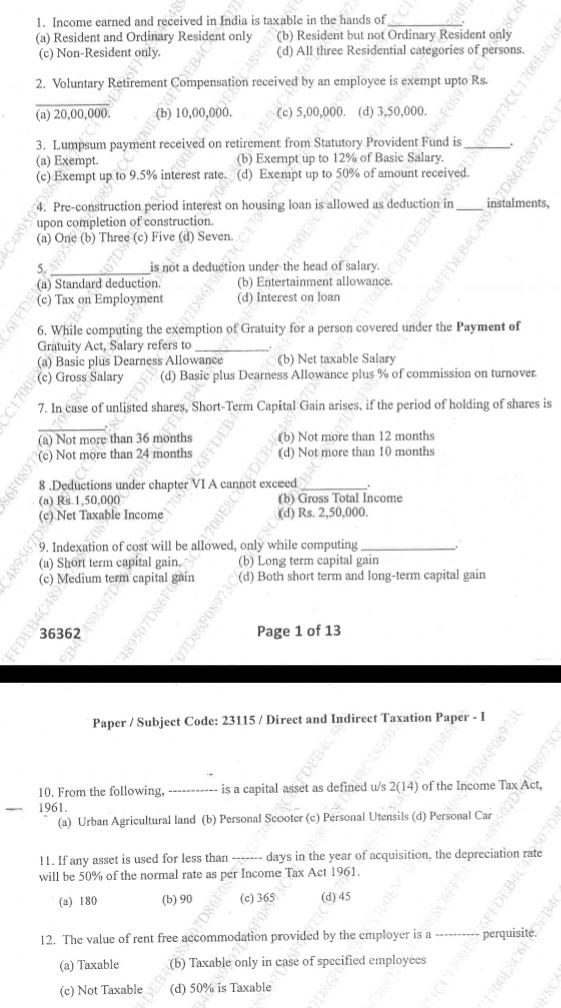

1. Income earned and received in India is taxable in the hands of (a) Resident and Ordinary Resident only (b) Resident but not Ordinary Resident only (c) Non-Resident only. (d) All... 1. Income earned and received in India is taxable in the hands of (a) Resident and Ordinary Resident only (b) Resident but not Ordinary Resident only (c) Non-Resident only. (d) All three Residential categories of persons. 2. Voluntary Retirement Compensation received by an employee is exempt up to Rs. (a) 20,00,000 (b) 10,00,000 (c) 5,00,000 (d) 3,50,000. 3. Lumpsum payment received on retirement from Statutory Provident Fund is (a) Exempt. (b) Exempt up to 12% of Basic Salary. (c) Exempt up to 9.5% interest rate. (d) Exempt up to 50% of amount received. 4. Pre-construction period interest on housing loan is allowed as deduction in (a) One (b) Three (c) Five (d) Seven instalments upon completion of construction. 5. __________ is not a deduction under the head of salary. (a) Standard deduction. (b) Entertainment allowance. (c) Tax on Employment. (d) Interest on loan. 6. While computing the exemption of Gratuity for a person covered under the Payment of Gratuity Act, Salary refers to (a) Basic plus Dearness Allowance (b) Net taxable Salary (c) Gross Salary (d) Basic plus Dearness Allowance plus 9% of commission on turnover. 7. In case of unlisted shares, Short-Term Capital Gain arises, if the period of holding of shares is (a) Not more than 36 months (b) Not more than 12 months (c) Not more than 24 months (d) Not more than 10 months. 8. Deductions under chapter VIA cannot exceed (a) Gross Total Income (b) Net Taxable Income (c) Rs. 1,50,000 (d) Rs. 2,50,000. 9. Indexation of cost will be allowed, only while computing (a) Short term capital gain. (b) Long term capital gain (c) Medium term capital gain. (d) Both short term and long-term capital gain. 10. From the following, __________ is a capital asset as defined u/s 2(14) of the Income Tax Act, 1961. (a) Urban Agricultural land (b) Personal Scooter (c) Personal Utensils (d) Personal Car. 11. If any asset is used for less than ______ days in the year of acquisition, the depreciation rate will be 50% of the normal rate as per Income Tax Act 1961. (a) 180 (b) 90 (c) 365 (d) 45. 12. The value of rent free accommodation provided by the employer is a _______ perquisite. (a) Taxable (b) Taxable only in case of specified employees (c) Not Taxable (d) 50% is Taxable.

Understand the Problem

The question is a set of multiple-choice questions related to taxation laws and principles, mostly focusing on income tax, deductions, capital gains, and asset classification. It requires knowledge of specific tax regulations and concepts.

Answer

1. d, 2. a, 3. a, 4. c, 5. d, 6. d, 7. a, 8. a, 9. b, 10. a, 11. a, 12. a

- d, 2. a, 3. a, 4. c, 5. d, 6. d, 7. a, 8. a, 9. b, 10. a, 11. a, 12. a

Answer for screen readers

- d, 2. a, 3. a, 4. c, 5. d, 6. d, 7. a, 8. a, 9. b, 10. a, 11. a, 12. a

More Information

These answers are based on general knowledge of the Indian taxation system, as it is likely to be applied in a taxation exam setting.

Tips

Ensure understanding of tax terms and conditions for specific contexts like Residents vs. Non-Residents, etc.

AI-generated content may contain errors. Please verify critical information