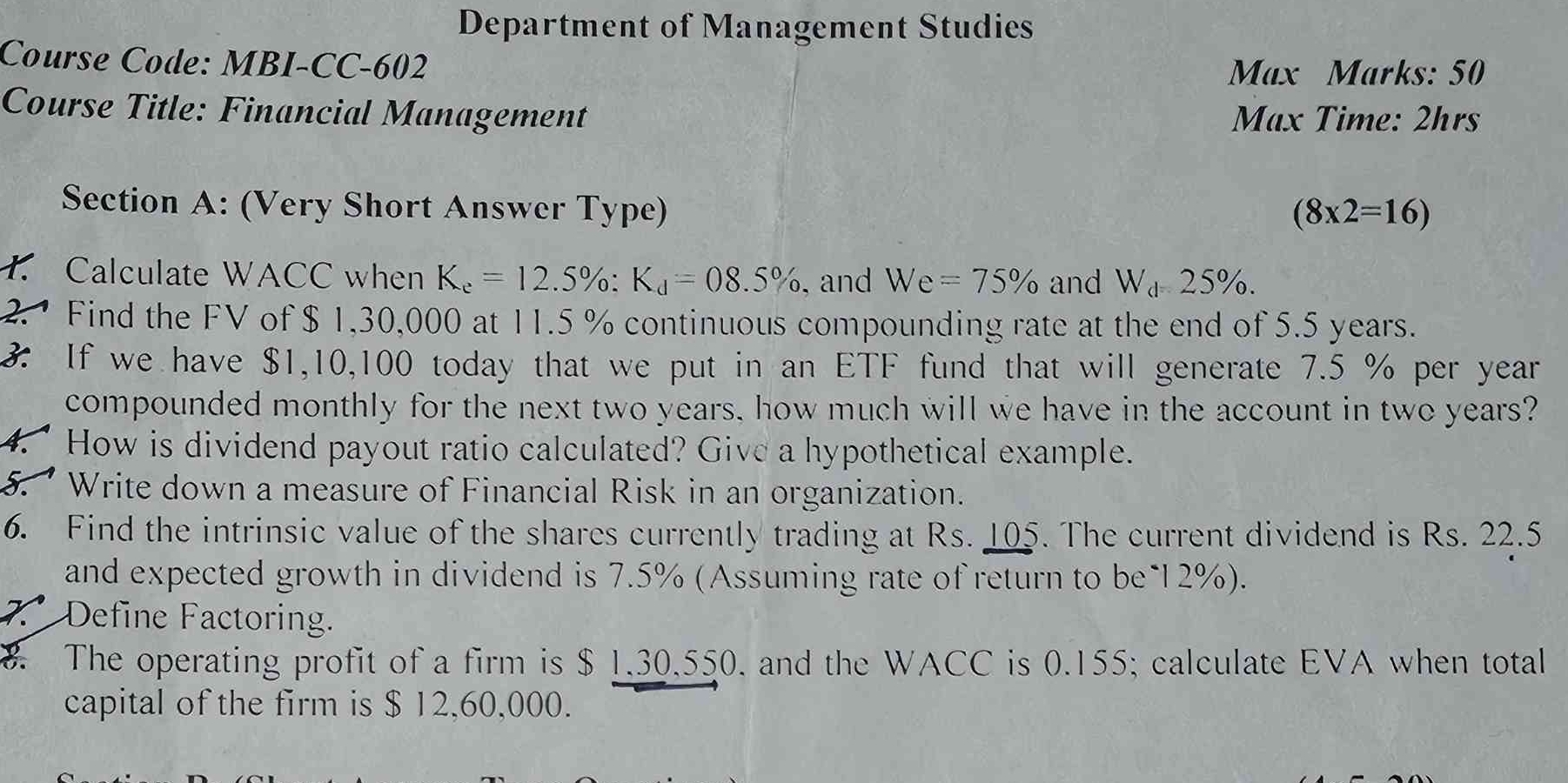

1. Calculate WACC when Ke = 12.5%; Kd = 08.5%, and We = 75% and Wd = 25%. 2. Find the FV of $130,000 at 11.5% continuous compounding rate at the end of 5.5 years. 3. If we have $11... 1. Calculate WACC when Ke = 12.5%; Kd = 08.5%, and We = 75% and Wd = 25%. 2. Find the FV of $130,000 at 11.5% continuous compounding rate at the end of 5.5 years. 3. If we have $110,100 today that we put in an ETF fund that will generate 7.5% per year compounded monthly for the next two years, how much will we have in the account in two years? 4. How is dividend payout ratio calculated? Give a hypothetical example. 5. Write down a measure of Financial Risk in an organization. 6. Find the intrinsic value of the shares currently trading at Rs. 105. The current dividend is Rs. 22.5 and expected growth in dividend is 7.5%. (Assuming rate of return to be 12%). 7. Define Factoring. 8. The operating profit of a firm is $130,550, and the WACC is 0.155; calculate EVA when total capital of the firm is $12,60,000.

Understand the Problem

The questions are related to Financial Management topics, including calculations for WACC, FV, investment growth, dividend payout ratios, financial risk measures, intrinsic value, and EVA calculations. Each question requires mathematical computations or theoretical explanations based on financial principles.

