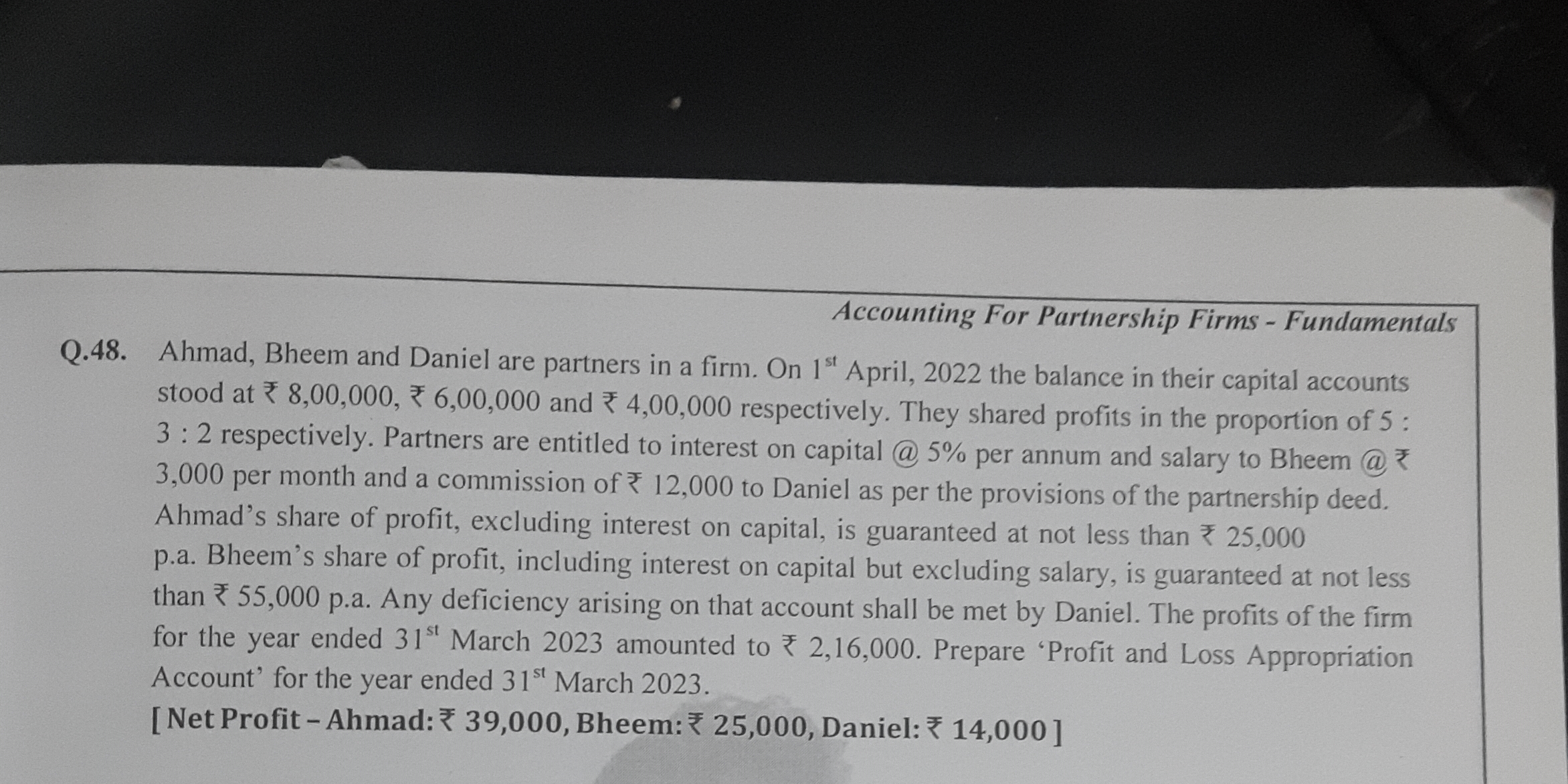

Ahmad, Bheem and Daniel are partners in a firm. On 1st April, 2022 the balance in their capital accounts stood at ₹8,00,000, ₹6,00,000 and ₹4,00,000 respectively. They shared profi... Ahmad, Bheem and Daniel are partners in a firm. On 1st April, 2022 the balance in their capital accounts stood at ₹8,00,000, ₹6,00,000 and ₹4,00,000 respectively. They shared profits in the proportion of 5:3:2 respectively. Partners are entitled to interest on capital @ 5% per annum and salary to Bheem @ ₹3,000 per month and a commission of ₹12,000 to Daniel as per the provisions of the partnership deed. Ahmad's share of profit, excluding interest on capital, is guaranteed at not less than ₹25,000 p.a. Bheem's share of profit, including interest on capital but excluding salary, is guaranteed at not less than ₹55,000 p.a. Any deficiency arising on that account shall be met by Daniel. The profits of the firm for the year ended 31st March 2023 amounted to ₹2,16,000. Prepare 'Profit and Loss Appropriation Account' for the year ended 31st March 2023.

Understand the Problem

The question is asking to prepare the Profit and Loss Appropriation Account for a partnership firm based on the provided capital balances, profit-sharing ratios, guaranteed profit amounts, and other conditions related to the partners' earnings.

Answer

Ahmad: ₹39,000, Bheem: ₹55,000, Daniel: ₹14,000

Answer for screen readers

The Profit and Loss Appropriation Account for the year ended 31st March 2023 shows:

- Ahmad: ₹39,000

- Bheem: ₹55,000

- Daniel: ₹14,000

Steps to Solve

- Calculate Interest on Capital

Calculate the interest on capital for each partner at the rate of 5% per annum:

-

Ahmad: $$ \text{Interest} = 8,00,000 \times \frac{5}{100} = ₹40,000 $$

-

Bheem: $$ \text{Interest} = 6,00,000 \times \frac{5}{100} = ₹30,000 $$

-

Daniel: $$ \text{Interest} = 4,00,000 \times \frac{5}{100} = ₹20,000 $$

- Calculate Salary and Commission

Determine Bheem’s salary and Daniel's commission for the year:

-

Bheem's Salary: $$ \text{Salary} = 3,000 \times 12 = ₹36,000 $$

-

Daniel's Commission: $$ \text{Commission} = ₹12,000 $$

