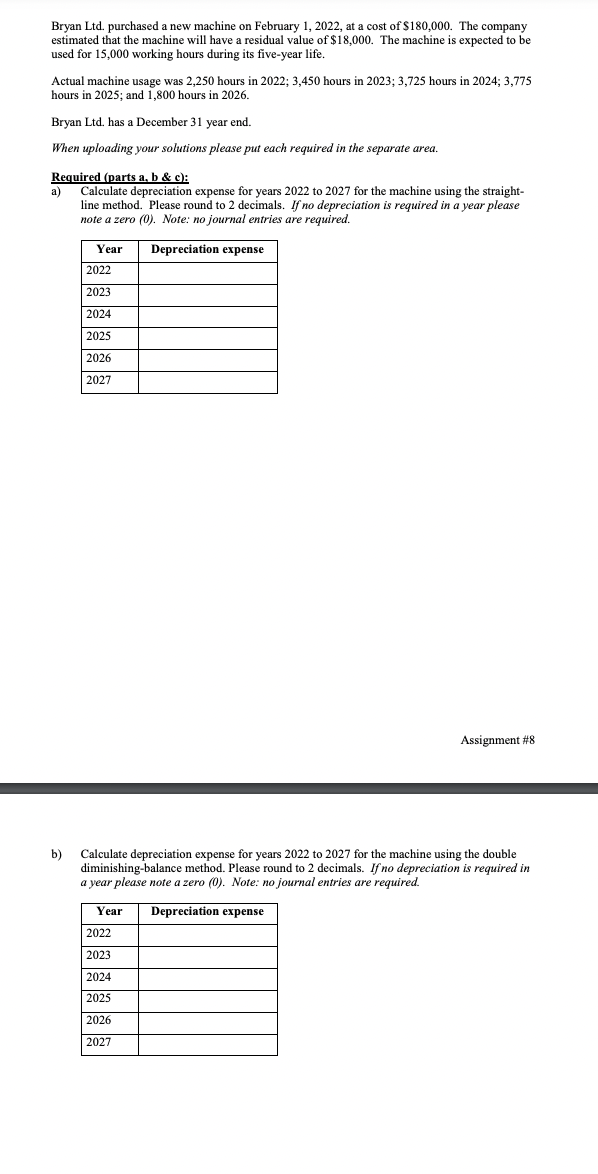

Calculate depreciation expense for years 2022 to 2027 for the machine using the straight-line and double diminishing-balance methods.

Understand the Problem

The question is asking to calculate the depreciation expense for a machine using both the straight-line method and the double diminishing-balance method for the years 2022 to 2027. This involves applying specific formulas for each method based on the machine's cost, residual value, and estimated useful life. The user needs to present the results in a table format, noting any years with zero depreciation.

Answer

Straight-Line: $32,400 per year; Double Diminishing Balance: $72,000 (2022), $43,200 (2023), $25,920 (2024), $15,552 (2025), $9,331.20 (2026), $5,598.72 (2027).

Answer for screen readers

Straight-Line Depreciation Expense:

| Year | Depreciation Expense |

|---|---|

| 2022 | $32,400 |

| 2023 | $32,400 |

| 2024 | $32,400 |

| 2025 | $32,400 |

| 2026 | $32,400 |

| 2027 | $32,400 |

Double Diminishing Balance Depreciation Expense:

| Year | Depreciation Expense |

|---|---|

| 2022 | $72,000 |

| 2023 | $43,200 |

| 2024 | $25,920 |

| 2025 | $15,552 |

| 2026 | $9,331.20 |

| 2027 | $5,598.72 |

Steps to Solve

- Calculate the Annual Depreciation using Straight-Line Method

First, determine the annual depreciation expense using the straight-line method formula:

[ \text{Annual Depreciation Expense} = \frac{\text{Cost} - \text{Residual Value}}{\text{Useful Life}} ]

Given:

- Cost = $180,000

- Residual Value = $18,000

- Useful Life = 5 years

Calculate:

[ \text{Annual Depreciation Expense} = \frac{180,000 - 18,000}{5} = \frac{162,000}{5} = 32,400 ]

- Record Depreciation Expense for Each Year (Straight-Line)

Since the straight-line method allocates a constant depreciation expense each year, fill in the table with the calculated annual depreciation for all years from 2022 to 2027.

| Year | Depreciation Expense |

|---|---|

| 2022 | $32,400 |

| 2023 | $32,400 |

| 2024 | $32,400 |

| 2025 | $32,400 |

| 2026 | $32,400 |

| 2027 | $32,400 |

- Calculate Annual Depreciation using Double Diminishing-Balance Method

For the double declining balance method, calculate the rate and apply it to the remaining balance each year:

[ \text{Depreciation Rate} = \frac{1}{\text{Useful Life}} \times 2 = \frac{1}{5} \times 2 = 40% ]

Apply this rate to the remaining book value each year.

- Record Depreciation Expense for Each Year (Double Diminishing-Balance)

-

Year 2022: [ \text{Depreciation } = 180,000 \times 0.40 = 72,000 ] Remaining Book Value = $180,000 - $72,000 = $108,000

-

Year 2023: [ \text{Depreciation } = 108,000 \times 0.40 = 43,200 ] Remaining Book Value = $108,000 - $43,200 = $64,800

-

Year 2024: [ \text{Depreciation } = 64,800 \times 0.40 = 25,920 ] Remaining Book Value = $64,800 - $25,920 = $38,880

-

Year 2025: [ \text{Depreciation } = 38,880 \times 0.40 = 15,552 ] Remaining Book Value = $38,880 - $15,552 = $23,328

-

Year 2026: [ \text{Depreciation } = 23,328 \times 0.40 = 9,331.20 ] Remaining Book Value = $23,328 - $9,331.20 = $13,996.80

-

Year 2027: [ \text{Depreciation } = 13,996.80 \times 0.40 = 5,598.72 ] Remaining Book Value = $13,996.80 - $5,598.72 = $8,398.08 (or residual value if it reaches)

| Year | Depreciation Expense |

|---|---|

| 2022 | $72,000 |

| 2023 | $43,200 |

| 2024 | $25,920 |

| 2025 | $15,552 |

| 2026 | $9,331.20 |

| 2027 | $5,598.72 |

Straight-Line Depreciation Expense:

| Year | Depreciation Expense |

|---|---|

| 2022 | $32,400 |

| 2023 | $32,400 |

| 2024 | $32,400 |

| 2025 | $32,400 |

| 2026 | $32,400 |

| 2027 | $32,400 |

Double Diminishing Balance Depreciation Expense:

| Year | Depreciation Expense |

|---|---|

| 2022 | $72,000 |

| 2023 | $43,200 |

| 2024 | $25,920 |

| 2025 | $15,552 |

| 2026 | $9,331.20 |

| 2027 | $5,598.72 |

More Information

The straight-line method provides a consistent expense each year, while the double diminishing-balance method results in higher expenses in the earlier years, decreasing over time due to the declining balance approach.

Tips

- Miscalculating the depreciation rates or not applying them consistently.

- Forgetting to consider the residual value in the straight-line method.

- Not recording zero depreciation for any years if applicable in the double diminishing balance.

AI-generated content may contain errors. Please verify critical information