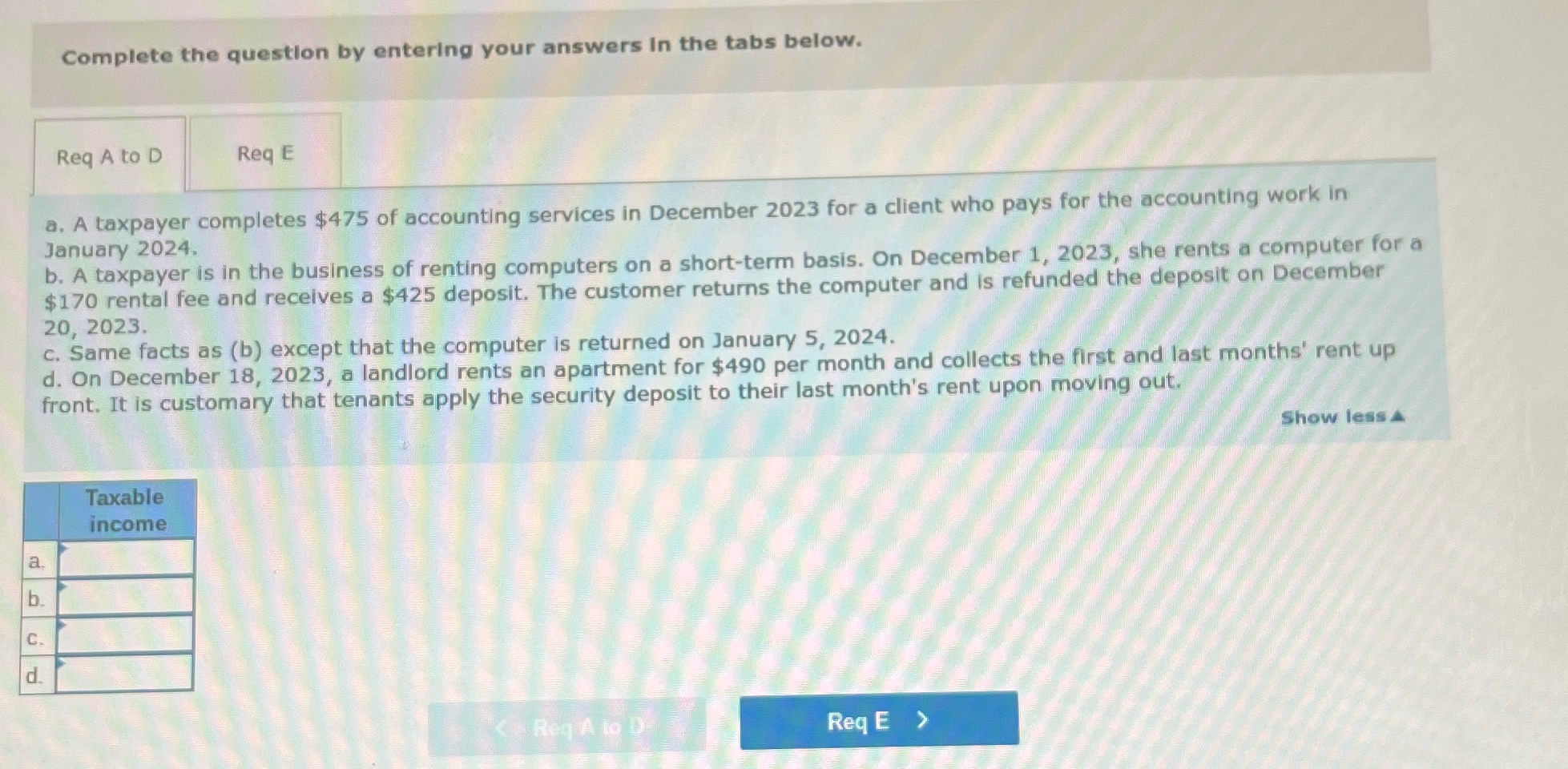

a. A taxpayer completes $475 of accounting services in December 2023 for a client who pays for the accounting work in January 2024. b. A taxpayer is in the business of renting comp... a. A taxpayer completes $475 of accounting services in December 2023 for a client who pays for the accounting work in January 2024. b. A taxpayer is in the business of renting computers on a short-term basis. On December 1, 2023, she rents a computer for a $170 rental fee and receives a $425 deposit. The customer returns the computer and is refunded the deposit on December 20, 2023. c. Same facts as (b) except that the computer is returned on January 5, 2024. d. On December 18, 2023, a landlord rents an apartment for $490 per month and collects the first and last month's rent up front. It is customary that tenants apply the security deposit to their last month's rent upon moving out.

Understand the Problem

The question is asking about the taxable income from various scenarios involving accounting services and rental arrangements. Each scenario outlines specific transactions, and the task is likely to determine how these transactions affect taxable income in each case.

Answer

- a: $475 - b: $170 - c: $170 - d: $980

Answer for screen readers

- a: $475

- b: $170

- c: $170

- d: $980

Steps to Solve

-

Determine Taxable Income from Accounting Services

The taxpayer completed $475 worth of accounting services in December 2023. This amount is taxable in January 2024 because the payment is received for work done.

Taxable income: $$ \text{Taxable Income (a)} = 475 $$

-

Calculate Taxable Income from Rental Business (Deposit Included)

The taxpayer earns $170 as rental income for the computer. The $425 deposit received is not taxable as income at this moment, but the rental income is.

Taxable income: $$ \text{Taxable Income (b)} = 170 $$

-

Assess Taxable Income for Returned Computer (Deposit Refund)

The same rental arrangement as (b) applies, and since the deposit was refunded after the computer return, it doesn't count as taxable income.

Taxable income: $$ \text{Taxable Income (c)} = 170 $$

-

Evaluate Taxable Income from Apartment Rental

For the apartment rental situation, the landlord gets $490 for the current rent and $490 as last month's rent, which has already been received. Thus, the total income for December is $490.

Taxable income: $$ \text{Taxable Income (d)} = 490 + 490 = 980 $$

- a: $475

- b: $170

- c: $170

- d: $980

More Information

Taxable income is determined based on the time services are rendered and the nature of deposits. In rental situations, security deposits are typically not taxable until forfeited.

Tips

- Misclassifying security deposits as immediate income; they should only be counted when they are retained.

- Failing to recognize when income is earned (e.g., services rendered might be reported in a different tax year).

AI-generated content may contain errors. Please verify critical information