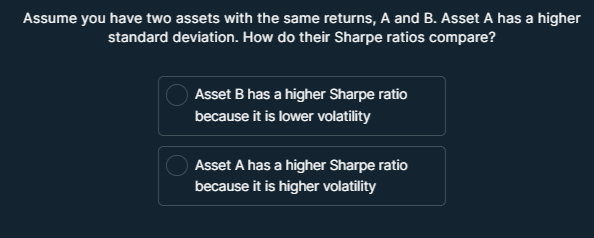

Assume you have two assets with the same returns, A and B. Asset A has a higher standard deviation. How do their Sharpe ratios compare?

Understand the Problem

The question is asking for a comparison of the Sharpe ratios of two assets with the same returns, specifically focusing on how their different standard deviations affect the ratios. To solve this, we will need to apply the formula for the Sharpe ratio, which is the difference between the asset's return and the risk-free rate divided by the standard deviation. Since asset A has a higher standard deviation, its Sharpe ratio will be lower compared to asset B, which has the same return but a lower standard deviation.

Answer

Asset B has a higher Sharpe ratio because it is lower volatility.

Answer for screen readers

Asset B has a higher Sharpe ratio because it is lower volatility.

Steps to Solve

- Understanding the Sharpe Ratio Formula

The Sharpe ratio is calculated using the formula: $$ Sharpe \ Ratio = \frac{(R_a - R_f)}{\sigma_a} $$ where $R_a$ is the return of the asset, $R_f$ is the risk-free rate, and $\sigma_a$ is the standard deviation of the asset's returns.

- Applying the Formula to Both Assets

Given that both assets, A and B, have the same return ($R_a$) and risk-free rate ($R_f$), we can express the Sharpe ratios for both:

- For Asset A: $$ Sharpe \ Ratio_A = \frac{(R_a - R_f)}{\sigma_A} $$

- For Asset B: $$ Sharpe \ Ratio_B = \frac{(R_a - R_f)}{\sigma_B} $$

- Comparison Based on Standard Deviation

Since Asset A has a higher standard deviation ($\sigma_A > \sigma_B$), the Sharpe ratio for Asset A will be lower: $$ Sharpe \ Ratio_A < Sharpe \ Ratio_B $$ This indicates that Asset B has a higher Sharpe ratio because it has lower volatility.

Asset B has a higher Sharpe ratio because it is lower volatility.

More Information

A higher Sharpe ratio indicates better risk-adjusted returns. Since volatility (risk) is higher for Asset A, its Sharpe ratio decreases compared to Asset B, which offers the same return but lower risk.

Tips

- Confusing returns with risk; it’s essential to understand that a higher return does not always indicate a better Sharpe ratio if the risk is significantly higher.

- Forgetting to account for the standard deviation when comparing ratios.

AI-generated content may contain errors. Please verify critical information