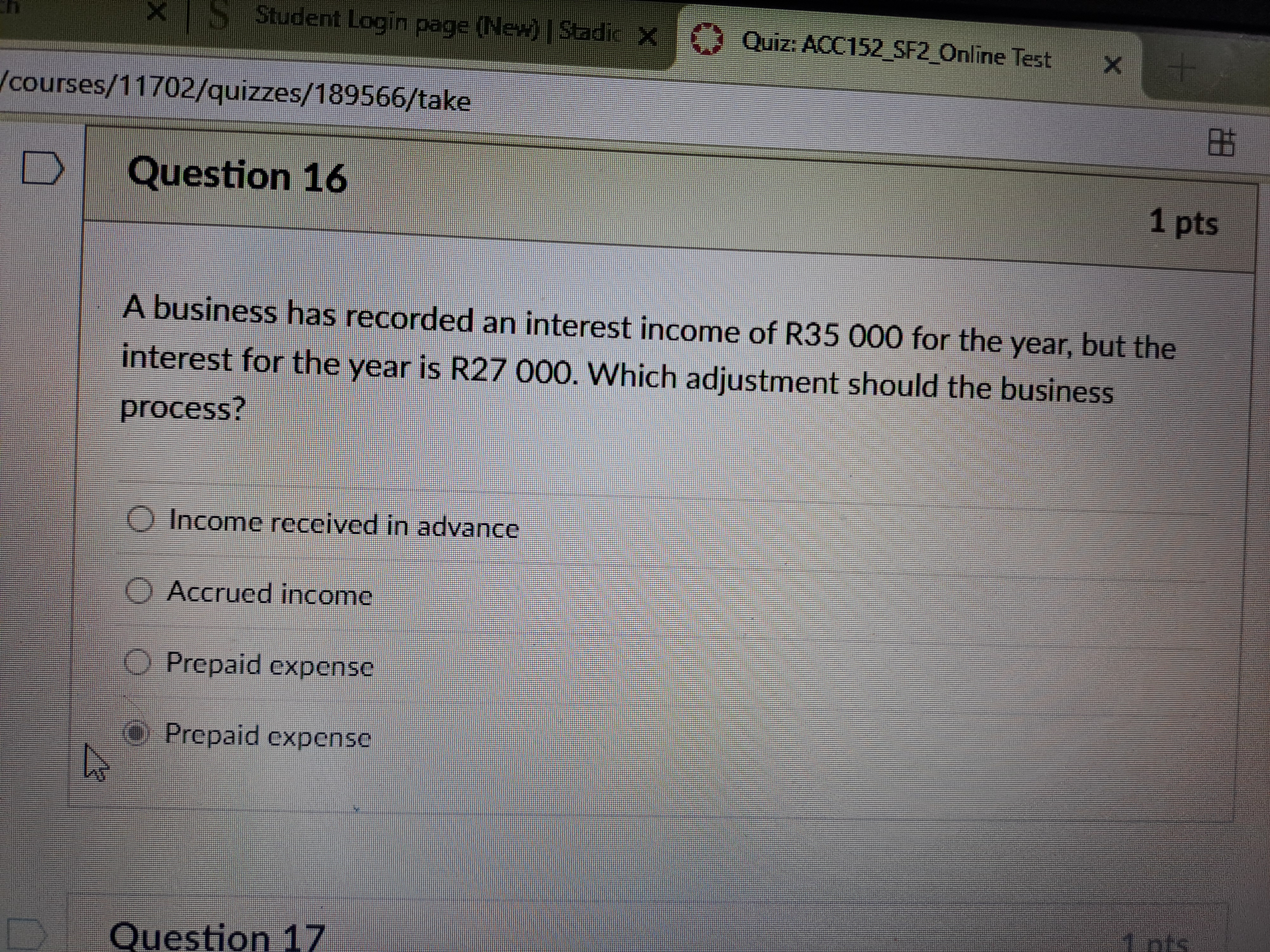

A business has recorded an interest income of R35 000 for the year, but the interest for the year is R27 000. Which adjustment should the business process?

Understand the Problem

The question is asking what accounting adjustment a business should make regarding interest income for the year. It provides specific figures and options related to accounting concepts, implying the need to apply knowledge of financial adjustments.

Answer

Income received in advance

The final answer is 'Income received in advance' needs to be recorded to adjust the interest income to the correct amount.

Answer for screen readers

The final answer is 'Income received in advance' needs to be recorded to adjust the interest income to the correct amount.

More Information

When interest income is over-recorded, the adjustment needed is to reclassify the excess as unearned income or 'income received in advance'. This reflects a liability for the business as it is income not yet earned.

Tips

A common mistake is to incorrectly consider the excess as accrued income instead of recognizing it as unearned.

AI-generated content may contain errors. Please verify critical information