Compute the static budget variance, the sales-activity variance and the flexible-budget variance for both revenues and operating income. Use U or F to indicate whether the variance... Compute the static budget variance, the sales-activity variance and the flexible-budget variance for both revenues and operating income. Use U or F to indicate whether the variances are favorable or unfavorable.

Understand the Problem

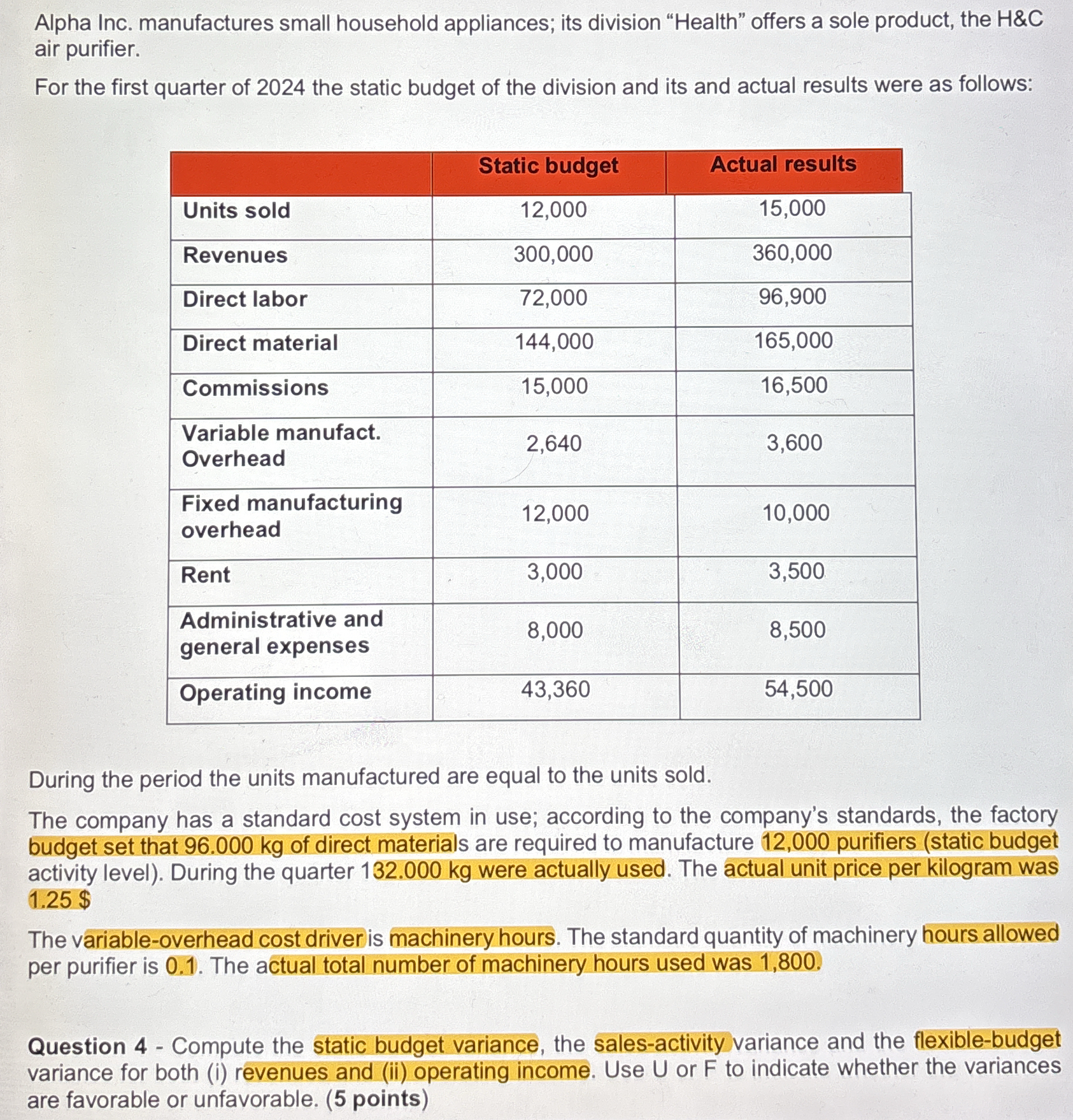

The question is asking to compute three variances related to the budget and performance of Alpha Inc.'s division: the static budget variance, the sales-activity variance, and the flexible-budget variance for revenues and operating income. This involves analyzing the differences between the static budget amounts and the actual results, as well as adjusting for changes in activity levels.

