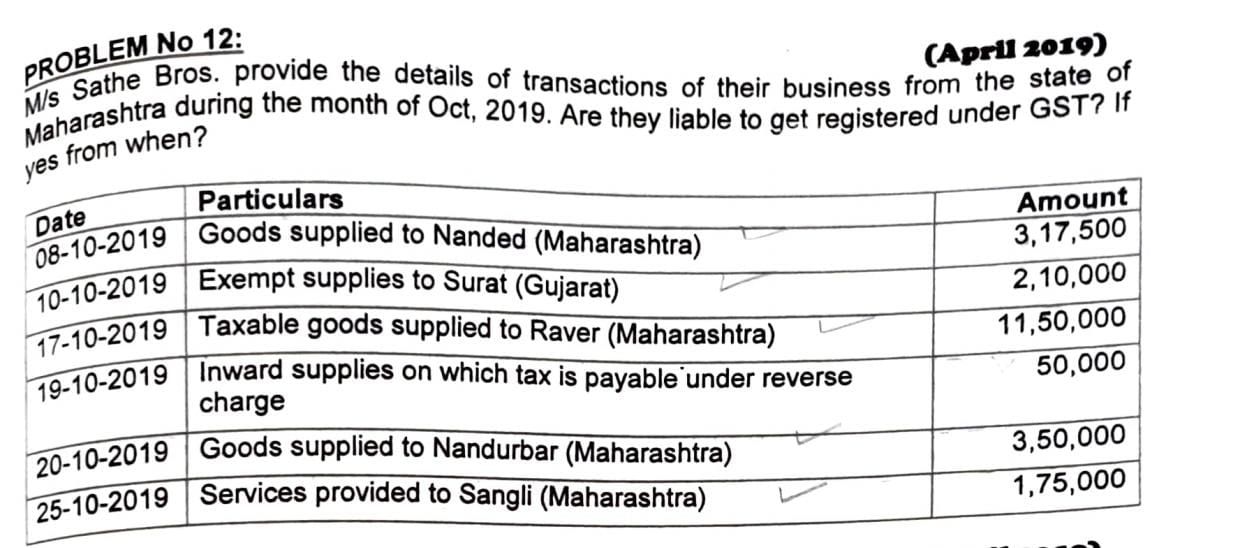

Are M/s Sathe Bros. liable to get registered under GST based on their transactions in October 2019? If yes, from when?

Understand the Problem

The question is asking whether M/s Sathe Bros. are liable to get registered under GST based on their transactions in October 2019 and if so, from what date they should be registered. It requires analyzing their transactions and determining liability under GST regulations.

Answer

Liable; register from October 2019.

M/s Sathe Bros. are liable to register for GST as their taxable supplies amount to ₹18,92,500, exceeding the threshold for services. They should register from October 2019, when the threshold was surpassed.

Answer for screen readers

M/s Sathe Bros. are liable to register for GST as their taxable supplies amount to ₹18,92,500, exceeding the threshold for services. They should register from October 2019, when the threshold was surpassed.

More Information

As of 2019, the threshold for GST registration was ₹20 lakhs for service providers in India. M/s Sathe Bros. exceeded this with their taxable supplies, making GST registration mandatory.

Tips

Common mistakes include including exempt supplies in the threshold calculation or not considering the correct threshold for the type of supply.

AI-generated content may contain errors. Please verify critical information