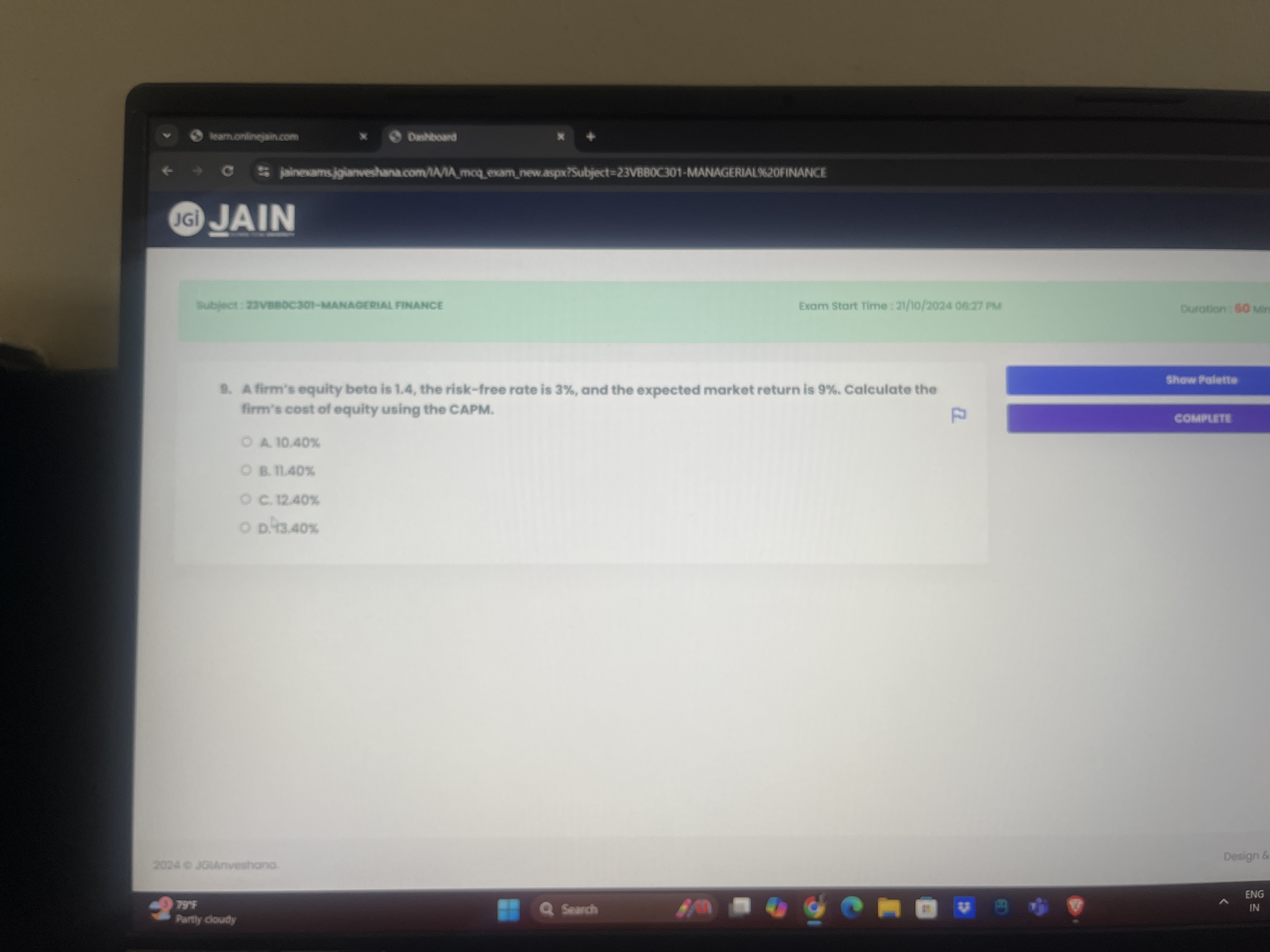

A firm's equity beta is 1.4, the risk-free rate is 3%, and the expected market return is 9%. Calculate the firm's cost of equity using the CAPM.

Understand the Problem

The question is asking us to calculate the cost of equity for a firm using the Capital Asset Pricing Model (CAPM). It provides the necessary values such as the firm's equity beta, risk-free rate, and expected market return to solve the problem.

Answer

The cost of equity is $11.40\%$.

Answer for screen readers

The firm's cost of equity using the CAPM is $11.40%$.

Steps to Solve

- Identify the Given Values

We have the following values:

- Beta ($\beta$) = 1.4

- Risk-free rate ($r_f$) = 3% = 0.03

- Expected market return ($r_m$) = 9% = 0.09

- Use the CAPM Formula

The Capital Asset Pricing Model (CAPM) formula is: $$ r_e = r_f + \beta \times (r_m - r_f) $$ Where:

- $r_e$ = cost of equity

- $r_f$ = risk-free rate

- $r_m$ = expected market return

- $\beta$ = equity beta

- Substitute the Values into the CAPM Formula

Substituting the known values into the equation: $$ r_e = 0.03 + 1.4 \times (0.09 - 0.03) $$

- Calculate the Market Risk Premium

Calculate the market risk premium: $$ r_m - r_f = 0.09 - 0.03 = 0.06 $$

- Calculate the Cost of Equity

Now substitute the market risk premium back into the equation: $$ r_e = 0.03 + 1.4 \times 0.06 $$

- Perform the Final Calculation

Calculating the multiplication and addition: $$ 1.4 \times 0.06 = 0.084 $$ Then: $$ r_e = 0.03 + 0.084 = 0.114 $$

Finally, convert to percentage: $$ r_e = 0.114 \times 100 = 11.4% $$

The firm's cost of equity using the CAPM is $11.40%$.

More Information

The cost of equity is crucial for firms to determine the return expected by investors. CAPM is widely used in finance to establish expected return based on risk.

Tips

- Forgetting to convert percentages to decimal form. Always ensure to convert values properly before using them in calculations.

- Misapplying the CAPM formula. Each component must be substituted accurately.