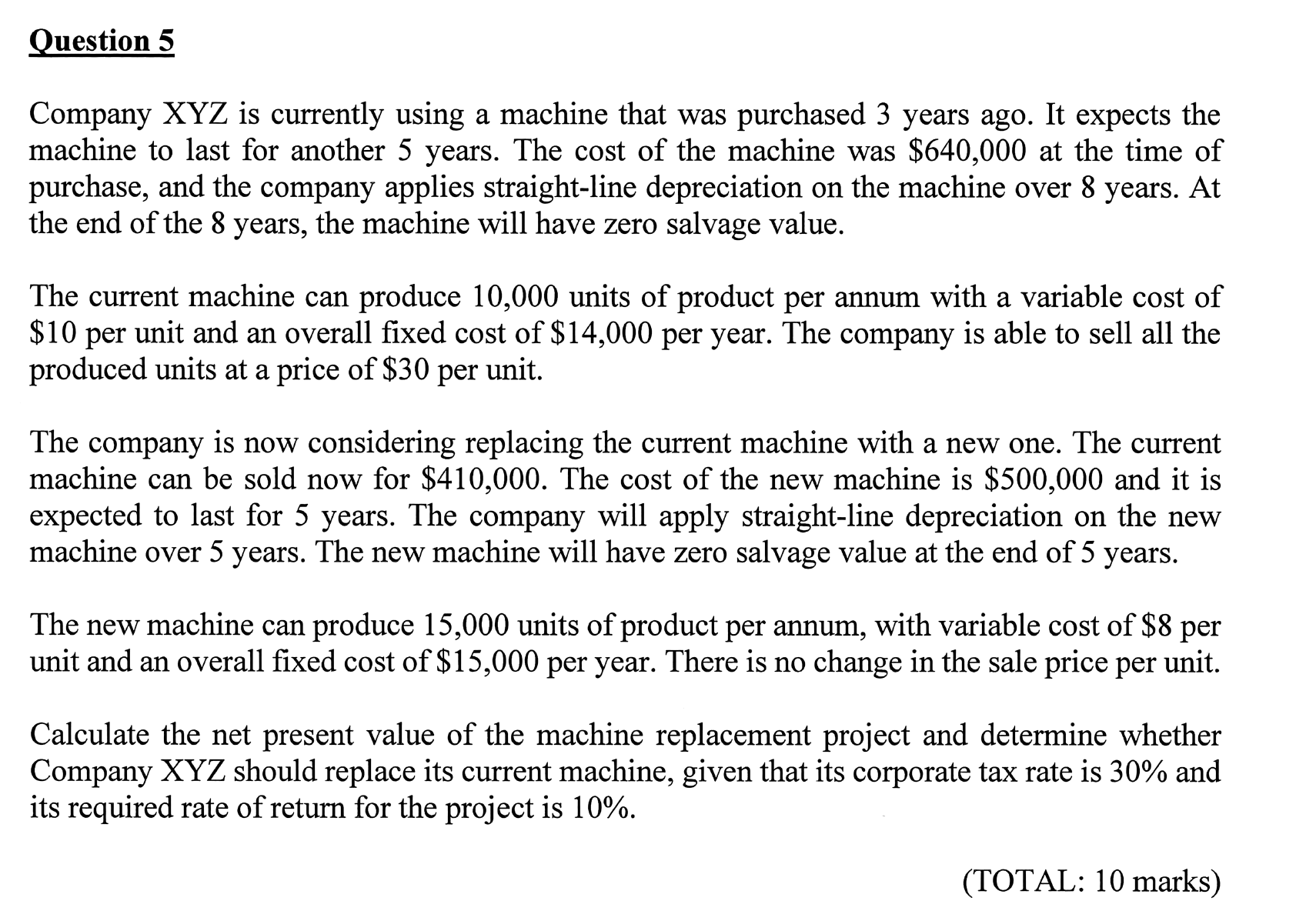

Calculate the net present value of the machine replacement project and determine whether Company XYZ should replace its current machine, given that its corporate tax rate is 30% an... Calculate the net present value of the machine replacement project and determine whether Company XYZ should replace its current machine, given that its corporate tax rate is 30% and its required rate of return for the project is 10%.

Understand the Problem

The question asks for the net present value (NPV) of a machine replacement project considering the costs, revenues, depreciation, and tax implications over a defined period. It requires an analysis of the current vs. new machine's financial performance to determine if the replacement is justified.

Answer

The NPV of the machine replacement project is approximately $1,124,396.57.

Answer for screen readers

The net present value (NPV) of the machine replacement project is approximately $1,124,396.57.

