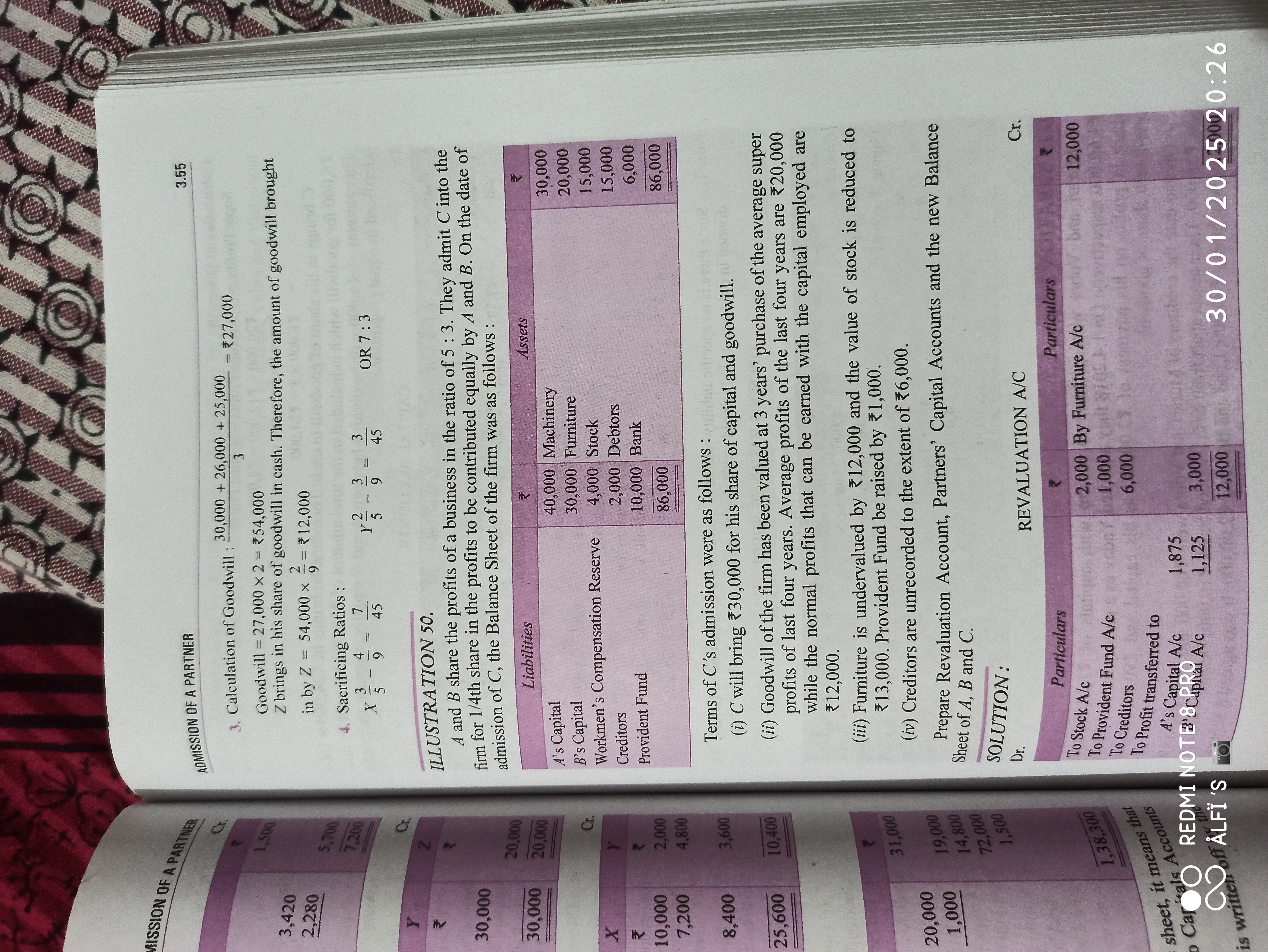

Prepare Revaluation Account, Partners' Capital Accounts and the new Balance Sheet of A, B, and C.

Understand the Problem

The question involves calculating goodwill, sacrificial ratios, and preparing Revaluation Account and Partners' Capital Accounts based on the admission of a new partner into a business. It provides specific financial figures and requires an understanding of partnership accounting principles.

Answer

C's share of goodwill is ₹15,000, adjusted according to the sacrificing ratio of A and B, which is 5:3.

Answer for screen readers

C's share of goodwill is ₹15,000, which will be adjusted in the partners' capital accounts based on the sacrificing ratios of 5:3 for A and B.

Steps to Solve

-

Calculate Goodwill

The average profits over the last four years are given as ₹20,000. The goodwill is valued using 3 years' purchase:$$ \text{Goodwill} = \text{Average Profits} \times \text{Number of Years} = ₹20,000 \times 3 = ₹60,000 $$

-

Determine C's Share of Goodwill

C is entitled to a 1/4 share of the profits. Therefore, C's share of goodwill is:$$ \text{C's Share of Goodwill} = \frac{1}{4} \times ₹60,000 = ₹15,000 $$

-

Calculate Sacrificing Ratios

The sacrificing ratio for A and B can be calculated as follows:- A's new share = $ \frac{5}{8} $ (old share = $ \frac{5}{8} $)

- B's new share = $ \frac{3}{8} $ (old share = $ \frac{3}{8} $)

- A sacrifices $ \frac{5}{8} - \frac{5}{12} = \frac{5}{24} $

- B sacrifices $ \frac{3}{8} - \frac{3}{12} = \frac{3}{24} $

Therefore, the sacrificing ratio of A to B is $ 5:3 $.

-

Prepare the Revaluation Account

Adjust the asset values based on new assessments. Here’s how the items will be adjusted:- Stock decreased by ₹1,000

- Furniture increased by ₹12,000

The Revaluation Account will have:

$$ \text{Dr} \hspace{10pt} \text{To Stock A/c} \hspace{10pt} 1,000 $$ $$ \text{Dr} \hspace{10pt} \text{To Furniture A/c} \hspace{10pt} 12,000 $$

-

Update Partners' Capital Accounts

After recording goodwill and revaluations, adjust the partners’ capital accounts. Each partner’s capital will be adjusted based on the sacrificial and goodwill calculations.

C's share of goodwill is ₹15,000, which will be adjusted in the partners' capital accounts based on the sacrificing ratios of 5:3 for A and B.

More Information

Goodwill is an intangible asset reflecting the value of a business's reputation, brand, and customer relationships. When a new partner is admitted, goodwill must be calculated to determine how much the new partner's share contributes to the overall partnership value.

Tips

- Neglecting to calculate the correct sacrificing ratio can lead to inaccuracies in adjusting the capital accounts.

- Forgetting to include revaluation entries for both assets and liabilities can result in discrepancies in the financial statements.

AI-generated content may contain errors. Please verify critical information