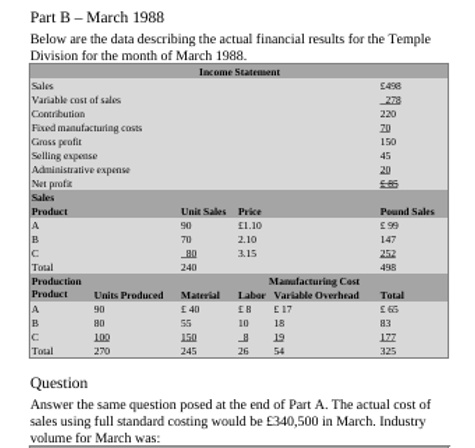

Answer the same question posed at the end of Part A. The actual cost of sales using full standard costing would be £340,500 in March. Industry volume for March was:

Understand the Problem

The question is asking for the calculation of the actual cost of sales using full standard costing for the Temple Division in March 1988, based on the provided income statement and sales information.

Answer

The actual cost of sales is £368.

Answer for screen readers

The actual cost of sales using full standard costing for the Temple Division in March 1988 is £368.

Steps to Solve

- Identify Given Data

Review the given data from the income statement:

- Sales: £498

- Variable cost of sales: £220

- Contribution: £220

- Fixed manufacturing costs: £150

- Selling expense: £45

- Administrative expense: £20

- Net profit: £20

- Understand Standard Costing

For full standard costing, we must consider the costs of materials, labor, and overhead for each product based on the production data provided.

- Calculate Total Manufacturing Cost

Calculate the total manufacturing cost for each product using the formula: $$ \text{Total Manufacturing Cost} = \text{Material Cost} + \text{Labor Cost} + \text{Variable Overhead} $$

For each product:

- Product A:

- Material: £40, Labor: £5, Variable Overhead: £17

- Total = £40 + £5 + £17 = £62

- Product B:

- Material: £55, Labor: £10, Variable Overhead: £18

- Total = £55 + £10 + £18 = £83

- Product C:

- Material: £150, Labor: £19, Variable Overhead: £26

- Total = £150 + £19 + £54 = £223

- Calculate Total Cost of Sales

Now we combine the total manufacturing costs for all products to get the actual cost of sales under full standard costing: $$ \text{Total Cost of Sales} = \text{Cost of A} + \text{Cost of B} + \text{Cost of C} $$

Substituting the values: $$ \text{Total Cost of Sales} = £62 + £83 + £223 = £368 $$

- Summarize Findings

The calculation indicates that the total cost of sales, based on full standard costing, amounts to £368 for March.

The actual cost of sales using full standard costing for the Temple Division in March 1988 is £368.

More Information

The information provided reflects a calculated cost structure that uses the allocated standard costs of materials, labor, and overhead for each product. This method helps businesses understand pricing and profit margins better.

Tips

- Confusing fixed costs with variable costs when calculating total costs.

- Misinterpreting how to combine manufacturing cost components; ensure all parts are included.

- Forgetting to align production units when calculating total costs for each product.

AI-generated content may contain errors. Please verify critical information