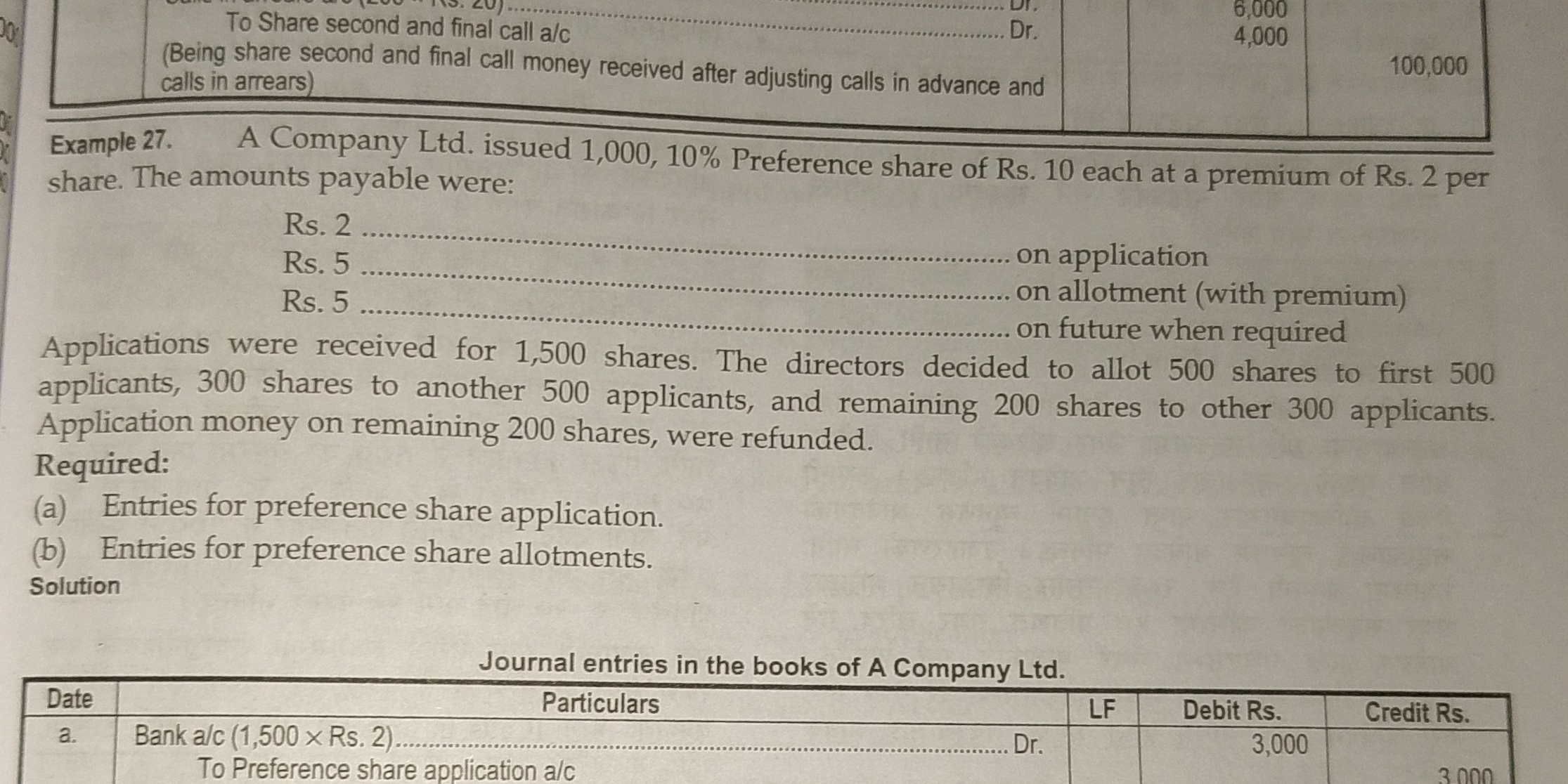

(a) Entries for preference share application. (b) Entries for preference share allotments.

Understand the Problem

The question is asking for the journal entries related to the application and allotment of preference shares, specifically for a company that issued shares and received applications from multiple individuals. We're required to formulate the accounting entries based on the information provided regarding share applications and refunds.

Answer

1. **For Preference Share Application** ``` Bank A/c Dr. Rs. 3,000 To Preference Share Application A/c Rs. 3,000 ``` 2. **For Preference Share Allotment** ``` Preference Share Application A/c Dr. Rs. 3,000 Bank A/c Dr. Rs. 3,500 To Preference Share Capital A/c Rs. 5,000 ``` 3. **For Share Refunds** ``` Preference Share Application A/c Dr. Rs. 2,000 To Bank A/c Rs. 2,000 ```

Answer for screen readers

The journal entries are as follows:

-

For Preference Share Application

Bank A/c Dr. Rs. 3,000 To Preference Share Application A/c Rs. 3,000 -

For Preference Share Allotment

Preference Share Application A/c Dr. Rs. 3,000 Bank A/c Dr. Rs. 3,500 To Preference Share Capital A/c Rs. 5,000 -

For Share Refunds

Preference Share Application A/c Dr. Rs. 2,000 To Bank A/c Rs. 2,000

Steps to Solve

-

Journal Entry for Share Applications

Record the total amount received from the share applications.

The company received applications for 1,500 shares at an application fee of Rs. 2 each.

Therefore, total application money = 1,500 shares * Rs. 2 = Rs. 3,000.The journal entry will be:

Bank A/c Dr. Rs. 3,000 To Preference Share Application A/c Rs. 3,000 -

Journal Entry for Share Allotments

Allotment is made for 500 shares to the first 500 applicants, and the remaining 1,000 applications are refunded.

The allotment amount includes a premium, which is Rs. 5 on allotment and Rs. 2 premium per share.

Therefore,

Total allotment money = 500 shares * (Rs. 5 + Rs. 2) = Rs. 3,500.The journal entry will be:

Preference Share Application A/c Dr. Rs. 3,000 Bank A/c Dr. Rs. 3,500 To Preference Share Capital A/c Rs. 5,000 -

Journal Entry for Share Refunds

Since 1,000 applicants are refunded, we need to record the refund of application money for 1,000 shares.

Refund amount = 1,000 shares * Rs. 2 = Rs. 2,000.The journal entry will be:

Preference Share Application A/c Dr. Rs. 2,000 To Bank A/c Rs. 2,000

The journal entries are as follows:

-

For Preference Share Application

Bank A/c Dr. Rs. 3,000 To Preference Share Application A/c Rs. 3,000 -

For Preference Share Allotment

Preference Share Application A/c Dr. Rs. 3,000 Bank A/c Dr. Rs. 3,500 To Preference Share Capital A/c Rs. 5,000 -

For Share Refunds

Preference Share Application A/c Dr. Rs. 2,000 To Bank A/c Rs. 2,000

More Information

This reflects the accounting process of handling preference shares, where companies deal with receiving applications, allotting shares, and refunding excess applications. It's essential to maintain accurate records to comply with financial reporting requirements.

Tips

- Incorrect Calculation of Shares: Not properly calculating the total application or refund amounts based on the number of shares and the application fee can lead to incorrect journal entries.

- Neglecting to Record Refunds: Failing to record the refunds for shares that were not allotted can distort the company's financial position.

- Inaccurate Account Names: Using incorrect account names in the journal entries can lead to complications in understanding the accounts involved.

AI-generated content may contain errors. Please verify critical information