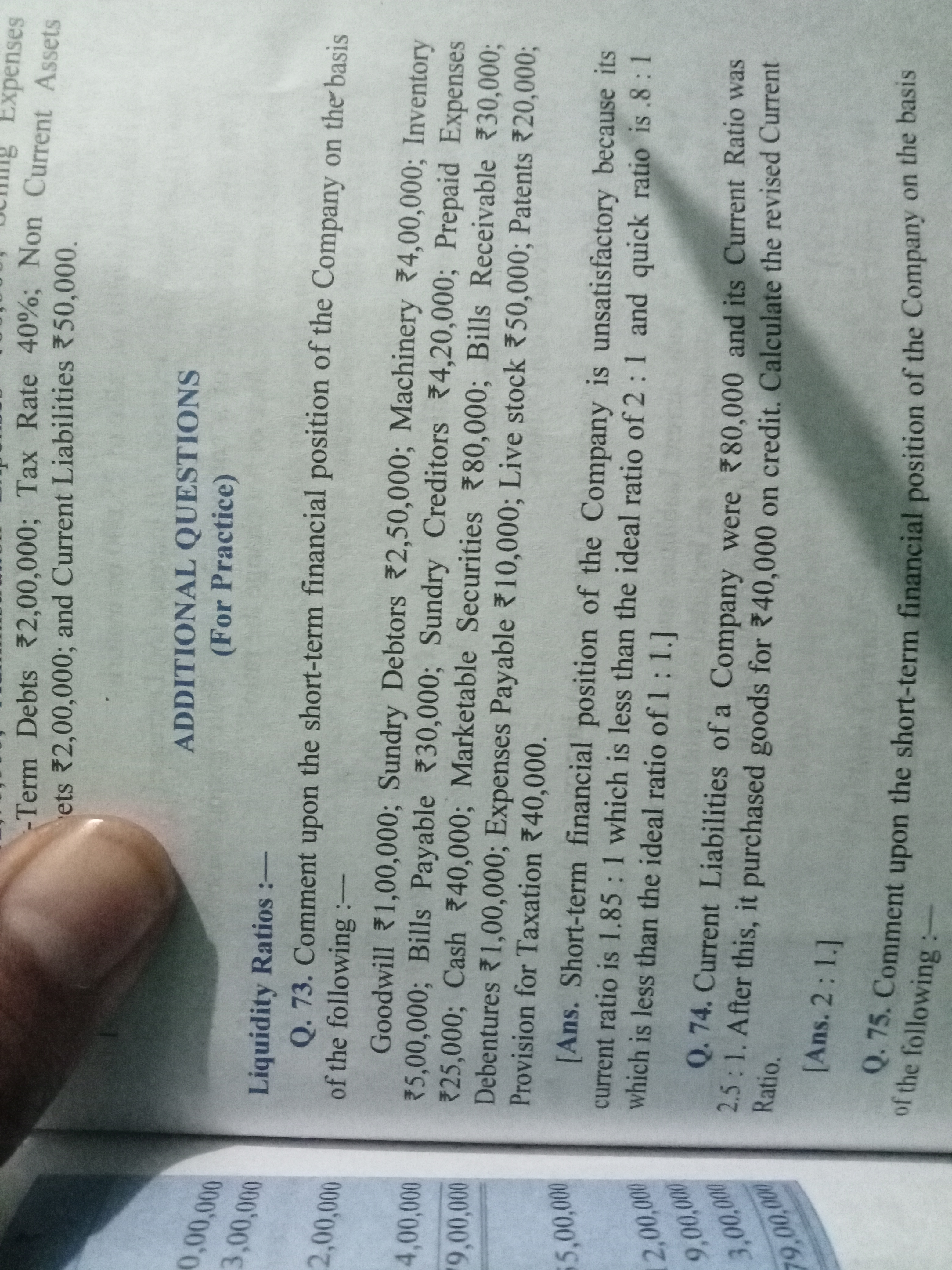

Calculate the revised current ratio of the Company on the basis of the provided financial position.

Understand the Problem

The question is requesting a calculation of the revised current ratio for a company based on its financial position, including various assets and liabilities. The essential steps involve identifying total current assets and current liabilities to determine the current ratio.

Answer

The revised current ratio is $1.24$.

Answer for screen readers

The revised current ratio is approximately $1.24$.

Steps to Solve

-

Calculate Total Current Assets

To find the total current assets, we sum the values of the given assets:

- Sundry Debtors: ₹100,000

- Inventory: ₹400,000

- Prepaid Expenses: ₹30,000

- Securities: ₹30,000

- Bills Receivable: ₹10,000

- Livestock: ₹50,000

Thus,

$$ \text{Total Current Assets} = 100,000 + 400,000 + 30,000 + 30,000 + 10,000 + 50,000 = ₹620,000 $$

-

Calculate Total Current Liabilities

Next, we identify the total current liabilities:

- Sundry Creditors: ₹420,000

Thus,

$$

\text{Total Current Liabilities} = ₹420,000

$$

-

Calculate the Current Ratio

The current ratio is calculated as: $$ \text{Current Ratio} = \frac{\text{Total Current Assets}}{\text{Total Current Liabilities}} $$

Substituting the totals:

$$ \text{Current Ratio} = \frac{620,000}{420,000} = \frac{62}{42} \approx 1.476 $$

This indicates that the company has a current ratio of approximately 1.48. -

Calculate Revised Current Ratio After Additional Liabilities

According to the problem, additional liabilities were added:

- Current Liabilities after purchase: ₹80,000 (from previous liabilities)

Thus, the new total current liabilities will be:

$$

\text{New Total Current Liabilities} = 420,000 + 80,000 = ₹500,000

$$

-

Calculate Revised Current Ratio

Now we recalculate the current ratio with the updated liabilities:

$$ \text{Revised Current Ratio} = \frac{620,000}{500,000} = 1.24 $$

The revised current ratio is approximately $1.24$.

More Information

The current ratio indicates whether a company can cover its short-term obligations with its short-term assets. A ratio above 1 suggests that the company has more current assets than current liabilities, which is generally a good sign of financial health.

Tips

- Forgetting to include all current assets or liabilities in the totals can lead to incorrect ratios.

- Misinterpreting the ratio as a static measure; it should be re-evaluated after changes in assets or liabilities.

AI-generated content may contain errors. Please verify critical information