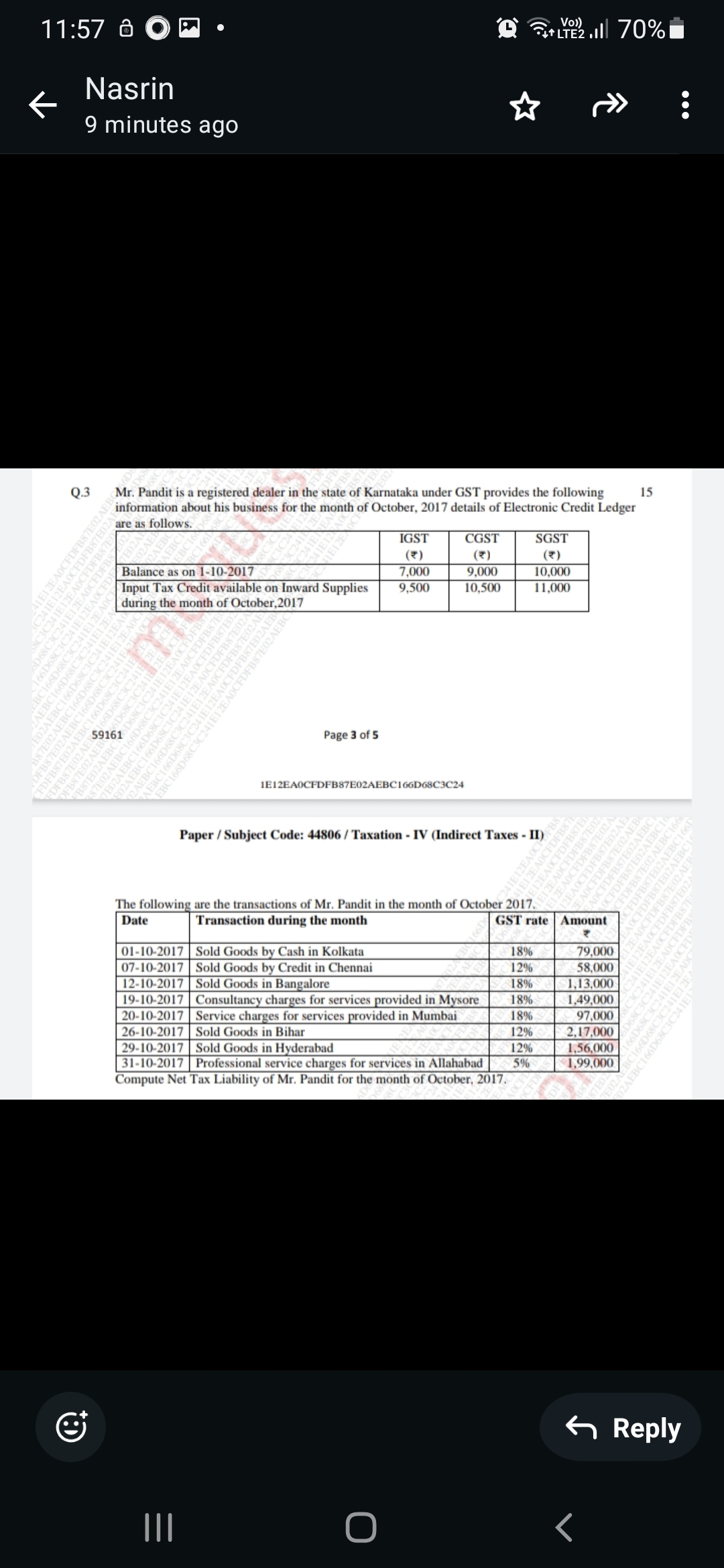

Compute the Net Tax Liability of Mr. Pandit for the month of October 2017.

Understand the Problem

The question asks to compute the Net Tax Liability of Mr. Pandit for the month of October 2017 based on given transactions and GST information. It requires assessment of input tax credit and sales to arrive at the net tax liability calculation.

Answer

The Net Tax Liability is ₹88,610.

Answer for screen readers

The Net Tax Liability of Mr. Pandit for the month of October 2017 is ₹88,610.

Steps to Solve

- Identify GST Transactions and Rates

List the total sales (output) for each transaction along with their respective GST rates:

- Sold by Cash in Kolkata: ₹79,000 at 18%

- Sold by Credit in Chennai: ₹58,000 at 12%

- Sold in Bangalore: ₹1,13,000 at 18%

- Consultancy in Mysore: ₹1,49,000 at 18%

- Service in Mumbai: ₹97,000 at 18%

- Sold in Bihar: ₹2,17,000 at 12%

- Sold in Hyderabad: ₹1,56,000 at 12%

- Professional service in Allahabad: ₹1,99,000 at 5%

- Calculate Output Tax Payable

Use the formula for GST (Output Tax) for each sale:

[ \text{Output GST} = \text{Sale Amount} \times \frac{\text{GST Rate}}{100} ]

Calculating for each transaction:

- Kolkata: ( 79,000 \times 0.18 = 14,220 )

- Chennai: ( 58,000 \times 0.12 = 6,960 )

- Bangalore: ( 1,13,000 \times 0.18 = 20,340 )

- Mysore: ( 1,49,000 \times 0.18 = 26,820 )

- Mumbai: ( 97,000 \times 0.18 = 17,460 )

- Bihar: ( 2,17,000 \times 0.12 = 26,040 )

- Hyderabad: ( 1,56,000 \times 0.12 = 18,720 )

- Allahabad: ( 1,99,000 \times 0.05 = 9,950 )

- Summing All Output Taxes

Add all the output taxes to find the total output tax liability:

[ \text{Total Output Tax} = 14,220 + 6,960 + 20,340 + 26,820 + 17,460 + 26,040 + 18,720 + 9,950 ]

Calculating this gives:

[ \text{Total Output Tax} = 1,19,610 ]

- Calculate Input Tax Credit (ITC)

Sum the available input tax credits:

- IGST: ₹9,500

- CGST: ₹10,500

- SGST: ₹11,000

[ \text{Total ITC} = 9,500 + 10,500 + 11,000 = 31,000 ]

- Compute Net Tax Liability

Finally, use the formula for net tax liability:

[ \text{Net Tax Liability} = \text{Total Output Tax} - \text{Total ITC} ]

Substituting in the values:

[ \text{Net Tax Liability} = 1,19,610 - 31,000 = 88,610 ]

The Net Tax Liability of Mr. Pandit for the month of October 2017 is ₹88,610.

More Information

In the GST system, the net tax liability is essential for businesses to determine their tax obligations after credits for taxes paid on purchases are taken into account.

Tips

- Forgetting to calculate the GST for each transaction separately.

- Not summing the output tax or input tax credits correctly.

- Misunderstanding which taxes can be credited against output taxes.

AI-generated content may contain errors. Please verify critical information