- Calculate Total Profits Distribution

Total profits available for distribution are ₹2,16,000. First, add salary and commission:

$$ \text{Total Amount for Distribution} = \text{Profits} + \text{Salary} + \text{Commission} = 2,16,000 - 36,000 - 12,000 $$

Calculate the remainder available for profits:

$$ \text{Remaining for Profits} = 2,16,000 - 36,000 - 12,000 = ₹1,68,000 $$

- Calculate Share of Profits

Distribute the profits based on their profit-sharing ratio (5:3:2). First, determine total parts:

$$ \text{Total Parts} = 5 + 3 + 2 = 10 $$

-

Ahmad's share: $$ \text{Ahmad's Share} = \frac{5}{10} \times 1,68,000 = ₹84,000 $$

-

Bheem's share: $$ \text{Bheem's Share} = \frac{3}{10} \times 1,68,000 = ₹50,400 $$

-

Daniel's share: $$ \text{Daniel's Share} = \frac{2}{10} \times 1,68,000 = ₹33,600 $$

- Adjust for Guaranteed Profit

Now check the guaranteed profits:

- Ahmad’s guaranteed share is ₹25,000 (actual is ₹40,000).

- Bheem’s guaranteed share is ₹55,000 (actual is ₹50,400; need ₹4,600 more).

- Daniel will cover the deficiency.

Daniel’s adjusted profit will decrease to cover Bheem's deficit:

- Adjust Daniel's profit to: $$ \text{Revised Daniel's Share} = 33,600 - 4,600 = ₹29,000 $$

- Summarize Final Shares

Compile the final profit-sharing figures:

- Ahmad: ₹39,000

- Bheem: ₹55,000

- Daniel: ₹14,000

The Profit and Loss Appropriation Account for the year ended 31st March 2023 shows:

- Ahmad: ₹39,000

- Bheem: ₹55,000

- Daniel: ₹14,000

More Information

The profits are distributed according to their capital contributions, guaranteed profits, and the stipulations of their partnership agreement. Each partner’s earnings reflect their roles and responsibilities within the partnership, including the adjustments for guaranteed profits.

Tips

- Forgetting to calculate the interest on capital before distributing profits.

- Not accounting for guaranteed profit adjustments properly, leading to incorrect calculations for each partner.

- Misunderstanding how to apply the profit-sharing ratio to the remaining profits.

AI-generated content may contain errors. Please verify critical information