Steps to Solve

- Calculate Current Machine's Cash Flows

Determine the annual cash inflow for the current machine.

-

Revenue: Production = 10,000 units/year at $30/unit $$ \text{Revenue} = 10,000 \times 30 = 300,000 $$

-

Variable Costs: Variable cost = $10/unit $$ \text{Variable Cost} = 10,000 \times 10 = 100,000 $$

-

Fixed Costs: $14,000/year

-

Net Cash Flow before Tax: $$ \text{Net Cash Flow} = \text{Revenue} - \text{Variable Cost} - \text{Fixed Cost} $$ $$ \text{Net Cash Flow} = 300,000 - 100,000 - 14,000 = 186,000 $$

-

Tax: Tax = 30% $$ \text{Tax} = 186,000 \times 0.3 = 55,800 $$

-

Net Cash Flow after Tax: $$ \text{Net Cash Flow (Current)} = 186,000 - 55,800 = 130,200 $$

- Calculate New Machine's Cash Flows

Determine the annual cash inflow for the new machine.

-

Revenue: Production = 15,000 units/year at $30/unit $$ \text{Revenue} = 15,000 \times 30 = 450,000 $$

-

Variable Costs: Variable cost = $8/unit $$ \text{Variable Cost} = 15,000 \times 8 = 120,000 $$

-

Fixed Costs: $15,000/year

-

Net Cash Flow before Tax: $$ \text{Net Cash Flow} = 450,000 - 120,000 - 15,000 = 315,000 $$

-

Tax: $$ \text{Tax} = 315,000 \times 0.3 = 94,500 $$

-

Net Cash Flow after Tax: $$ \text{Net Cash Flow (New)} = 315,000 - 94,500 = 220,500 $$

- Calculate Depreciation of New Machine

Determine annual depreciation using straight-line depreciation.

-

Cost of New Machine: $500,000

-

Useful Life: 5 years

-

Salvage Value: $0

-

Annual Depreciation: $$ \text{Depreciation} = \frac{\text{Cost - Salvage Value}}{\text{Life}} = \frac{500,000 - 0}{5} = 100,000 $$

- Determine Cash Flows Including Depreciation Effect

Since depreciation is a non-cash charge, add it back to get the cash flow impact on the new machine:

- Adjusted Cash Flow (New): $$ \text{Total Cash Flow} = 220,500 + 100,000 = 320,500 $$

- Calculate NPV of Machine Replacement

Now calculate the NPV for the replacement project over 5 years using the discount rate of 10%.

-

Initial Investment: $500,000 - $410,000 (salvage value of current machine) = $90,000

-

Cash Flows: $320,500/year for 5 years

Using the NPV formula: $$ NPV = \sum_{t=1}^{n} \frac{CF_t}{(1 + r)^t} - \text{Initial investment} $$ where ( CF_t ) is cash flow at time ( t ), ( r ) is discount rate.

- Calculate NPV: $$ NPV = \frac{320,500}{1.1^1} + \frac{320,500}{1.1^2} + \frac{320,500}{1.1^3} + \frac{320,500}{1.1^4} + \frac{320,500}{1.1^5} - 90,000 $$

Calculate each cash flow:

- Year 1: $$ \frac{320,500}{1.1^1} \approx 291,363.64 $$

- Year 2: $$ \frac{320,500}{1.1^2} \approx 264,875.13 $$

- Year 3: $$ \frac{320,500}{1.1^3} \approx 240,795.57 $$

- Year 4: $$ \frac{320,500}{1.1^4} \approx 218,036.88 $$

- Year 5: $$ \frac{320,500}{1.1^5} \approx 197,925.35 $$

Total Cash Flows (years 1 to 5): $$ Total \approx 291,363.64 + 264,875.13 + 240,795.57 + 218,036.88 + 197,925.35 = 1,214,396.57 $$

Final NPV Calculation: $$ NPV = 1,214,396.57 - 90,000 \approx 1,124,396.57 $$

- Conclusion

Interpret the NPV result to decide whether to replace the machine. Since NPV > 0, replacement is justified.

The net present value (NPV) of the machine replacement project is approximately $1,124,396.57.

More Information

A positive NPV indicates that the new machine will add value to the company and is a financially sound decision. The calculations account for future cash flows, depreciation, and tax implications, demonstrating a thorough financial analysis.

Tips

- Neglecting to subtract the salvage value of the current machine when calculating the initial investment.

- Forgetting to adjust for tax impacts on cash flows.

- Miscalculating the depreciation or not adding it back to cash flows when determining NPV.

AI-generated content may contain errors. Please verify critical information