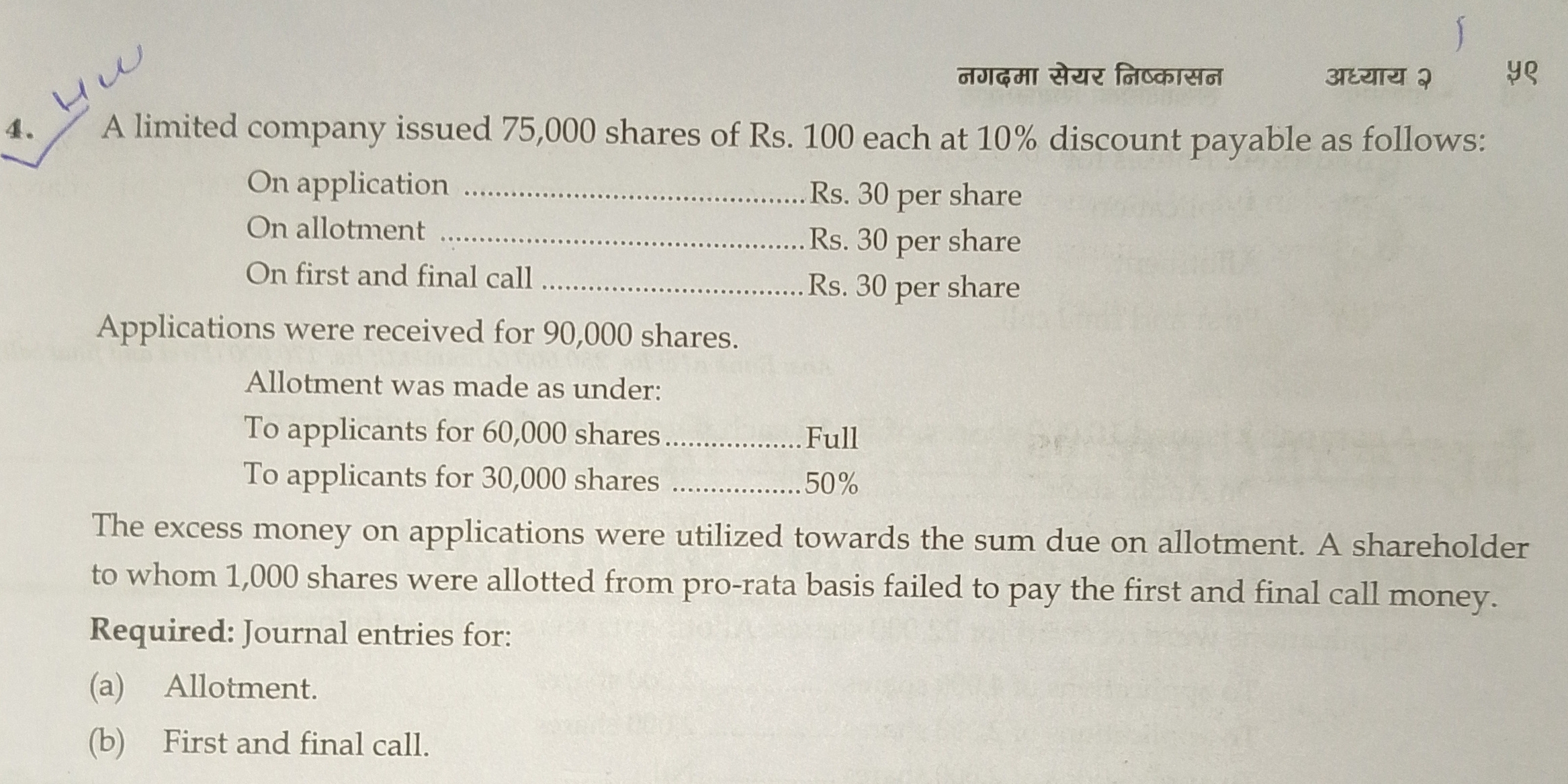

A limited company issued 75,000 shares of Rs. 100 each at 10% discount payable as follows: On application Rs. 30 per share, On allotment Rs. 30 per share, On first and final call R... A limited company issued 75,000 shares of Rs. 100 each at 10% discount payable as follows: On application Rs. 30 per share, On allotment Rs. 30 per share, On first and final call Rs. 30 per share. Applications were received for 90,000 shares. Allotment was made as under: To applicants for 60,000 shares Full, To applicants for 30,000 shares 50%. The excess money on applications were utilized towards the sum due on allotment. A shareholder to whom 1,000 shares were allotted from pro-rata basis failed to pay the first and final call money. Required: Journal entries for: (a) Allotment. (b) First and final call.

Understand the Problem

The question is asking for journal entries related to the allotment and first and final call of shares issued by a limited company. It includes specific details on the number of shares, the amounts payable, and how the applications were handled, particularly noting the excess money from applications that were allocated to pay for the due amounts.

Answer

Allotment Journal Entry: - Debit: Bank Rs. 2,250,000 - Credit: Share Capital Rs. 2,250,000 First and Final Call Journal Entry: - Debit: Share Calls Rs. 2,250,000 - Credit: Share Capital Rs. 2,250,000

Answer for screen readers

Journal Entries:

(a) Allotment

- Bank Account Debit Rs. 2,250,000

- Share Capital Account Credit Rs. 2,250,000

(b) First and Final Call

- Share Call Account Debit Rs. 2,250,000

- Share Capital Account Credit Rs. 2,250,000

Steps to Solve

-

Understand the shares issued and amounts The company has issued 75,000 shares of Rs. 100 each at a 10% discount. This means the nominal value is Rs. 100, but the shares are issued at Rs. 90.

-

Calculate total shares applied Applications were received for 90,000 shares. Allotment was made as follows:

