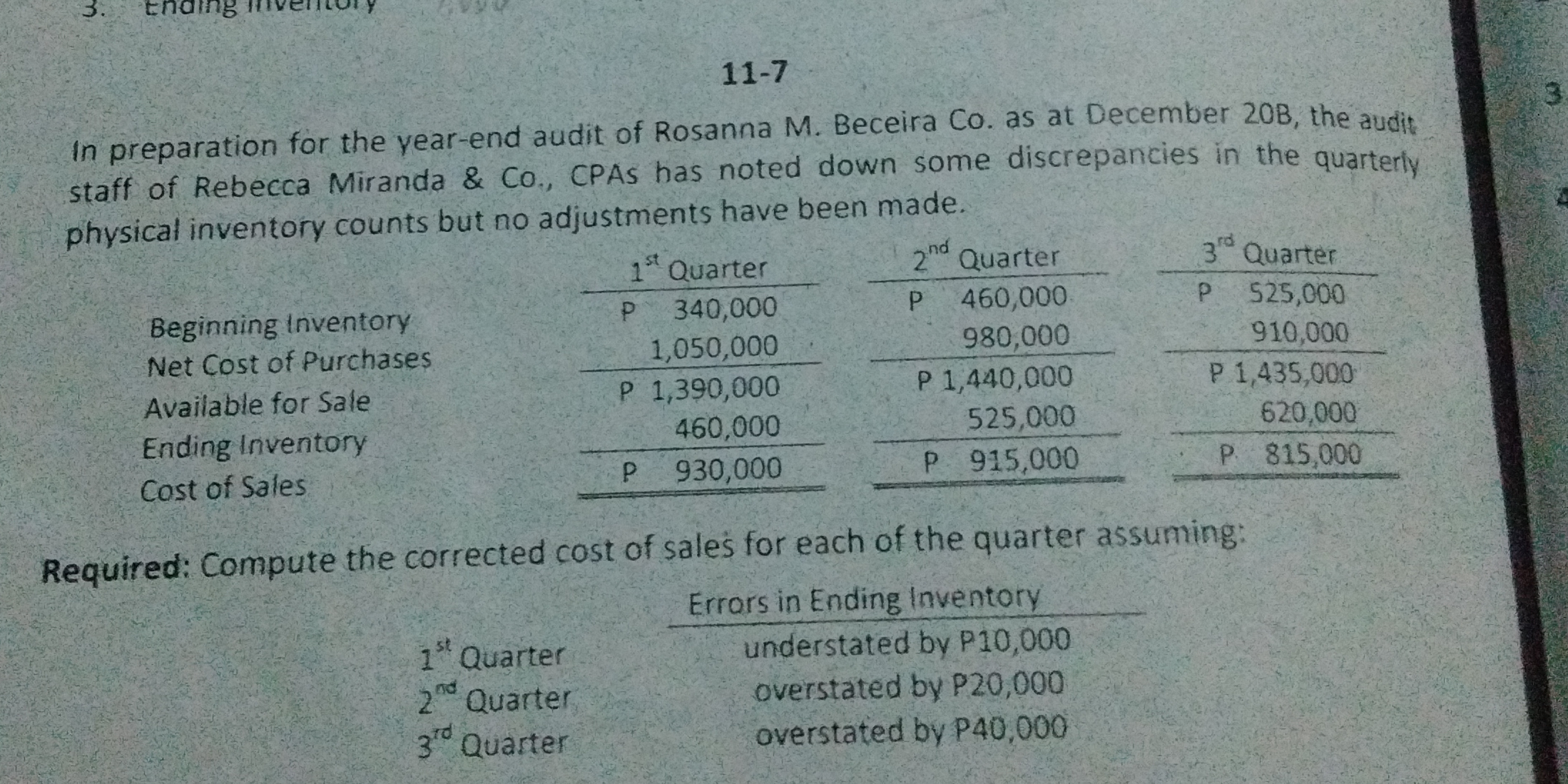

Compute the corrected cost of sales for each of the quarter assuming: 1st Quarter: understated by P10,000, 2nd Quarter: overstated by P20,000, 3rd Quarter: overstated by P40,000.

Understand the Problem

The question requires us to compute the correct cost of sales for each quarter given discrepancies in the ending inventory for a company. It provides details on beginning inventory, net cost of purchases, available for sale, ending inventory, and cost of sales for three quarters, along with specific errors to consider.

Answer

1st Quarter: P920,000; 2nd Quarter: P935,000; 3rd Quarter: P855,000

Answer for screen readers

- 1st Quarter: P920,000

- 2nd Quarter: P935,000

- 3rd Quarter: P855,000

Steps to Solve

- Understand the Cost of Sales Formula

The Cost of Sales can be calculated using the formula:

$$ \text{Cost of Sales} = \text{Available for Sale} - \text{Ending Inventory} $$

Where:

- Available for Sale is the sum of Beginning Inventory and Net Cost of Purchases.

- Calculate Available for Sale for Each Quarter

For each quarter, compute the Available for Sale:

-

1st Quarter: $$ \text{Available for Sale} = 340,000 + 1,050,000 = 1,390,000 $$

-

2nd Quarter: $$ \text{Available for Sale} = 460,000 + 980,000 = 1,440,000 $$

-

3rd Quarter: $$ \text{Available for Sale} = 525,000 + 910,000 = 1,435,000 $$

- Adjust Ending Inventory for Errors

Modify the Ending Inventory based on the given errors:

-

1st Quarter: Underrated by P10,000 $$ \text{Adjusted Ending Inventory} = 460,000 + 10,000 = 470,000 $$

-

2nd Quarter: Overrated by P20,000 $$ \text{Adjusted Ending Inventory} = 525,000 - 20,000 = 505,000 $$

-

3rd Quarter: Overrated by P40,000 $$ \text{Adjusted Ending Inventory} = 620,000 - 40,000 = 580,000 $$

- Calculate Corrected Cost of Sales for Each Quarter

Apply the adjustments to calculate the corrected Cost of Sales:

-

1st Quarter: $$ \text{Cost of Sales} = 1,390,000 - 470,000 = 920,000 $$

-

2nd Quarter: $$ \text{Cost of Sales} = 1,440,000 - 505,000 = 935,000 $$

-

3rd Quarter: $$ \text{Cost of Sales} = 1,435,000 - 580,000 = 855,000 $$

- 1st Quarter: P920,000

- 2nd Quarter: P935,000

- 3rd Quarter: P855,000

More Information

The calculations reflect the adjustments of inventory errors impacting each quarter's Cost of Sales. Accurate inventory tracking is essential for financial reporting.

Tips

- Miscalculating the Available for Sale figure by not adding Beginning Inventory and Net Purchases correctly.

- Incorrectly applying the inventory errors, either adding when it should be subtracted or vice versa.

AI-generated content may contain errors. Please verify critical information