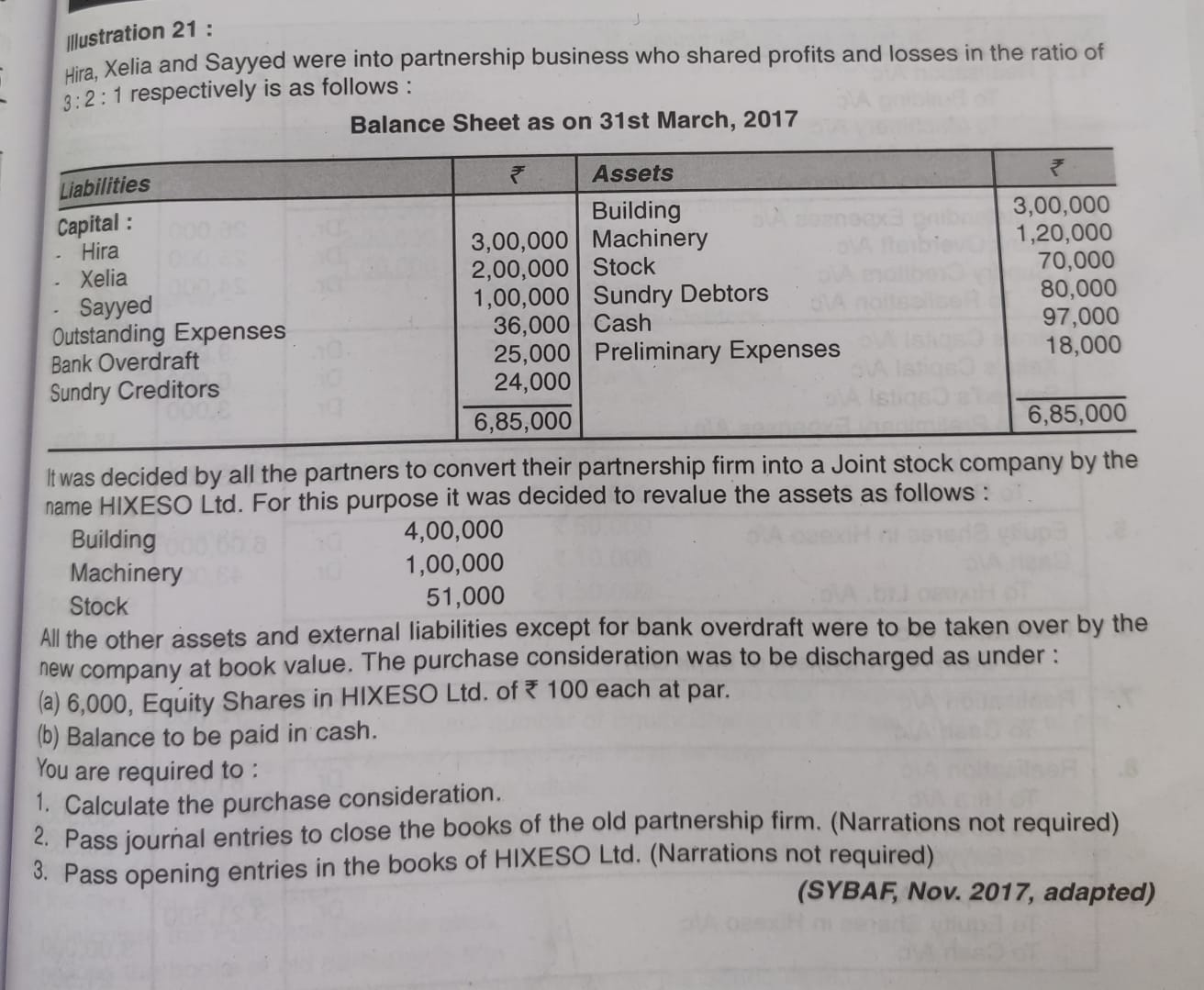

Calculate the purchase consideration. Pass journal entries to close the books of the old partnership firm. Pass opening entries in the books of HIXESO Ltd.

Understand the Problem

The question is asking to calculate the purchase consideration following the conversion of a partnership into a joint stock company, as well as to pass necessary journal and opening entries. This involves financial accounting concepts including asset valuation and partnership dissolution.

Answer

The total purchase consideration is ₹6,765,000.

Answer for screen readers

The total purchase consideration is ₹6,765,000.

Steps to Solve

-

Calculate Total Assets and Liabilities of the Partnership Firm

First, identify the total assets and liabilities as per the partnership's balance sheet. The total assets = 3,000,000 (Building) + 1,200,000 (Machinery) + 700,000 (Stock) + 800,000 (Sundry Debtors) + 970,000 (Cash) + 180,000 (Preliminary Expenses) = 6,850,000. The total liabilities = 36,000 (Outstanding Expenses) + 25,000 (Bank Overdraft) + 24,000 (Sundry Creditors) = 85,000.

-

Calculate Net Assets

Net assets can be calculated by subtracting total liabilities from total assets: $$ \text{Net Assets} = \text{Total Assets} - \text{Total Liabilities} = 6,850,000 - 85,000 = 6,765,000 $$

-

Calculate Purchase Consideration

The purchase consideration consists of equity shares and cash balance.

a) Equity shares: 6,000 equity shares at ₹100 each = ₹600,000.

b) Calculate the balance (cash) that needs to be paid: $$ \text{Balance} = \text{Net Assets} - \text{Equity Shares} = 6,765,000 - 600,000 = 6,165,000 $$

-

Final Purchase Consideration

Therefore, the total purchase consideration is: $$ \text{Total Purchase Consideration} = \text{Equity Shares (₹600,000)} + \text{Balance (₹6,165,000)} = 6,765,000 $$

-

Journal Entries for Closing the Old Firm

To close the books:

- Debit all asset accounts and credit all liability accounts amounting to ₹6,850,000.

- Any revaluation entries for assets should also be recorded based on the new values.

-

Opening Entries for HIXESO Ltd.

Record the opening of the new company accounts as follows:

- Debit all assets (as newly valued).

- Credit all liabilities.

- Credit the Capital Accounts of the partners.

The total purchase consideration is ₹6,765,000.

More Information

The purchase consideration reflects the agreed value of the partnership's assets after revaluation. When converting a partnership to a joint stock company, the assets often need to be revalued, impacting the overall equity and cash requirements.

Tips

- Ignoring the revaluation of assets before calculating the purchase consideration.

- Confusing total assets with net assets, leading to incorrect cash balance calculations.

AI-generated content may contain errors. Please verify critical information