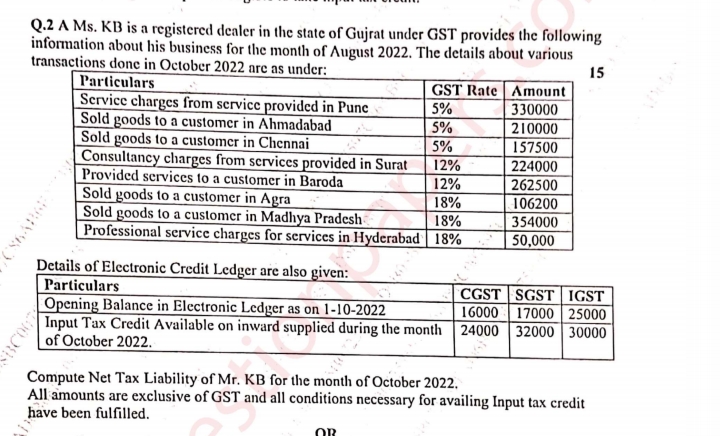

Compute Net Tax Liability of Mr. KB for the month of October 2022. All amounts are exclusive of GST and all conditions necessary for availing Input tax credit have been fulfilled.

Understand the Problem

The question is asking to compute the net tax liability for Mr. KB based on the given business transactions and details related to the Electronic Credit Ledger for the month of October 2022. This involves calculating the total GST collected from sales and subtracting the input tax credit available.

Answer

The net tax liability for Mr. KB for October 2022 is $62591$.

Answer for screen readers

The net tax liability for Mr. KB for the month of October 2022 is $62591$.

Steps to Solve

- Calculate GST on Sales Transactions

First, we will calculate the GST for each of the sales transactions based on the given GST rates:

- Service charges from Pune: $330000 \times 0.05 = 16500$

- Goods sold in Ahmadabad: $210000 \times 0.05 = 10500$

- Goods sold in Chennai: $157500 \times 0.05 = 7875$

- Consultancy charges in Surat: $224000 \times 0.12 = 26880$

- Services in Baroda: $262500 \times 0.12 = 31500$

- Goods sold in Agra: $106200 \times 0.18 = 19116$

- Goods sold in Madhya Pradesh: $354000 \times 0.18 = 63720$

- Professional services in Hyderabad: $50000 \times 0.18 = 9000$

Now, we sum these values to find the total GST collected.

- Sum Up Total GST Collected

Total GST collected from the transactions:

$$ \text{Total GST} = 16500 + 10500 + 7875 + 26880 + 31500 + 19116 + 63720 + 9000 = 164591 $$

- Calculate Total Input Tax Credit (ITC)

Next, we will calculate the total Input Tax Credit available. This includes the opening balance and the credits for the current month.

-

Opening Balance in Electronic Ledger:

- CGST: $16000$

- SGST: $17000$

- IGST: $25000$

-

Input Tax Credit (ITC) available:

- $24000$ (CGST)

- $25000$ (SGST)

- $30000$ (IGST)

Total ITC:

$$ \text{Total ITC} = (16000 + 24000) + (17000 + 25000) + 25000 = 102000 $$

- Calculate Net Tax Liability

Finally, we compute the net tax liability by subtracting the total ITC from the total GST collected:

$$ \text{Net Tax Liability} = \text{Total GST} - \text{Total ITC} $$

Substituting the values:

$$ \text{Net Tax Liability} = 164591 - 102000 = 62591 $$

The net tax liability for Mr. KB for the month of October 2022 is $62591$.

More Information

The net tax liability reflects the amount Mr. KB must remit to the government after accounting for his input tax credits. Proper accounting of GST collected and the available ITC is crucial for compliance under GST regulations.

Tips

- Ignoring different GST rates: Ensure that calculations consider the correct rates for each transaction.

- Miscalculating the total ITC: Verify that all components of the input tax credit, including opening balances and ITC for the month, are included.

AI-generated content may contain errors. Please verify critical information