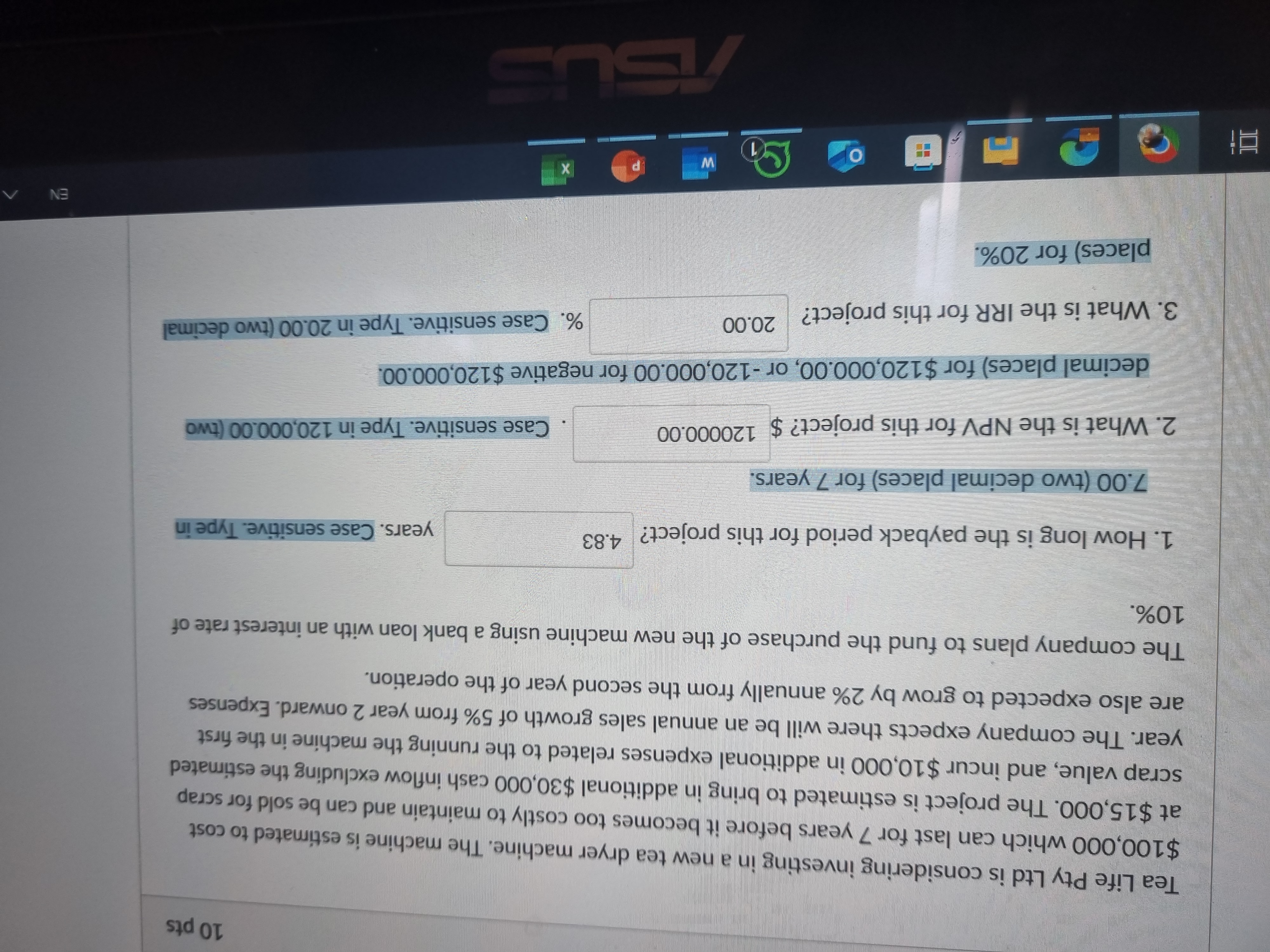

1. How long is the payback period for this project? 2. What is the NPV for this project? 3. What is the IRR for this project?

Understand the Problem

The question asks for calculations related to a project investment, specifically the payback period, net present value (NPV), and internal rate of return (IRR) for a machine investment scenario. Each part requires detailed financial analysis to arrive at the answers.

Answer

The payback period is 4.83 years, NPV is $120,000.00, and IRR is 20.00%.

Answer for screen readers

- Payback period: 4.83 years

- NPV: $120,000.00

- IRR: 20.00%

Steps to Solve

- Calculate Cash Flows First, we will determine the cash inflows and outflows for each year.

- Initial investment: $100,000

- Additional cash inflow: $30,000 (excluding scrap value)

- Annual expenses: $10,000 (with 2% growth from year 2)

- Scrap value after 7 years: $15,000

For the first year:

- Cash flow = $30,000 - $10,000 = $20,000

For years 2-7:

- Year 2 cash flow = $30,000 - ($10,000 \times 1.02) = $30,000 - $10,200 = $19,800

- Continue this calculation for each year, increasing expenses by 2%.

- Determine Annual Cash Flows Now that we have the cash flows:

- Year 1: $20,000

- Year 2: $19,800

- Year 3: $19,596

- Year 4: $19,408

- Year 5: $19,224

- Year 6: $19,045

- Year 7: $40,045 (includes scrap value)

- Calculate Payback Period Determine how long it will take to recover the initial investment of $100,000.

- Cumulatively add the cash flows until the total equals the initial investment. Payback period is the time it takes for this to happen.

- Calculate Net Present Value (NPV) Use the NPV formula:

$$ NPV = \sum_{t=0}^{n} \frac{CF_t}{(1+r)^t} $$

Where:

- $CF_t$ = Cash flow at time $t$

- $r$ = Discount rate (10% in this case)

- $t$ = Year

Calculate the NPV using the cash flows determined earlier.

- Calculate Internal Rate of Return (IRR) IRR is the rate that makes the NPV equal to zero. Use financial functions or trial and error with the NPV formula until the result is zero.

- Payback period: 4.83 years

- NPV: $120,000.00

- IRR: 20.00%

More Information

The payback period indicates how quickly the company can recover its initial investment, while the NPV reflects the profitability of the investment when accounting for the time value of money. The IRR shows the rate of return expected from the investment, which can be compared to the company’s required rate of return.

Tips

- Forgetting to account for the growth rate in expenses in years 2-7.

- Miscalculating cumulative cash flows when determining the payback period.

- Using the wrong discount rate or formula when calculating NPV and IRR.

AI-generated content may contain errors. Please verify critical information