Can you explain the characteristics and regulations surrounding Certificates of Deposit (CDs) in financial markets?

Understand the Problem

The question is asking for specific information about Certificates of Deposit (CDs) within the context of financial markets, including their issuance, maturity, size, transferability, and commercial papers. It focuses on the rules and regulations related to these financial instruments.

Answer

A CD is a fixed-term investment with higher interest rates, a minimum size of ₹1 lakh, and a maturity of 7 days to one year for banks. They are freely transferable without a lock-in period.

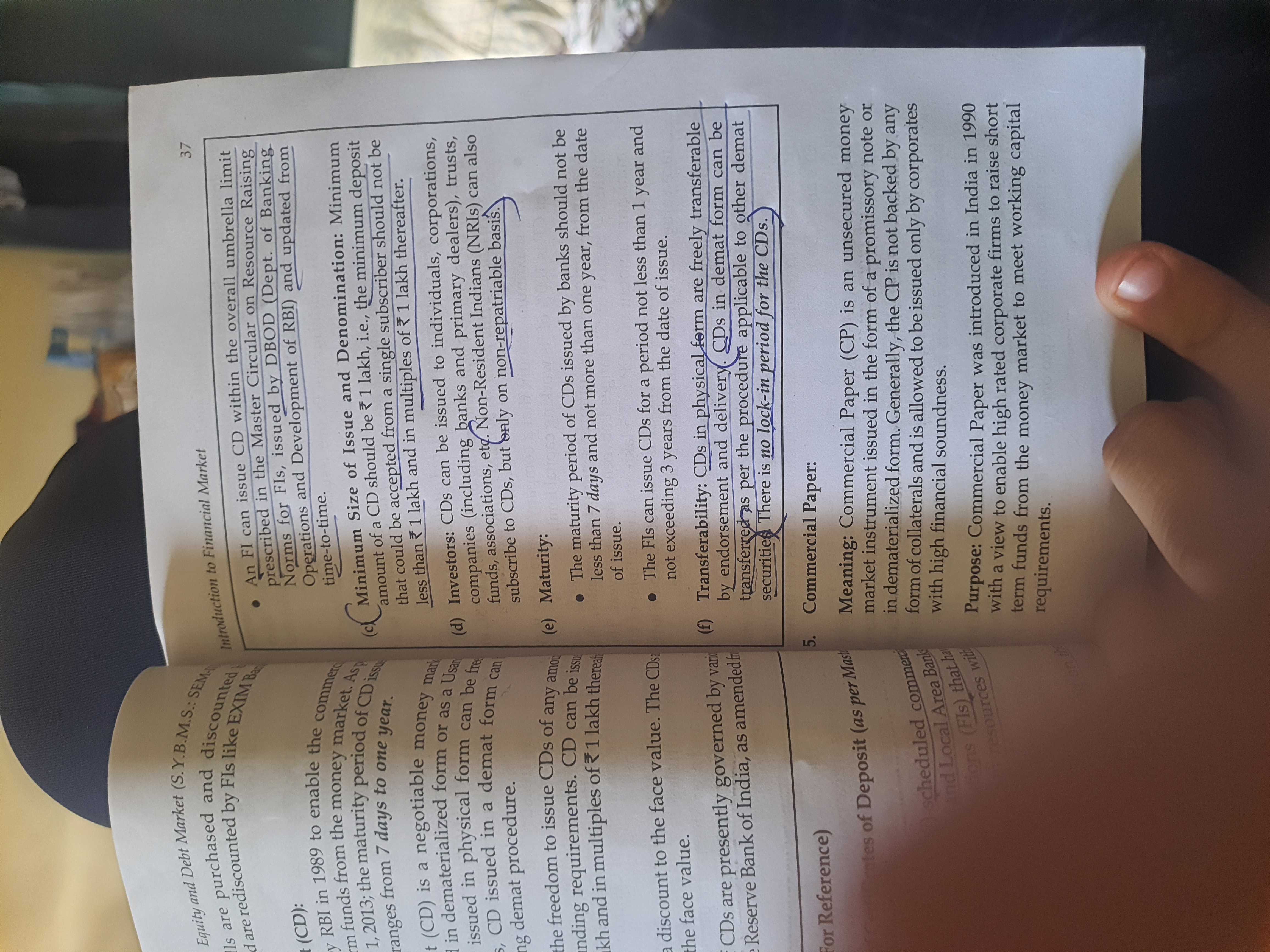

A Certificate of Deposit (CD) is a fixed-term investment product offered by financial institutions. CDs generally offer higher interest rates compared to savings accounts but have penalties for early withdrawal. The minimum size of a CD issue should be ₹1 lakh, with a maturity period ranging from 7 days to one year for banks. CDs can be issued to various investors and are freely transferable with no lock-in period.

Answer for screen readers

A Certificate of Deposit (CD) is a fixed-term investment product offered by financial institutions. CDs generally offer higher interest rates compared to savings accounts but have penalties for early withdrawal. The minimum size of a CD issue should be ₹1 lakh, with a maturity period ranging from 7 days to one year for banks. CDs can be issued to various investors and are freely transferable with no lock-in period.

More Information

CDs provide a safe savings option, generally offering higher interest rates than regular savings accounts. They are insured up to $250,000 if bought through a federally insured bank.

Tips

One common mistake is withdrawing funds from a CD before its maturity date, which incurs penalties. It is also important to be aware of the minimum deposit requirements.

Sources

- What Is a Certificate of Deposit (CD) and How Does It Work? - synchrony.com

- Certificates of Deposit (CDs) - Investor.gov - investor.gov

- What Is A CD (Certificate Of Deposit)? | Bankrate - bankrate.com

AI-generated content may contain errors. Please verify critical information