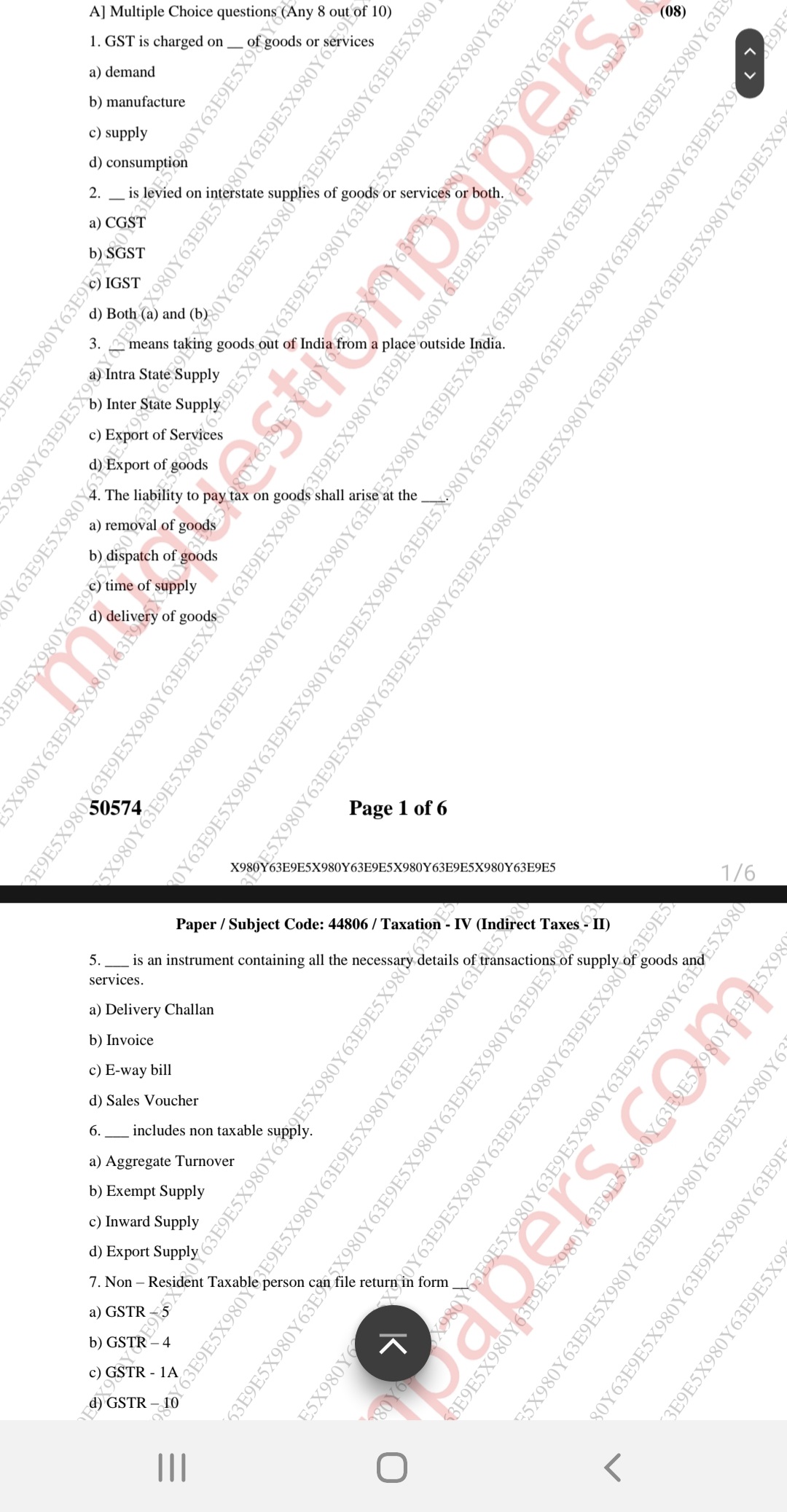

1. GST is charged on ___ of goods or services. 2. ___ is levied on interstate supplies of goods or services or both. 3. ___ means taking goods out of India from a place outside Ind... 1. GST is charged on ___ of goods or services. 2. ___ is levied on interstate supplies of goods or services or both. 3. ___ means taking goods out of India from a place outside India. 4. The liability to pay tax on goods shall arise at the ___. 5. ___ is an instrument containing all the necessary details of transactions of supply of goods and services. 6. ___ includes non-taxable supply. 7. Non-Resident Taxable person can file return in form ___.

Understand the Problem

The question involves multiple choice questions related to tax concepts, specifically GST and transactional details in the context of Indian taxation.

Answer

1. supply 2. IGST 3. Export of goods 4. time of supply 5. Invoice 6. Aggregate Turnover 7. GSTR – 5

- supply 2. IGST 3. Export of goods 4. time of supply 5. Invoice 6. Aggregate Turnover 7. GSTR – 5

Answer for screen readers

- supply 2. IGST 3. Export of goods 4. time of supply 5. Invoice 6. Aggregate Turnover 7. GSTR – 5

More Information

GST is essentially a multi-stage tax that is levied on each point of sale or service, but is eventually borne by the end-consumer.

Tips

A common mistake is confusing 'supply' with 'consumption' for the GST charge. Ensure correct tax forms are selected for specific taxpayer categories.

Sources

- What is SGST, CGST, IGST and UTGST? - ClearTax - cleartax.in

- Goods and Services Tax: What is GST in India? Indirect Tax Law - ClearTax - cleartax.in

- Integrated Goods and Services Tax (IGST) - WBComtax - wbcomtax.gov.in

AI-generated content may contain errors. Please verify critical information