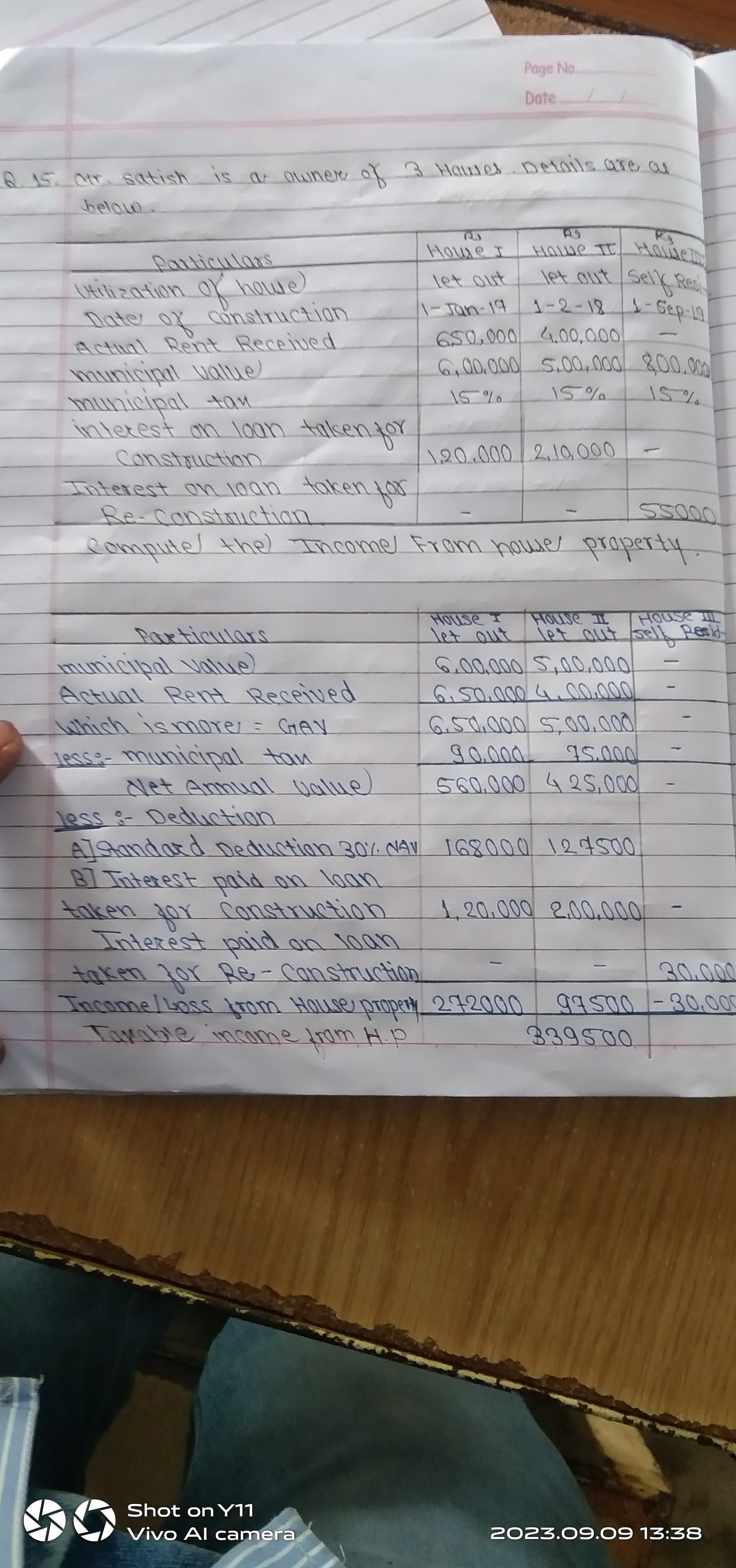

Compute the Income from house property based on the details provided for three houses.

Understand the Problem

The question presents financial details related to three properties owned by an individual. It asks to compute the income from these house properties based on the provided data, including rents received, municipal values, taxes, and deductions.

Answer

The taxable income from house properties is $2,79,500$.

Answer for screen readers

The taxable income from the house properties is $2,79,500$.

Steps to Solve

- Identify Rental Income for Each House

Add the actual rents received for each house:

- For House I: $6,50,000$

- For House II: $4,00,000$

- For House III: $0$ (self-occupied)

Total rent received:

$$ 6,50,000 + 4,00,000 + 0 = 10,50,000 $$

- Determine Municipal Values

Identify the municipal values for the properties:

- For House I: $6,00,000$

- For House II: $5,00,000$

- For House III: $8,00,000$

- Calculate Municipal Tax

Calculate the municipal tax for each house based on the rates provided (15%):

- For House I: $$ 6,00,000 \times 0.15 = 90,000 $$

- For House II: $$ 5,00,000 \times 0.15 = 75,000 $$

- For House III: $$ 8,00,000 \times 0.15 = 120,000 $$

- Calculate Net Annual Value (NAV)

Calculate the Net Annual Value for each house by deducting municipal taxes from rent received:

- For House I: $$ 6,50,000 - 90,000 = 5,60,000 $$

- For House II: $$ 4,00,000 - 75,000 = 3,25,000 $$

- For House III: $$ 0 - 120,000 = -120,000 $$

- Deductions for Each House

Calculate the deductions:

-

Standard Deduction (30% of NAV for let out properties)

- For House I: $$ 5,60,000 \times 0.30 = 1,68,000 $$

- For House II: $$ 3,25,000 \times 0.30 = 97,500 $$

- House III has no deductions since it is self-occupied.

-

Interest on Loans:

- For House I (Construction Loan): $1,20,000$

- For House II (Re-Construction Loan): $2,00,000$

- House III has no loan deductions.

- Calculate Total Income/Loss

Now, calculate income/loss from house property:

- For House I: $$ 5,60,000 - (1,68,000 + 1,20,000) = 3,72,000 $$

- For House II: $$ 3,25,000 - (97,500 + 2,00,000) = 27,500 $$

- For House III: $$ 0 - 0 = -120,000 $$

- Aggregate Results

Add the incomes/losses from all houses to find the total taxable income:

$$ 3,72,000 + 27,500 - 1,20,000 = 2,79,500 $$

The taxable income from the house properties is $2,79,500$.

More Information

This summary provides a breakdown of income, deductions, and how to calculate the taxable income from multiple properties. Each house is treated distinctly, especially in cases of mortgage interest and standard deductions.

Tips

- Forgetting to apply the standard deduction percentage properly.

- Miscalculating the municipal tax based on the incorrect percentage.

- Not considering the deduction of interest on loans taken for construction or re-construction properly.

AI-generated content may contain errors. Please verify critical information