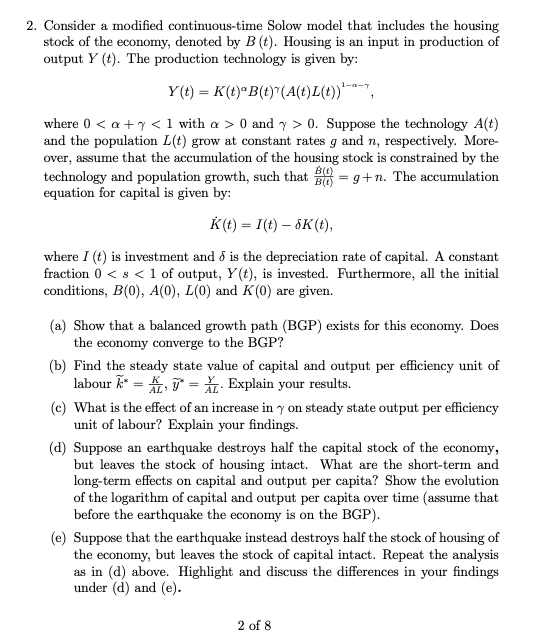

Consider a modified continuous-time Solow model that includes the housing stock of the economy, denoted by B(t). Housing is an input in production of output Y(t). The production te... Consider a modified continuous-time Solow model that includes the housing stock of the economy, denoted by B(t). Housing is an input in production of output Y(t). The production technology is given by Y(t) = K(t)αB(t)γ(A(t)L(t))1-α-γ, where 0 < α + γ < 1 with α > 0 and γ > 0. Suppose the technology A(t) and the population L(t) grow at constant rates g and n, respectively. Moreover, assume that the accumulation of the housing stock is constrained by the technology and population growth, such that Ḃ(t)/B(t) = g + n. The accumulation equation for capital is given by K̇(t) = I(t) - δK(t), where I(t) is investment and δ is the depreciation rate of capital. A constant fraction 0 < s < 1 of output, Y(t), is invested. Furthermore, all the initial conditions, B(0), A(0), L(0) and K(0) are given. Show that a balanced growth path (BGP) exists for this economy. Does the economy converge to the BGP? Find the steady state value of capital and output per efficiency unit of labor. What is the effect of an increase in γ on steady state output per efficiency unit of labour? Suppose an earthquake destroys half the capital stock of the economy, but leaves the stock of housing intact. What are the short-term and long-term effects on capital and output per capita? Show the evolution of the logarithm of capital and output per capita over time (assuming the economy is on the BGP) before the earthquake. Suppose that the earthquake instead destroys half the stock of housing of the economy, but leaves the stock of capital intact. Repeat the analysis as in (d) above. Highlight and discuss the differences in your findings under (d) and (e).

Understand the Problem

The question is asking us to analyze a modified continuous-time Solow model that includes housing as an input in production. It requires proving the existence of a balanced growth path (BGP), examining the effects of various changes in parameters, and determining the impact of earthquakes on capital and output per capita over time.

Answer

The balanced growth path exists, converging to $\hat{k}^* = \left( \frac{s}{\delta} \right)^{\frac{1}{1 - \alpha}}$; increase in $\gamma$ raises output per efficiency unit. Short-term capital loss due to earthquakes impacts recovery dynamics.

Answer for screen readers

The balanced growth path (BGP) exists; it converges to a steady state output, $\hat{k}^* = \left( \frac{s}{\delta} \right)^{\frac{1}{1 - \alpha}}$. An increase in $\gamma$ positively affects output per efficiency unit of labor, while capital destruction impacts output negatively in the short term but allows for recovery in the long run.

Steps to Solve

- Balanced Growth Path (BGP) Existence

To show that a balanced growth path exists, we express output per effective unit of labor:

$$ y(t) = \frac{Y(t)}{A(t)L(t)} = K(t)^{\alpha}B(t)^{\gamma} $$

We need to analyze the dynamics of capital and housing. To establish the existence of a BGP, we set the growth rates of all variables:

- The growth rate of $K(t)$: $K(t)$ grows at rate $g + n$.

- The growth rate of $B(t)$ also evolves with $g+n$.

Since these growth rates are equal, hence a stable relationship exists for $y(t)$ implying a BGP exists.

- Steady State Capital and Output Per Efficiency Unit of Labor

We derive the steady-state condition. We define the capital per effective unit of labor as:

$$ \hat{k} = \frac{K}{AL} $$

In steady state, we have:

$$ \dot{\hat{k}} = I(t) - \delta \hat{k} = s\cdot y = s K^{\alpha}B^{\gamma} $$

Then, solve for $\hat{k}$:

$$ \hat{k}^* = \left( \frac{s}{\delta} \right)^{\frac{1}{1 - \alpha}} $$

- Effect of Increase in $\gamma$ on Steady State Output Per Efficiency Unit of Labor

An increase in $\gamma$ will lead to a rise in $B(t)$ in the production function, affecting $y(t)$:

$$ \frac{\partial y^*}{\partial \gamma} > 0 $$

This indicates that as $\gamma$ increases, the output per efficiency unit of labor also increases, since more housing positively impacts production.

- Earthquake Impact on Capital and Output Per Capita

If an earthquake destroys capital but retains the housing stock, initially output and capital will fall. Long-term adjustments will occur as:

$$ y(t) = \frac{K(t)}{A(t)L(t)} $$

Assess the short-run drop due to lack of capital, followed by a gradual recovery as investment leads to new capital accumulation.

- Earthquake Impact on Housing and Capital

If the earthquake destroys housing and retains capital, the short-term will show minimal capital since housing lessens output. Long-term effects will be characterized by:

$$ \dot{y} < 0 \text{ short-term, } \dot{y} > 0 \text{ long-term} $$

The output will steadily increase again over time as labor and technology interact in the production of goods.

The balanced growth path (BGP) exists; it converges to a steady state output, $\hat{k}^* = \left( \frac{s}{\delta} \right)^{\frac{1}{1 - \alpha}}$. An increase in $\gamma$ positively affects output per efficiency unit of labor, while capital destruction impacts output negatively in the short term but allows for recovery in the long run.

More Information

The modified Solow model shows that including housing can significantly alter economic dynamics. Understanding the relationship between housing, capital, and output is crucial for better policy-making in disaster scenarios.

Tips

- Misunderstanding the relationship between growth rates; be clear that capital and housing growth impacts output.

- Confusing short-run analysis with long-run effects; always clarify the time frame of your conclusions.

AI-generated content may contain errors. Please verify critical information