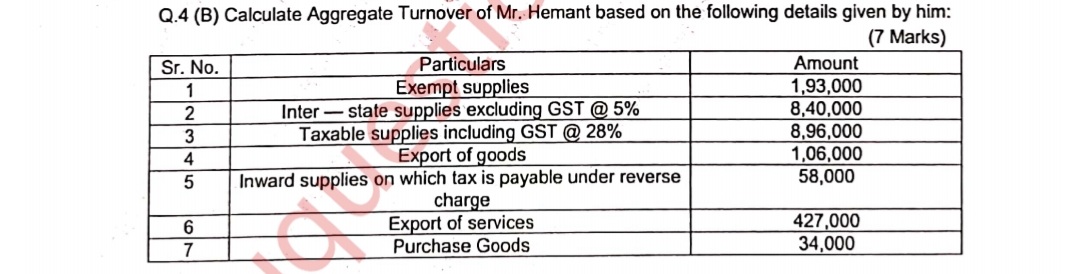

Calculate the Aggregate Turnover of Mr. Hemant based on the following details given by him: Exempt supplies 1,93,000, Inter-state supplies excluding GST @ 5% 8,40,000, Taxable supp... Calculate the Aggregate Turnover of Mr. Hemant based on the following details given by him: Exempt supplies 1,93,000, Inter-state supplies excluding GST @ 5% 8,40,000, Taxable supplies including GST @ 28% 8,96,000, Export of goods 1,06,000, Inward supplies on which tax is payable under reverse charge 58,000, Export of services 4,27,000, Purchase Goods 34,000.

Understand the Problem

The question is asking to calculate the aggregate turnover of Mr. Hemant based on provided financial details related to various types of supplies, including exempt supplies and taxable supplies at different GST rates.

Answer

The aggregate turnover is $22,66,000$.

Answer for screen readers

The aggregate turnover of Mr. Hemant is $22,66,000$.

Steps to Solve

- Identify Relevant Supplies for Aggregate Turnover

Aggregate turnover includes all taxable supplies, exempt supplies, and export supplies, but excludes inward supplies and purchase goods.

- List Supply Amounts

- Exempt Supplies: $1,93,000$

- Inter-state Supplies: $8,40,000$

- Taxable Supplies: $8,96,000$ (including GST)

- Export of Goods: $1,06,000$

- Export of Services: $4,27,000$

- Calculate Total Aggregate Turnover

To find the aggregate turnover, sum the relevant amounts: [ \text{Aggregate Turnover} = \text{Exempt Supplies} + \text{Inter-state Supplies} + \text{Taxable Supplies (excluding GST)} + \text{Export of Goods} + \text{Export of Services} ]

- Adjust Taxable Supplies for GST

Since the taxable supplies are given including GST, we need to extract the taxable amount. To find the taxable amount: [ \text{Taxable Amount} = \frac{\text{Taxable Supplies}}{1 + \text{Tax Rate}} = \frac{8,96,000}{1 + 0.28} ]

- Perform Final Calculation

Substituting all values: [ \text{Aggregate Turnover} = 1,93,000 + 8,40,000 + \left(\frac{8,96,000}{1.28}\right) + 1,06,000 + 4,27,000 ]

- Calculate Each Component

Calculating the taxable amount: [ \text{Taxable Amount} = \frac{8,96,000}{1.28} = 7,00,000 ]

Now substitute back into the aggregate turnover equation: [ \text{Aggregate Turnover} = 1,93,000 + 8,40,000 + 7,00,000 + 1,06,000 + 4,27,000 ]

- Final Aggregate Turnover Calculation

Sum up: [ \text{Aggregate Turnover} = 1,93,000 + 8,40,000 + 7,00,000 + 1,06,000 + 4,27,000 = 22,66,000 ]

The aggregate turnover of Mr. Hemant is $22,66,000$.

More Information

Aggregate turnover is a crucial metric for businesses as it influences GST registration requirements and compliance. It helps determine the tax payable on goods and services sold.

Tips

- Not excluding inward supplies or purchase goods from the turnover calculation.

- Forgetting to adjust the taxable supplies for GST before including them in the total.