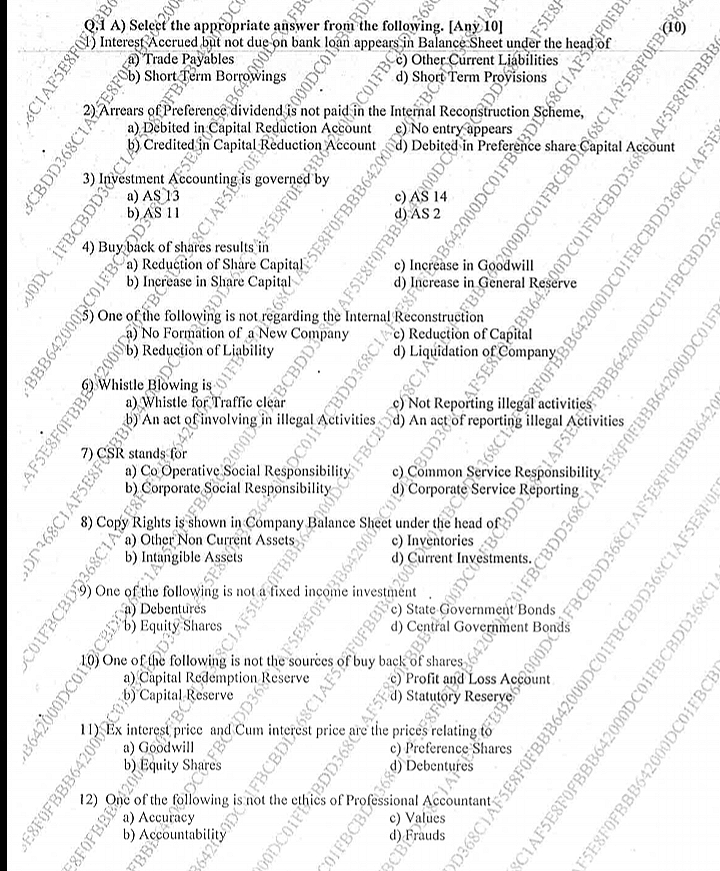

1) Interest Accrued but not due on bank loan appears in Balance Sheet under the head of: a) Trade Payables b) Short Term Borrowings c) Other Current Liabilities d) Short Term Provi... 1) Interest Accrued but not due on bank loan appears in Balance Sheet under the head of: a) Trade Payables b) Short Term Borrowings c) Other Current Liabilities d) Short Term Provisions 2) Arrears of Preference dividends not paid in the Internal Reconstruction Scheme, a) Debited in Capital Reduction Account b) Credited in Capital Reduction Account c) No entry appears d) Debited in Preference Share Capital Account 3) Investment Accounting is governed by a) AS 13 b) AS 11 c) AS 14 d) AS 2 4) Buy-back of shares results in a) Reduction of Share Capital b) Increase in Share Capital c) Increase in Goodwill d) Increase in General Reserve 5) One of the following is not regarding the Internal Reconstruction: a) Capital Reconstruction b) No Formation of a New Company c) Reduction of Capital d) Liquidation of Company 6) Whistle Blowing is a) Whistle for Traffic clear b) An act of involving in illegal activities c) Not Reporting illegal activities d) An act of reporting illegal activities 7) CSR stands for a) Co-Operative Social Responsibility b) Corporate Social Responsibility c) Common Service Responsibility d) Corporate Service Reporting 8) Copy Rights is shown in Company Balance Sheet under the head of: a) Other Non-Current Assets b) Intangible Assets c) Inventories d) Current Investments 9) One of the following is not a fixed income investment: a) Debentures b) Equity Shares c) State Government Bonds d) Central Government Bonds 10) One of the following is not the sources of buy back of shares: a) Capital Redemption Reserve b) Profit and Loss Account c) Capital Reserve d) Statutory Reserve 11) Ex interest price and cum interest price are the prices relating to a) Goodwill b) Preference Shares c) Equity Shares d) Debentures 12) One of the following is not the ethics of Professional Accountant: a) Accuracy b) Values c) Accountability d) Frauds

Understand the Problem

The question includes a series of multiple-choice accounting-related queries, focusing on topics such as interest accrual, investment accounting standards, corporate actions like share buybacks, whistleblowing definitions, and corporate social responsibility.

Answer

1) c, 2) c, 3) a, 4) a, 5) d, 6) d, 7) b, 8) b, 9) b, 10) d, 11) d, 12) d

The final answer is: 1) c) Other Current Liabilities, 2) c) No entry appears, 3) a) AS 13, 4) a) Reduction of Share Capital, 5) d) Liquidation of Company, 6) d) An act of reporting illegal activities, 7) b) Corporate Social Responsibility, 8) b) Intangible Assets, 9) b) Equity Shares, 10) d) Statutory Reserve, 11) d) Debentures, 12) d) Frauds

Answer for screen readers

The final answer is: 1) c) Other Current Liabilities, 2) c) No entry appears, 3) a) AS 13, 4) a) Reduction of Share Capital, 5) d) Liquidation of Company, 6) d) An act of reporting illegal activities, 7) b) Corporate Social Responsibility, 8) b) Intangible Assets, 9) b) Equity Shares, 10) d) Statutory Reserve, 11) d) Debentures, 12) d) Frauds

More Information

Accrued but unpaid interest and preference dividends have specific accounting treatments in financial statements. Rights such as copyrights fall under intangible assets due to their non-physical, long-term utility.

Tips

A common mistake is misclassifying interest or dividend-related entries due to misunderstanding liability categorization.