Answer

Static Budget Variance for Revenues: $60,000$ (F) Static Budget Variance for Operating Income: $11,140$ (F) Sales-Activity Variance for Revenues: $75,000$ (F) Sales-Activity Variance for Operating Income: $17,640$ (F) Flexible-Budget Variance for Revenues: $15,000$ (U) Flexible-Budget Variance for Operating Income: $6,500$ (U)

Answer for screen readers

- Static Budget Variance for Revenues: $60,000$ (Favorable)

- Static Budget Variance for Operating Income: $11,140$ (Favorable)

- Sales-Activity Variance for Revenues: $75,000$ (Favorable)

- Sales-Activity Variance for Operating Income: $17,640$ (Favorable)

- Flexible-Budget Variance for Revenues: $15,000$ (Unfavorable)

- Flexible-Budget Variance for Operating Income: $6,500$ (Unfavorable)

Steps to Solve

- Calculate the Static Budget Variance for Revenues and Operating Income

The static budget variance is calculated by subtracting the static budget amounts from the actual results.

For revenues: [ \text{Static Budget Variance (Revenues)} = \text{Actual Revenues} - \text{Static Budget Revenues} ] [ = 360,000 - 300,000 = 60,000 ]

For operating income: [ \text{Static Budget Variance (Operating Income)} = \text{Actual Operating Income} - \text{Static Budget Operating Income} ] [ = 54,500 - 43,360 = 11,140 ]

- Calculate the Sales-Activity Variance for Revenues and Operating Income

The sales-activity variance bases the static budget amounts on actual sales volume at their budgeted rates.

To determine the new revenue value based on actual units sold:

[ \text{Revenue per unit} = \frac{\text{Static Budget Revenues}}{\text{Static Budget Units Sold}} = \frac{300,000}{12,000} = 25 ] [ \text{Expected Revenue} = \text{Actual Units Sold} \times \text{Revenue per unit} = 15,000 \times 25 = 375,000 ]

The sales-activity variance for revenues is: [ \text{Sales-Activity Variance (Revenues)} = \text{Expected Revenues} - \text{Static Budget Revenues} ] [ = 375,000 - 300,000 = 75,000 ]

For operating income, we calculate the flexible budget operating income assuming budgeted costs remain the same. First, we need to re-calculate variable costs:

- Variable costs per unit:

- Direct labor: $\frac{72,000}{12,000} = 6$ per unit

- Direct material: $\frac{144,000}{12,000} = 12$ per unit

- Commissions: $\frac{15,000}{12,000} = 1.25$ per unit

- Variable overhead: $\frac{2,640}{12,000} = 0.22$ per unit

Total variable costs (per unit): [ 6 + 12 + 1.25 + 0.22 = 19.47 ]

Expected variable costs with actual units sold: [ \text{Total Variable Costs} = 15,000 \times 19.47 = 291,000 ]

Now subtract the total variable costs from expected revenues: [ \text{Flexible Budget Operating Income} = \text{Expected Revenues} - \text{Total Variable Costs} - \text{Fixed Costs} ] Where Fixed Costs = Fixed Manufacturing Overhead + Rent + Administrative Expenses: [ 12,000 + 3,000 + 8,000 = 23,000 ] [ = 375,000 - 291,000 - 23,000 = 61,000 ]

Now, calculating the sales-activity variance for operating income: [ \text{Sales-Activity Variance (Operating Income)} = \text{Flexible Budget Operating Income} - \text{Static Budget Operating Income} ] [ = 61,000 - 43,360 = 17,640 ]

- Calculate the Flexible-Budget Variance for Revenues and Operating Income

Now calculate the flexible-budget variance: [ \text{Flexible-Budget Variance (Revenues)} = \text{Actual Revenues} - \text{Expected Revenues} ] [ = 360,000 - 375,000 = -15,000 \quad \text{(unfavorable)} ]

For operating income: [ \text{Flexible-Budget Variance (Operating Income)} = \text{Actual Operating Income} - \text{Flexible Budget Operating Income} ] [ = 54,500 - 61,000 = -6,500 \quad \text{(unfavorable)} ]

- Static Budget Variance for Revenues: $60,000$ (Favorable)

- Static Budget Variance for Operating Income: $11,140$ (Favorable)

- Sales-Activity Variance for Revenues: $75,000$ (Favorable)

- Sales-Activity Variance for Operating Income: $17,640$ (Favorable)

- Flexible-Budget Variance for Revenues: $15,000$ (Unfavorable)

- Flexible-Budget Variance for Operating Income: $6,500$ (Unfavorable)

More Information

The variances indicate how well Alpha Inc.'s division performed relative to its expectations. Positive variances are typically seen as favorable, showing better performance than expected, while negative variances indicate performance that fell short of expectations. Understanding these variances helps in making informed business decisions.

Tips

- Failing to correctly calculate the per-unit costs for variable expenses, leading to incorrect total variances.

- Not adjusting the flexible budget for actual output levels, which can lead to inaccurate variances.

- Misinterpretation of favorable vs. unfavorable variances.

AI-generated content may contain errors. Please verify critical information