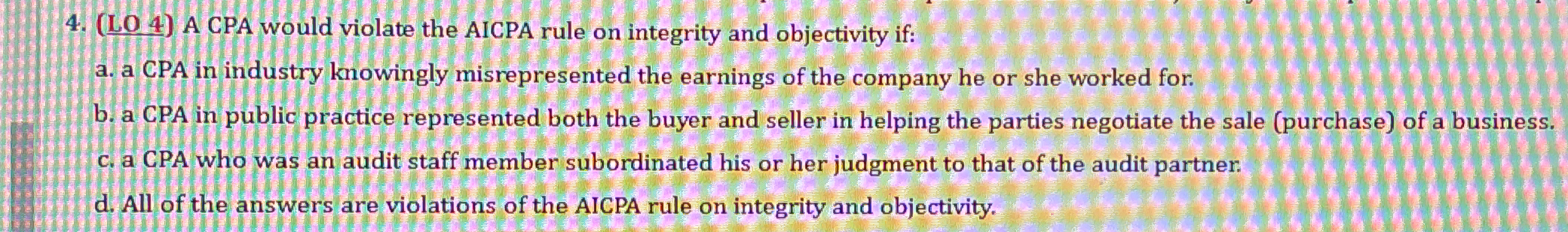

A CPA would violate the AICPA rule on integrity and objectivity if: a. a CPA in industry knowingly misrepresented the earnings of the company he or she worked for. b. a CPA in publ... A CPA would violate the AICPA rule on integrity and objectivity if: a. a CPA in industry knowingly misrepresented the earnings of the company he or she worked for. b. a CPA in public practice represented both the buyer and seller in helping the parties negotiate the sale (purchase) of a business. c. a CPA who was an audit staff member subordinated his or her judgment to that of the audit partner. d. All of the answers are violations of the AICPA rule on integrity and objectivity.

Understand the Problem

The question is asking which situations involving a CPA would violate the AICPA rule on integrity and objectivity. It presents multiple choices that describe different scenarios regarding a CPA's conduct.

Answer

All options (a, b, c) are violations.

The final answer is all options (a, b, c) are violations.

Answer for screen readers

The final answer is all options (a, b, c) are violations.

More Information

According to the AICPA rule on integrity and objectivity, knowingly misrepresenting information, engaging in conflicts of interest, or subordinating judgment are considered violations. Thus, each of the listed scenarios would breach these rules.

Tips

A common misunderstanding involves not recognizing how each scenario impacts integrity and objectivity.

Sources

AI-generated content may contain errors. Please verify critical information