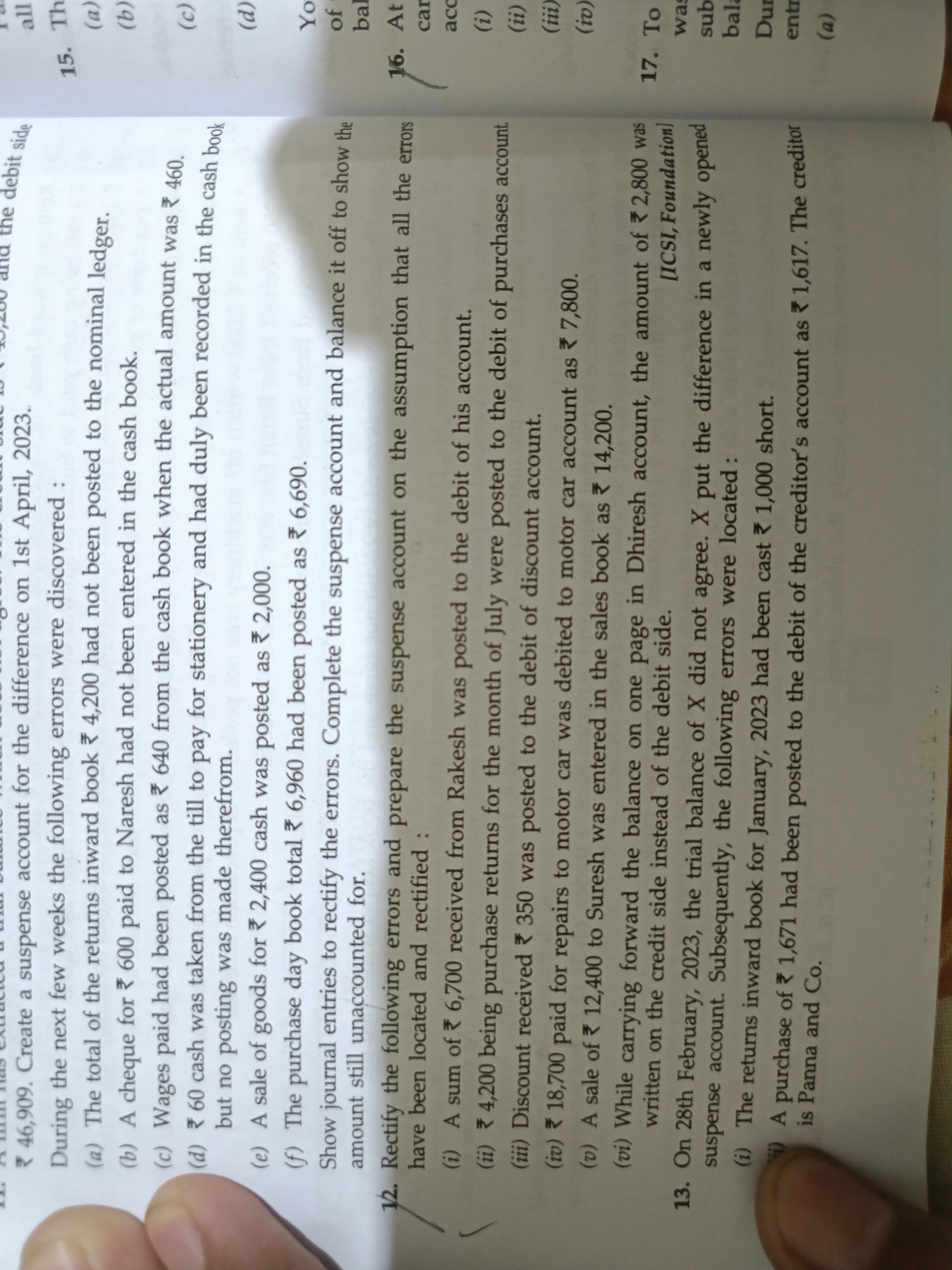

Create a suspense account for the difference on 14 April, 2023. During the next few weeks the following errors were discovered: (a) The total of the returns inward book £4,200 had... Create a suspense account for the difference on 14 April, 2023. During the next few weeks the following errors were discovered: (a) The total of the returns inward book £4,200 had not been posted to the nominal ledger. (b) A cheque for £460 paid to Naresh had not been entered in the cash book. (c) Wages of £640 paid to Salak had been recorded in the cash book, but no posting was made thereafter. (d) A sale of goods for £2,400 was posted as £6,960. (e) Discount received of £350 was posted to the debit of the purchases account. (f) Show journal entries to rectify the errors. Complete the amounts still unaccounted for, and prepare the suspense account.

Understand the Problem

The question is asking for the creation of journal entries to rectify certain accounting errors identified in various transactions. The focus is on correcting these entries and showing how they impact the accounts involved.

Answer

The journal entries for rectifying accounting errors include adjustments for wages, sales, discounts, and debtor accounts.

Answer for screen readers

The journal entries to rectify the errors are as follows:

-

For unposted cheque to Natresh:

Dr. Wage Expense $460 Cr. Bank $460 -

To correct sales entry:

Dr. Sales $6,960 Cr. Suspense Account $6,960 Dr. Suspense Account $2,400 Cr. Sales $2,400 -

For incorrect discount entry:

Dr. Purchases $350 Cr. Discount Received $350 -

To correct the debtor's account entry:

Dr. Suspense Account $1,200 Cr. Debtor's Account $1,200

Steps to Solve

- Identify Errors in Transactions

Review the list of transactions to identify specific errors that need rectifying. These include unposted amounts, incorrect postings, and wrong account entries.

- Create Journal Entries for Corrections

For each identified error, create a journal entry to correct it. Each entry should specifically reverse the incorrect action and correctly record the proper transaction.

- (a) For the unposted wage cheque to Natresh, create:

Dr. Wage Expense $460

Cr. Bank $460

- (b) For the sale mistakenly posted as $6,960 instead of the actual amount of $2,400:

Dr. Sales $6,960

Cr. Suspense Account $6,960

Dr. Suspense Account $2,400

Cr. Sales $2,400

- Adjust Other Affected Entries

Continue adjusting entries for other mentioned transactions.

- (c) For the discount on motor car posted incorrectly:

Dr. Purchases $350

Cr. Discount Received $350

- (d) For the debtor's account reflected twice:

Dr. Suspense Account $1,200

Cr. Debtor's Account $1,200

- Final Review

After all entries are created, review them to ensure that each error is addressed and that their effects on the accounts are properly balanced.

The journal entries to rectify the errors are as follows:

-

For unposted cheque to Natresh:

Dr. Wage Expense $460 Cr. Bank $460 -

To correct sales entry:

Dr. Sales $6,960 Cr. Suspense Account $6,960 Dr. Suspense Account $2,400 Cr. Sales $2,400 -

For incorrect discount entry:

Dr. Purchases $350 Cr. Discount Received $350 -

To correct the debtor's account entry:

Dr. Suspense Account $1,200 Cr. Debtor's Account $1,200

More Information

These entries help in maintaining accurate financial records by ensuring that each transaction reflects the true financial activity of the business. They also assist in rectifying discrepancies that occur in daily transactions.

Tips

- Failure to Properly Reverse Entries: Ensure to reverse the incorrect entry before posting the correct one.

- Mixing Up Debits and Credits: Double-check that debits and credits are correctly assigned in each transaction.

- Neglecting the Effects on the Suspense Account: Always ensure the suspense account is used correctly and balanced after corrections.