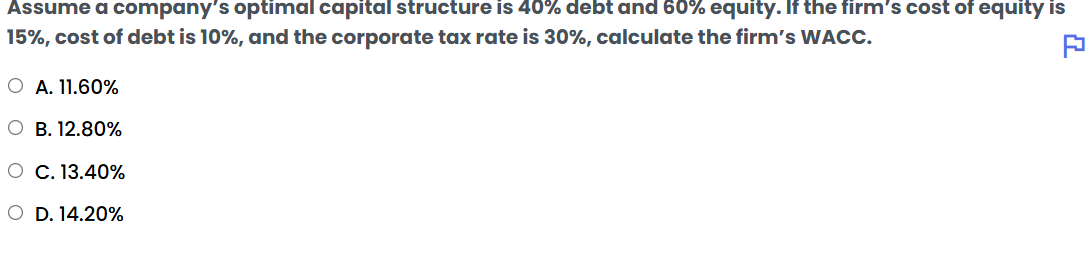

Assume a company's optimal capital structure is 40% debt and 60% equity. If the firm's cost of equity is 15%, cost of debt is 10%, and the corporate tax rate is 30%, calculate the... Assume a company's optimal capital structure is 40% debt and 60% equity. If the firm's cost of equity is 15%, cost of debt is 10%, and the corporate tax rate is 30%, calculate the firm's WACC.

Understand the Problem

The question is asking to calculate the Weighted Average Cost of Capital (WACC) for a firm given its capital structure, cost of equity, cost of debt, and corporate tax rate. The WACC is calculated using the formula: WACC = (E/V * Re) + (D/V * Rd * (1 - Tc)), where E is equity, D is debt, V is total value (E + D), Re is cost of equity, Rd is cost of debt, and Tc is corporate tax rate.

Answer

$11.80\%$

Answer for screen readers

The firm's WACC is $11.80%$.

Steps to Solve

- Identify Given Values

We have the following information:

- Cost of equity, $R_e = 15% = 0.15$

- Cost of debt, $R_d = 10% = 0.10$

- Corporate tax rate, $T_c = 30% = 0.30$

- Proportion of debt, $D/V = 40% = 0.40$

- Proportion of equity, $E/V = 60% = 0.60$

- Apply the WACC Formula

The Weighted Average Cost of Capital (WACC) formula is given by:

$$ WACC = \left( \frac{E}{V} \times R_e \right) + \left( \frac{D}{V} \times R_d \times (1 - T_c) \right) $$

- Calculate the Cost of Equity Contribution

Calculate the first part of the WACC:

$$ \frac{E}{V} \times R_e = 0.60 \times 0.15 = 0.09 $$

- Calculate the After-Tax Cost of Debt Contribution

Calculate the second part considering the tax impact:

$$ \frac{D}{V} \times R_d \times (1 - T_c) = 0.40 \times 0.10 \times (1 - 0.30) $$

First, calculate:

$$ 1 - T_c = 1 - 0.30 = 0.70 $$

Now compute:

$$ 0.40 \times 0.10 \times 0.70 = 0.028 $$

- Combine Both Contributions

Now, combine the contributions to find WACC:

$$ WACC = 0.09 + 0.028 = 0.118 $$

- Convert to Percentage

Convert the WACC into percentage:

$$ WACC = 0.118 \times 100 = 11.80% $$

The firm's WACC is $11.80%$.

More Information

WACC represents the average rate that a company is expected to pay to finance its assets. It's crucial for evaluating investment opportunities and understanding a firm's cost of capital.

Tips

- Confusing proportions of debt and equity; ensure they total to 100%.

- Forgetting to adjust the cost of debt for taxes; always apply the $(1 - T_c)$ factor.

AI-generated content may contain errors. Please verify critical information