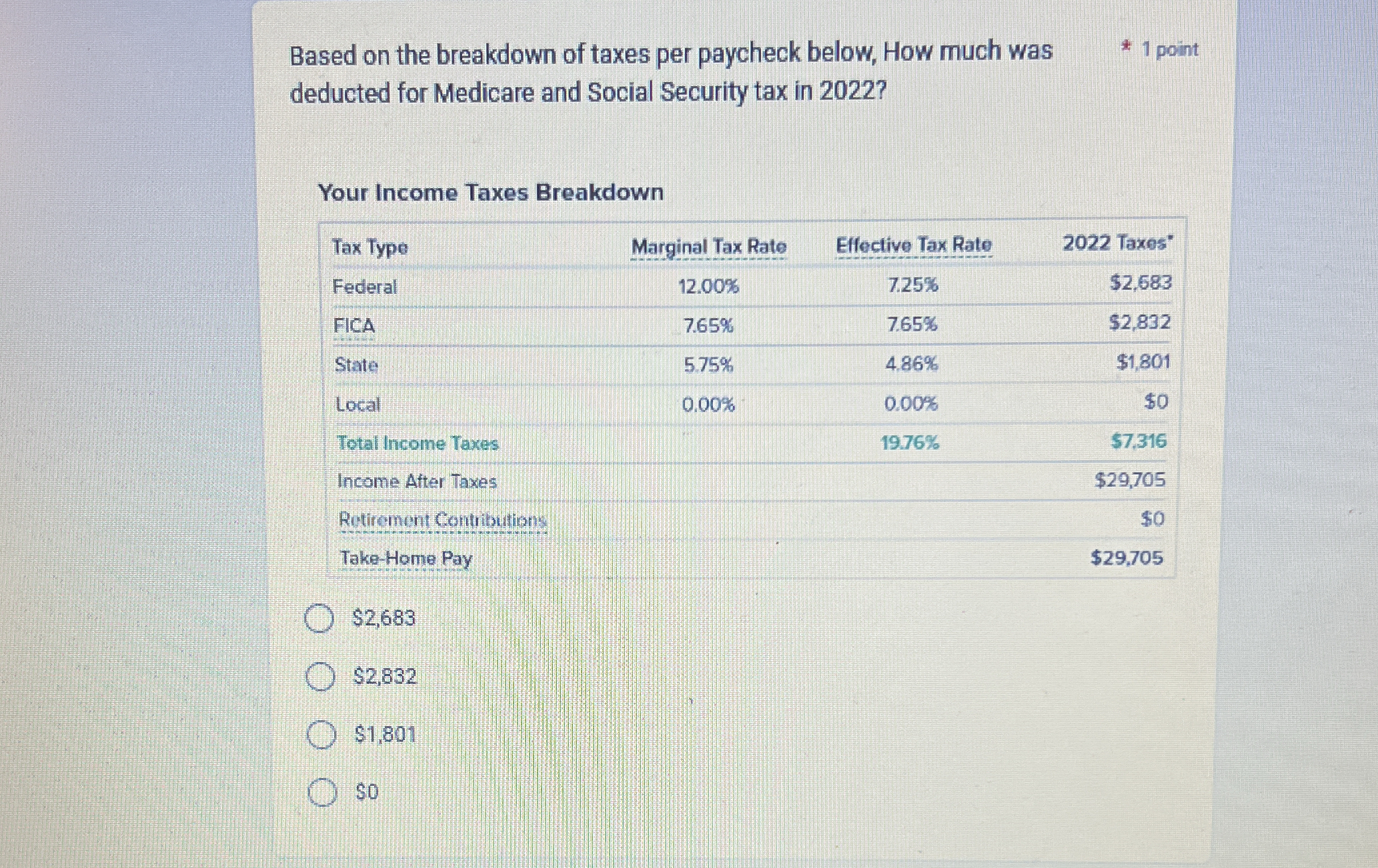

Based on the breakdown of taxes per paycheck below, how much was deducted for Medicare and Social Security tax in 2022?

Understand the Problem

The question is asking for the deduction amount specifically for Medicare and Social Security tax based on the given tax breakdown per paycheck in 2022. To solve it, we will focus on the FICA component, which includes both Social Security and Medicare deductions.

Answer

$2,832$

Answer for screen readers

The total amount deducted for Medicare and Social Security tax in 2022 is $2,832.

Steps to Solve

-

Identify FICA total The FICA tax is broken down into Social Security and Medicare, which together make up the total. From the table, we see the FICA total for 2022 taxes is $2,832.

-

Calculate Social Security and Medicare Rates In 2022, the FICA rate for Social Security is 6.2%, and the rate for Medicare is 1.45%. This totals to 7.65% for FICA.

-

Determine Social Security and Medicare Contribution Since the total FICA amount is $2,832, we can find the amounts for Social Security and Medicare:

- Social Security = $2,832 * (6.2 / 7.65)

- Medicare = $2,832 * (1.45 / 7.65)

-

Calculate individual contributions Let's calculate these values:

-

Social Security contribution: $$ Social Security = 2832 \times \frac{6.2}{7.65} \approx 2,283 $$

-

Medicare contribution: $$ Medicare = 2832 \times \frac{1.45}{7.65} \approx 549 $$

-

-

Sum contributions for verification To verify, we can check if the total of these two contributions equals the FICA amount: $$ Total = Social Security + Medicare $$

$$ Total = 2,283 + 549 = 2,832 $$

The total amount deducted for Medicare and Social Security tax in 2022 is $2,832.

More Information

FICA, which stands for the Federal Insurance Contributions Act, includes taxes for Social Security and Medicare. The combined rate for FICA deductions is 7.65%. Employees effectively contribute 6.2% to Social Security and 1.45% to Medicare.

Tips

-

Misunderstanding the FICA components: Sometimes, individuals confuse the total FICA amount with only one of the taxes. It's important to recognize that FICA includes both Social Security and Medicare.

-

Incorrectly applying percentages: Ensure that the correct percentage rates are applied and maintained throughout the calculations.

AI-generated content may contain errors. Please verify critical information