Answer

1. $0.115$ or $11.5\%$ 2. $243,880$ 3. $127,294.16$ 4. $20\%$ 5. Debt to Equity Ratio 6. $537.5$ 7. Factoring: Breaking down expressions. 8. $-64,750$

Answer for screen readers

-

WACC = $0.115$ or $11.5%$

-

FV = $243,880$

-

FV in ETF = $127,294.16$

-

Dividend Payout Ratio = $20%$

-

Measure of Financial Risk: Debt to Equity Ratio

-

Intrinsic Value = $537.5$

-

Factoring: Breaking down expressions.

-

EVA = $-64,750$

Steps to Solve

- Calculate WACC WACC (Weighted Average Cost of Capital) is calculated using the formula: $$ WACC = (E/V) * K_e + (D/V) * K_d * (1 - T) $$ Given that $K_e = 12.5%$, $K_d = 8.5%$, $W_e = 75%$, and $W_d = 25%$, and assuming there are no taxes (T=0):

- Convert percentages to decimals:

- $K_e = 0.125$

- $K_d = 0.085$

- $W_e = 0.75$

- $W_d = 0.25$

Plug in the values into the WACC formula: $$ WACC = (0.75 * 0.125) + (0.25 * 0.085) = 0.09375 + 0.02125 = 0.115 $$ So, $WACC = 11.5%$.

- Find the FV of $130,000 To find the future value (FV) with continuous compounding, we use the formula: $$ FV = P \cdot e^{rt} $$ Where ( P = 130,000 ), ( r = 0.115 ), and ( t = 5.5 ): $$ FV = 130,000 \cdot e^{(0.115 \cdot 5.5)} $$ Calculate:

- Compute ( r \cdot t = 0.115 \times 5.5 \approx 0.6325 ).

- Then compute ( e^{0.6325} \approx 1.876 ).

Finally, calculate FV: $$ FV \approx 130,000 \cdot 1.876 \approx 243,880 $$

- Calculate future value in ETF For the ETF growth, use the formula for compound interest: $$ FV = P(1 + r/n)^{nt} $$ Where ( P = 110,100 ), ( r = 0.075 ), ( n = 12 ) (monthly), and ( t = 2 ):

- Substitute values: $$ FV = 110,100 \left(1 + \frac{0.075}{12}\right)^{12 \cdot 2} $$ Calculate:

- Rate per month: ( \frac{0.075}{12} \approx 0.00625 ).

- Calculate ( (1 + 0.00625)^{24} \approx (1.00625)^{24} \approx 1.1616 ).

Finally, calculate FV: $$ FV \approx 110,100 \cdot 1.1616 \approx 127,294.16 $$

-

Dividend Payout Ratio The dividend payout ratio is calculated as: $$ \text{Dividend Payout Ratio} = \frac{Dividends}{Net Income} $$ Hypothetical example: If a company pays $20,000 in dividends and has a net income of $100,000, then: $$ \text{Dividend Payout Ratio} = \frac{20,000}{100,000} = 0.20 \text{ or } 20%. $$

-

Measure of Financial Risk A common measure of financial risk can be the Debt to Equity Ratio (D/E), which assesses the financial leverage of an organization.

-

Intrinsic Value Calculation Using the Gordon Growth Model: $$ P_0 = \frac{D_0(1 + g)}{r - g} $$ Where ( D_0 = 22.5 ), ( r = 0.12 ), and ( g = 0.075 ): $$ P_0 = \frac{22.5 \cdot (1 + 0.075)}{0.12 - 0.075} $$ Calculate:

-

Find ( D_0(1 + g) = 22.5 \cdot 1.075 \approx 24.1875 ).

-

Then calculate intrinsic value: $$ P_0 = \frac{24.1875}{0.045} \approx 537.5 $$

-

Define Factoring Factoring refers to the process of breaking down an expression into products of simpler expressions.

-

Calculate EVA EVA (Economic Value Added) is calculated as: $$ EVA = NOPAT - (WACC \cdot Capital) $$ Where ( NOPAT = 130,550 ), ( WACC = 0.155 ), and Capital = 1,260,000:

-

Calculate the charge for capital: $$ WACC \cdot Capital = 0.155 \cdot 1,260,000 \approx 195,300 $$

-

Finally, EVA calculation: $$ EVA = 130,550 - 195,300 = -64,750 $$

-

WACC = $0.115$ or $11.5%$

-

FV = $243,880$

-

FV in ETF = $127,294.16$

-

Dividend Payout Ratio = $20%$

-

Measure of Financial Risk: Debt to Equity Ratio

-

Intrinsic Value = $537.5$

-

Factoring: Breaking down expressions.

-

EVA = $-64,750$

More Information

The calculations demonstrate the application of financial principles including WACC, future value, and EVA, which are crucial in investment and corporate finance decision-making.

Tips

- Confusing WACC with a singular cost of capital.

- Misapplying the continuous compounding formula, especially in interpreting time periods.

- Not converting percentages to decimals appropriately before calculations.

AI-generated content may contain errors. Please verify critical information