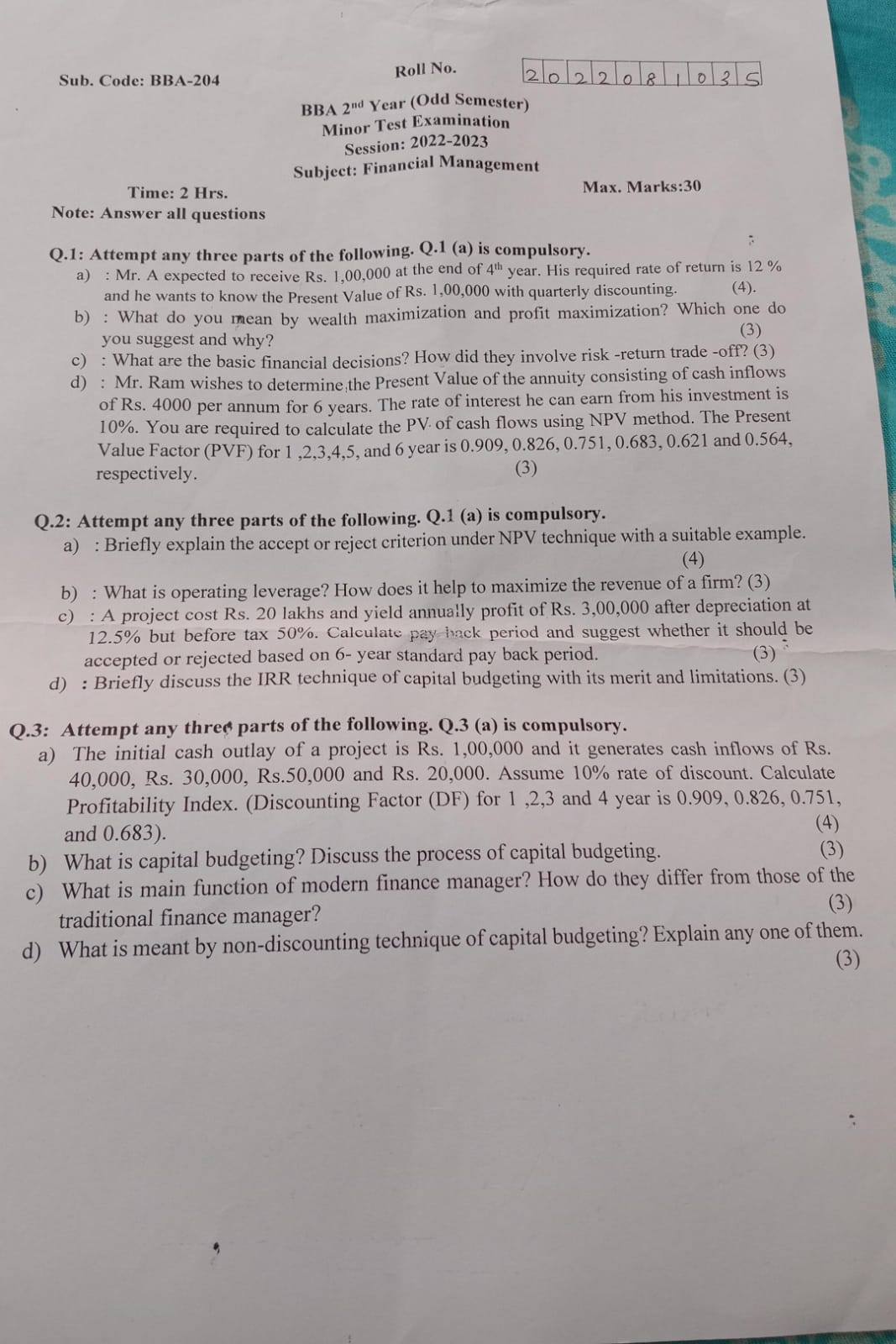

1. a) Mr. A expected to receive Rs. 1,00,000 at the end of 4th year. His required rate of return is 12% and he wants to know the Present Value of Rs. 1,00,000 with quarterly discou... 1. a) Mr. A expected to receive Rs. 1,00,000 at the end of 4th year. His required rate of return is 12% and he wants to know the Present Value of Rs. 1,00,000 with quarterly discounting. What do you mean by wealth maximization and profit maximization? Which one do you suggest and why? c) What are the basic financial decisions? How did they involve risk-return trade-off? d) Mr. Ram wishes to determine the Present Value of the annuity consisting of cash inflows of Rs. 4000 per annum for 6 years. The rate of interest he can earn from his investment is 10%. You are required to calculate the P.V. of cash flows using NPV method. The Present Value Factor (PVF) for 1, 2, 3, 4, 5, and 6 year is 0.909, 0.826, 0.751, 0.683, 0.621 and 0.564 respectively. 2. a) Briefly explain the accept or reject criterion under NPV technique with a suitable example. b) What is operating leverage? How does it help to maximize the revenue of a firm? c) A project cost Rs. 20 lakhs and yield annually profit of Rs. 3,00,000 after depreciation at 12.5% but before tax 50%. Calculate payback period and suggest whether it should be accepted or rejected based on 6-year standard payback period. d) Briefly discuss the IRR technique of capital budgeting with its merit and limitations. 3. a) The initial cash outlay of a project is Rs. 1,00,000 and it generates cash inflows of Rs. 40,000, Rs. 30,000, Rs. 50,000 and Rs. 20,000. Assume 10% rate of discount. Calculate Profitability Index. b) What is capital budgeting? Discuss the process of capital budgeting. c) What is the main function of a modern finance manager? How do they differ from those of the traditional finance manager? d) What is meant by non-discounting technique of capital budgeting? Explain any one of them.

Understand the Problem

The question is asking about various concepts in financial management, including present value calculations, risk-return trade-offs, capital budgeting techniques, operating leverage, and the roles of finance managers. It includes specific mathematical calculations as well as theoretical explanations.

Answer

The present value for Mr. A is approximately $63,673.41$, and for Mr. Ram, it is approximately $16,157.84$. Wealth maximization is preferred over profit maximization considering risks.

Answer for screen readers

Present Value of Rs. 1,00,000 after 4 years at 12% is approximately Rs. 63,673.41. Wealth maximization is preferred. Present Value of Mr. Ram's annuity is approximately Rs. 16,157.84. The Profitability Index is calculated as the ratio of total present value of inflows to the initial investment.

Steps to Solve

- Present Value Calculation for Mr. A

