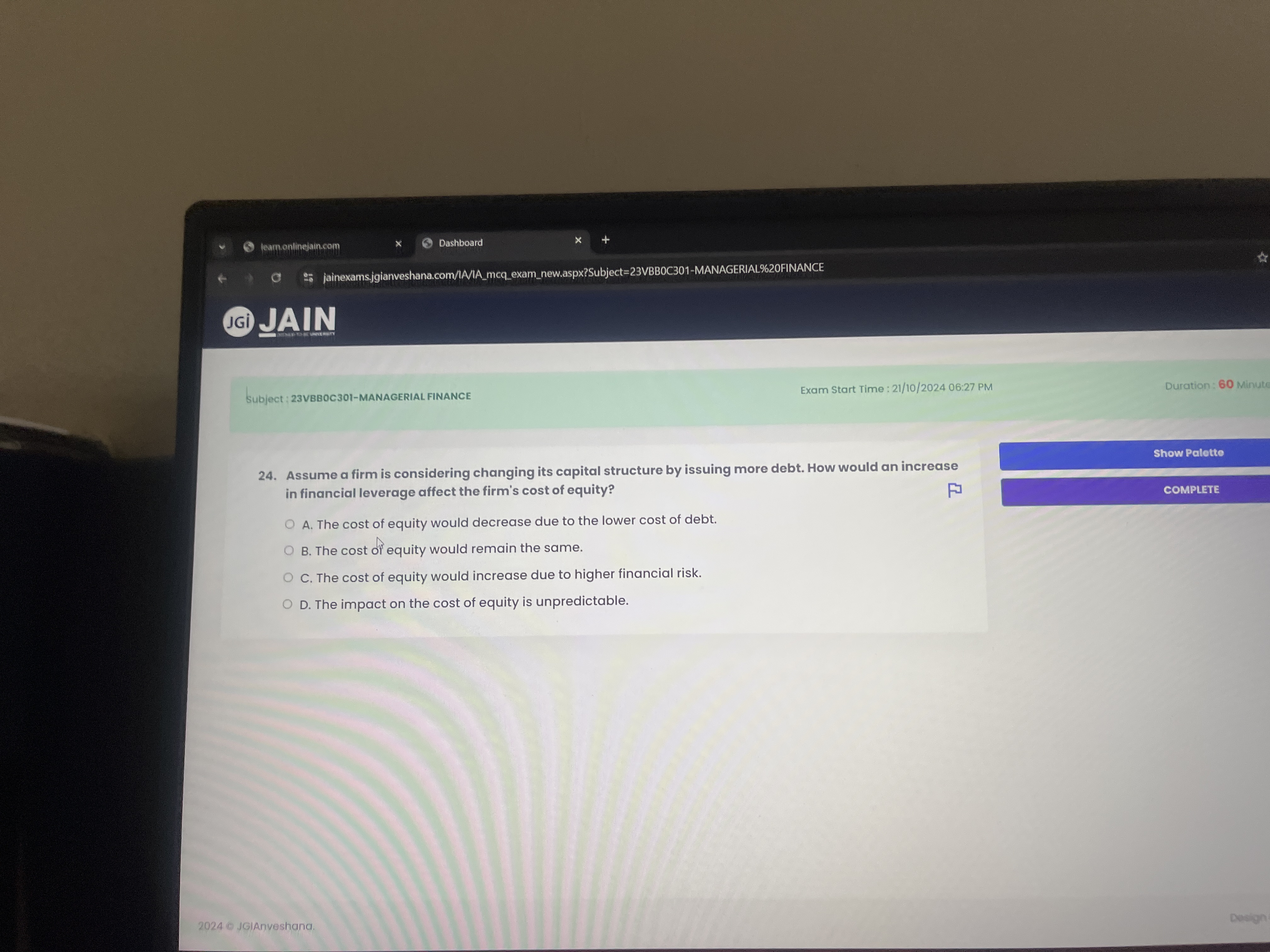

Assume a firm is considering changing its capital structure by issuing more debt. How would an increase in financial leverage affect the firm's cost of equity?

Understand the Problem

The question is asking how an increase in financial leverage, through issuing more debt, would affect the firm's cost of equity. It presents four options for possible outcomes related to the relationship between financial leverage and cost of equity.

Answer

The cost of equity would increase due to higher financial risk.

The cost of equity would increase due to higher financial risk.

Answer for screen readers

The cost of equity would increase due to higher financial risk.

More Information

Increased financial leverage enhances the potential returns but also increases the systematic risk faced by equity holders. As a result, equity investors typically demand higher returns, leading to an increased cost of equity.

Tips

A common mistake is assuming all costs decrease with increased debt due to tax shields, overlooking the corresponding increase in equity risk.

Sources

- Use of Financial Leverage in Corporate Capital Structure - investopedia.com

- The risks and rewards of leverage for your business - BerryDunn - berrydunn.com

- Modigliani-Miller Capital Structure Propositions - AnalystPrep - analystprep.com