Assume the Original Equity investment was $1,000,000. In Transaction 3, if the company had purchased 3 towers on credit for $125,000 each, instead of $250,000, what would the Inven... Assume the Original Equity investment was $1,000,000. In Transaction 3, if the company had purchased 3 towers on credit for $125,000 each, instead of $250,000, what would the Inventory balance above be?

Understand the Problem

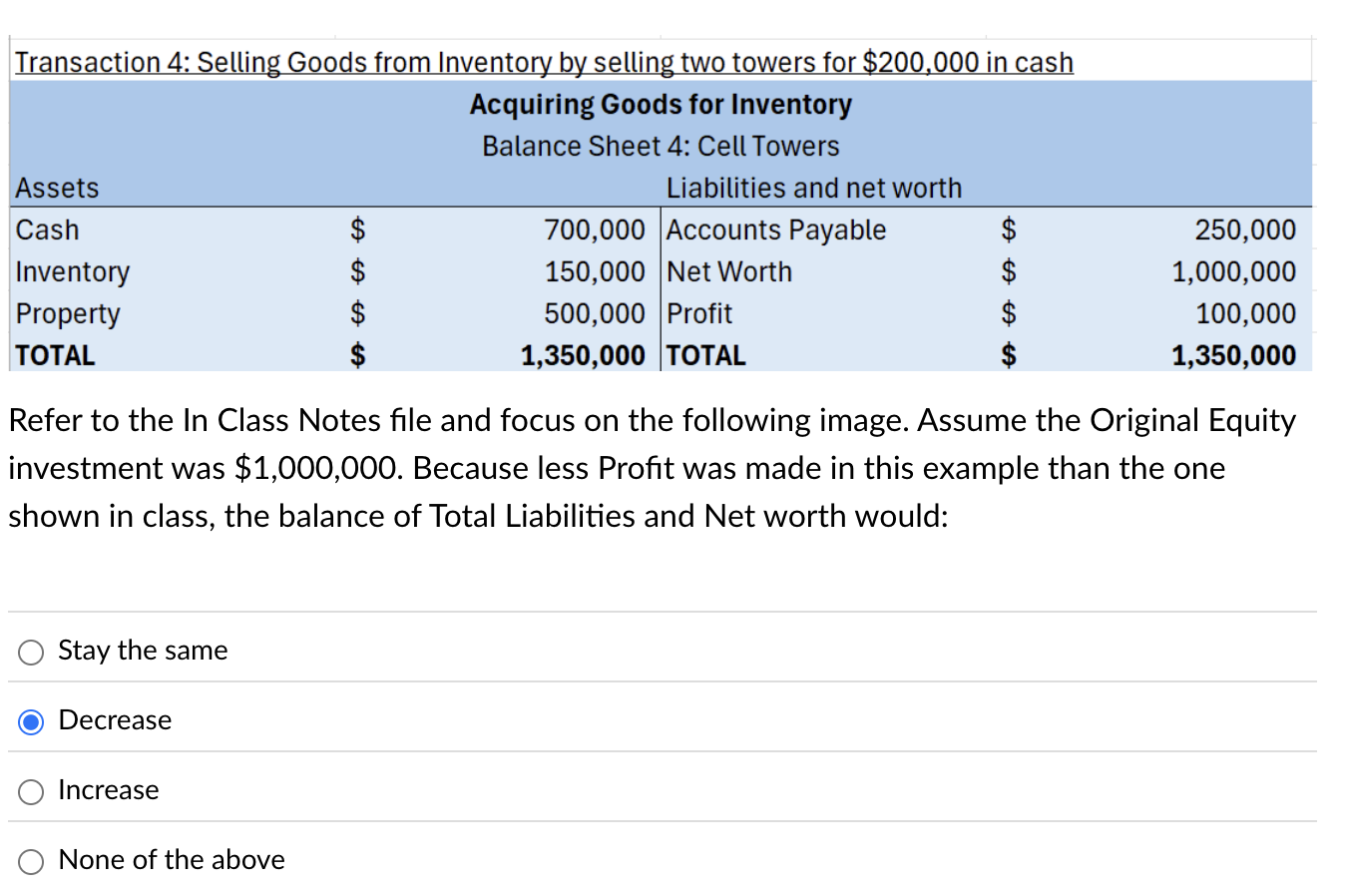

The question is asking for the Inventory balance adjustment based on the scenario provided, specifically if the company had instead purchased three towers on credit for $125,000 each. It examines how this change in transaction affects the Inventory total.

Answer

Decrease

The balance of Total Liabilities and Net worth would decrease due to less profit and lower purchase cost.

Answer for screen readers

The balance of Total Liabilities and Net worth would decrease due to less profit and lower purchase cost.

More Information

The change in inventory cost from $750,000 to $375,000 decreases both inventory value and the profit, leading to a lower balance of total liabilities and net worth.

Tips

Common mistakes include not adjusting accounts payable to reflect the new purchase price or incorrectly assuming inventory increases with purchase price rather than decreases.

AI-generated content may contain errors. Please verify critical information