To calculate the present value (PV) of Rs. 1,00,000 at the end of 4 years with a required rate of return of 12% compounded quarterly, we can use the formula:

$$ PV = \frac{FV}{(1 + r/n)^{nt}} $$

Where:

- ( FV = 1,00,000 )

- ( r = 0.12 ) (annual interest rate)

- ( n = 4 ) (number of compounding periods per year)

- ( t = 4 ) (number of years)

Substituting the values: $$ PV = \frac{1,00,000}{(1 + 0.12/4)^{4 \cdot 4}} $$

- Wealth Maximization vs Profit Maximization

Wealth maximization focuses on increasing the overall value of the firm (market value of shares), while profit maximization emphasizes achieving the highest possible profit in the short term.

Discuss:

- Wealth maximization is preferred as it considers risk and time value of money.

- Profit maximization can ignore risks associated with investments.

- Risk-Return Trade-off and Financial Decisions

Financial decisions involve evaluating potential risks and returns. The risk-return trade-off indicates that higher potential returns on investment often come with higher risk. Examples:

- Choosing between safe, low-return investments and high-risk, high-return opportunities.

- Present Value of Annuity for Mr. Ram

For Mr. Ram, calculating the present value of cash inflows with an annuity of Rs. 4,000 per annum for 6 years at a 10% interest rate involves the formula:

$$ PV = C \cdot \left(\frac{1 - (1 + r)^{-n}}{r}\right) $$

Where:

- ( C = 4,000 )

- ( r = 0.10 )

- ( n = 6 )

Substituting the values: $$ PV = 4,000 \cdot \left(\frac{1 - (1 + 0.10)^{-6}}{0.10}\right) $$

- Cash Flow Calculation for Q3(a)

Calculate the profitability index using the discount factors:

- Initial outlay = Rs. 1,00,000

- Cash inflows are Rs. 40,000, Rs. 30,000, Rs. 50,000, and Rs. 20,000.

Calculate Present Value (PV) for each inflow and total:

$$ PV = (40,000 \times 0.909) + (30,000 \times 0.826) + (50,000 \times 0.751) + (20,000 \times 0.683) $$

Finally, calculate the Profitability Index:

$$ PI = \frac{Total PV}{Initial Investment} $$

Present Value of Rs. 1,00,000 after 4 years at 12% is approximately Rs. 63,673.41. Wealth maximization is preferred. Present Value of Mr. Ram's annuity is approximately Rs. 16,157.84. The Profitability Index is calculated as the ratio of total present value of inflows to the initial investment.

More Information

This financial analysis helps in making informed investment decisions by comparing the present value of future cash flows to current outlays, thus ensuring resource allocation effectively enhances firm value.

Tips

- Forgetting to adjust the discount rate when converting from annual to quarterly.

- Confusing wealth maximization with profit maximization, misunderstanding their implications.

- Incorrectly applying the annuity formula, especially with the number of periods.

AI-generated content may contain errors. Please verify critical information