- 60,000 shares allotted fully.

- 30,000 shares allotted at 50%.

- Determine the allotment amounts

-

For the fully allotted shares (60,000):

Allotment = 60,000 shares * Rs. 30 = Rs. 1,800,000 -

For the partially allotted shares (15,000 from 30,000):

Allotment = 15,000 shares * Rs. 30 = Rs. 450,000

So, total allotment amount = Rs. 1,800,000 + Rs. 450,000 = Rs. 2,250,000.

- Journal entries for allotment

- Debit "Bank" with the total allotment amount.

- Credit "Share Capital" with the nominal value of shares allotted.

-

Handling excess money The excess money on applications (from 15,000 unsatisfied applications) is adjusted against the due amount of allotment.

-

Calculate due allotment amount The total due allotment amount was entered as:

- Total due from 75,000 shares = 75,000 * Rs. 30 = Rs. 2,250,000.

-

Final call on shares The first and final call of Rs. 30 per share applies to all shares. So total due for first and final call:

Total shares = 75,000

Total final call due = 75,000 * Rs. 30 = Rs. 2,250,000. -

Journal entries for final call

- Debit "Share Calls in Arrears" and Credit "Share Capital" for Rs. 2,250,000.

Journal Entries:

(a) Allotment

- Bank Account Debit Rs. 2,250,000

- Share Capital Account Credit Rs. 2,250,000

(b) First and Final Call

- Share Call Account Debit Rs. 2,250,000

- Share Capital Account Credit Rs. 2,250,000

More Information

The journal entries reflect the financial actions taken for the allotment and the final call of shares based on issued share capital, applications received, and payments made. Understanding these entries is crucial for maintaining accurate company accounts during share issuance.

Tips

- Not accounting for excess amounts: Ensure that excess funds from applications are credited correctly to the next due amounts.

- Mixing up the allotment and call amounts: It’s essential to separate these entries as they pertain to different financial transactions.

AI-generated content may contain errors. Please verify critical information