loss on dishonour of acceptance Rs. 300 Cr. Bill Receivable Rs. 20,000 -

Cash payment:

Dr. Darsh (Creditor) Rs. 5,300 Cr. Cash Rs. 5,300 -

Bill acceptance (remaining amount plus interest):

Dr. Bills Payable Rs. 14,333.33 Cr. Darsh Rs. 14,333.33

More Information

In this transaction, Namah has to manage both the dishonoured acceptance and the agreement to pay off part of the debt in cash. The remaining amount is formalized with a bill that accounts for interest, showing how financial instruments can be converted in transactions.

Tips

- Neglecting Interest Calculation: It's essential to calculate interest accurately and remember to apply it for the correct time period.

- Incorrect Entries for Payment: Ensure the entries clearly reflect cash payments and the corresponding reduction in liability.

AI-generated content may contain errors. Please verify critical information