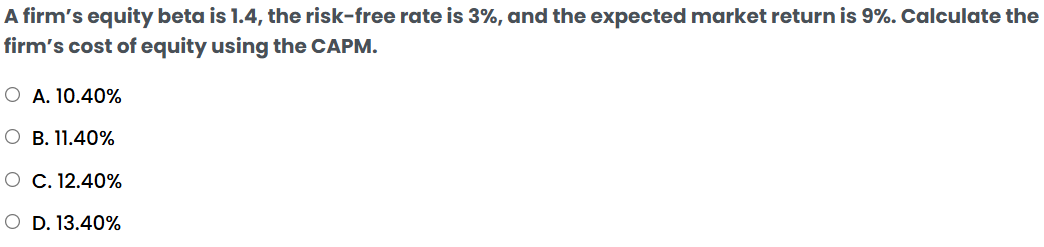

A firm's equity beta is 1.4, the risk-free rate is 3%, and the expected market return is 9%. Calculate the firm's cost of equity using the CAPM.

Understand the Problem

The question is asking for the calculation of a firm's cost of equity using the Capital Asset Pricing Model (CAPM), given the firm's equity beta, the risk-free rate, and the expected market return.

Answer

The firm's cost of equity is $11.4\%$.

Answer for screen readers

The firm's cost of equity using the CAPM is $11.4%$.

Steps to Solve

- Identify the CAPM Formula

The Capital Asset Pricing Model (CAPM) formula is given by:

$$ r_e = r_f + \beta \times (r_m - r_f) $$

where:

- ( r_e ) = cost of equity

- ( r_f ) = risk-free rate

- ( \beta ) = equity beta

- ( r_m ) = expected market return

- Substitute the Known Values

Plug in the values from the problem:

- ( r_f = 3% = 0.03 )

- ( \beta = 1.4 )

- ( r_m = 9% = 0.09 )

Now, substitute these values into the CAPM formula:

$$ r_e = 0.03 + 1.4 \times (0.09 - 0.03) $$

- Calculate the Market Risk Premium

Calculate the market risk premium, which is the difference between the expected market return and the risk-free rate:

$$ r_m - r_f = 0.09 - 0.03 = 0.06 $$

- Multiply Beta by the Market Risk Premium

Now, multiply the equity beta by the market risk premium:

$$ 1.4 \times 0.06 = 0.084 $$

- Calculate the Cost of Equity

Finally, add the risk-free rate to the result from the previous step:

$$ r_e = 0.03 + 0.084 = 0.114 $$

Convert this back to percentage:

$$ r_e = 11.4% $$

The firm's cost of equity using the CAPM is $11.4%$.

More Information

Using CAPM, the cost of equity is a critical measure for evaluating the required return an investor expects for providing capital to a firm.

Tips

- Failing to convert percentages to decimals when performing calculations.

- Neglecting to add the risk-free rate back to the calculated risk premium.

AI-generated content may contain errors. Please verify critical information