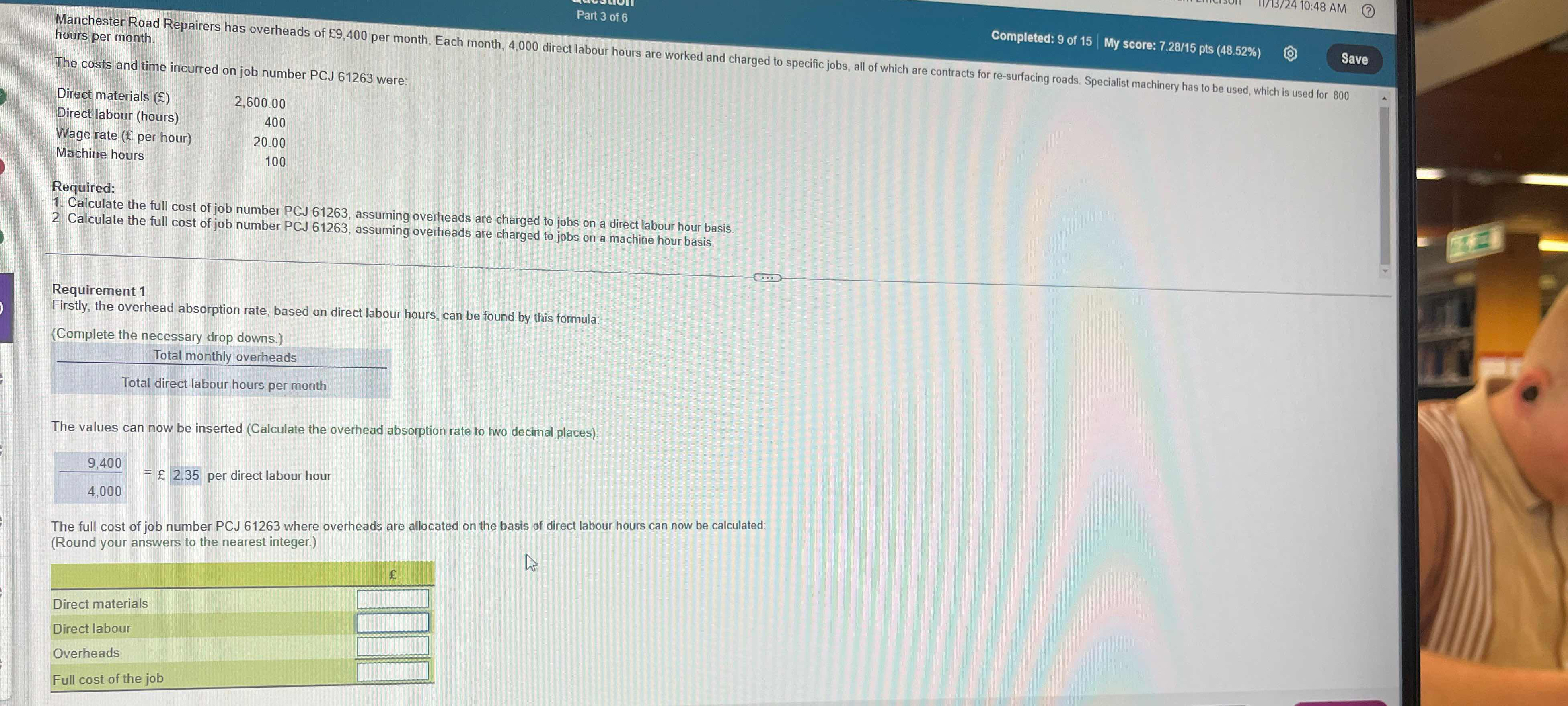

1. Calculate the full cost of job number PCJ 61263, assuming overheads are charged to jobs on a direct labour hour basis. 2. Calculate the full cost of job number PCJ 61263, assumi... 1. Calculate the full cost of job number PCJ 61263, assuming overheads are charged to jobs on a direct labour hour basis. 2. Calculate the full cost of job number PCJ 61263, assuming overheads are charged to jobs on a machine hour basis.

Understand the Problem

The question is asking to calculate the full cost of job number PCJ 61263 based on two different methods of allocating overheads: one based on direct labor hours and the other on machine hours. It involves understanding overhead absorption rates and applying them to compute total job costs.

Answer

The full cost of the job using direct labor hours is £10,540, and using machine hours is £11,775.

Answer for screen readers

The full cost of job PCJ 61263 is £10,540 when using direct labor hours and £11,775 when using machine hours.

Steps to Solve

- Calculate the Overhead Absorption Rate (Direct Labor Hours)

The total overheads are £9,400, and the total direct labor hours per month are 4,000.

Using the formula for the overhead absorption rate:

$$ \text{Overhead Absorption Rate} = \frac{\text{Total Overheads}}{\text{Total Direct Labor Hours}} = \frac{9400}{4000} = 2.35 \text{ per direct labor hour} $$

- Calculate Total Direct Labor Cost

Given the wage rate is £20 per hour, the total direct labor cost for 400 hours of labor can be calculated as follows:

$$ \text{Direct Labor Cost} = \text{Direct Labor Hours} \times \text{Wage Rate} = 400 \times 20 = 8000 $$

- Calculate Overhead Cost Using Direct Labor

Now, use the overhead absorption rate to calculate the total overhead costs allocated to job PCJ 61263:

$$ \text{Overhead Cost} = \text{Direct Labor Hours} \times \text{Overhead Absorption Rate} = 400 \times 2.35 = 940 $$

- Calculate Total Job Cost Using Direct Labor Hours

Finally, to find the full cost of job PCJ 61263, sum the direct materials, direct labor, and allocated overheads:

$$ \text{Full Cost} = \text{Direct Materials} + \text{Direct Labor Cost} + \text{Overhead Cost} = 2600 + 8000 + 940 = 10540 $$

- Calculate Overhead Absorption Rate (Machine Hours)

For machine hours, we need to calculate the overhead absorption rate using machine hours. Given that the machine hours used is 800:

$$ \text{Overhead Absorption Rate for Machine Hours} = \frac{9400}{800} = 11.75 \text{ per machine hour} $$

- Calculate Overhead Cost Using Machine Hours

Using the machine hours for job PCJ 61263:

$$ \text{Overhead Cost Using Machine Hours} = \text{Machine Hours} \times \text{Overhead Absorption Rate for Machine Hours} = 100 \times 11.75 = 1175 $$

- Calculate Total Job Cost Using Machine Hours

Finally, to find the total cost of the job using machine hours, sum the direct materials, direct labor, and overheads again:

$$ \text{Full Cost Using Machine Hours} = 2600 + 8000 + 1175 = 11775 $$

The full cost of job PCJ 61263 is £10,540 when using direct labor hours and £11,775 when using machine hours.

More Information

These calculations demonstrate how different bases for overhead absorption can impact the total job cost. Overhead rates are essential for accurately assigning indirect costs to specific jobs.

Tips

- Failing to correctly calculate the overhead absorption rate by mixing up the numerator and denominator.

- Not keeping track of the labor hours or machine hours properly, leading to incorrect cost calculations.

- Forgetting to include all costs (materials, labor, overhead) when calculating the full job cost.

AI-generated content may contain errors. Please verify critical information