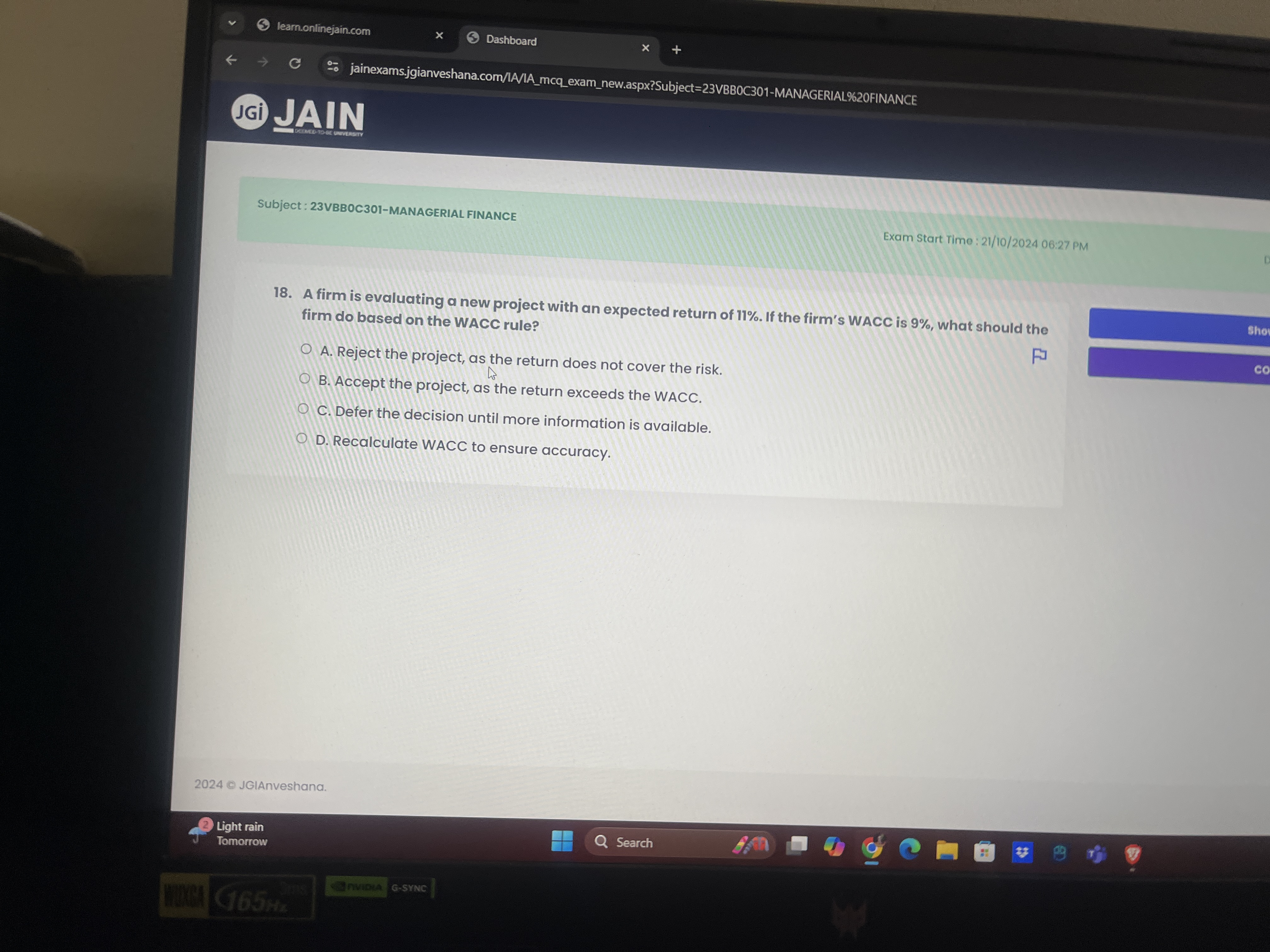

A firm is evaluating a new project with an expected return of 11%. If the firm's WACC is 9%, what should the firm do based on the WACC rule?

Understand the Problem

The question is asking how a firm should evaluate a new project with a return of 11% relative to its WACC of 9%. It outlines options for acceptance or rejection of the project based on this evaluation metric.

Answer

Accept the project, as the return exceeds the WACC.

The firm should accept the project because the expected return of 11% exceeds the firm's WACC of 9%.

Answer for screen readers

The firm should accept the project because the expected return of 11% exceeds the firm's WACC of 9%.

More Information

The WACC is used to evaluate the relative profitability of a project. If the project's return exceeds the WACC, it should enhance shareholder value.

Tips

Common mistake: Confusing WACC with other metrics or misunderstanding that a higher project return compared to WACC is beneficial.

Sources

- Weighted Average Cost of Capital (WACC): Definition and Formula - investopedia.com