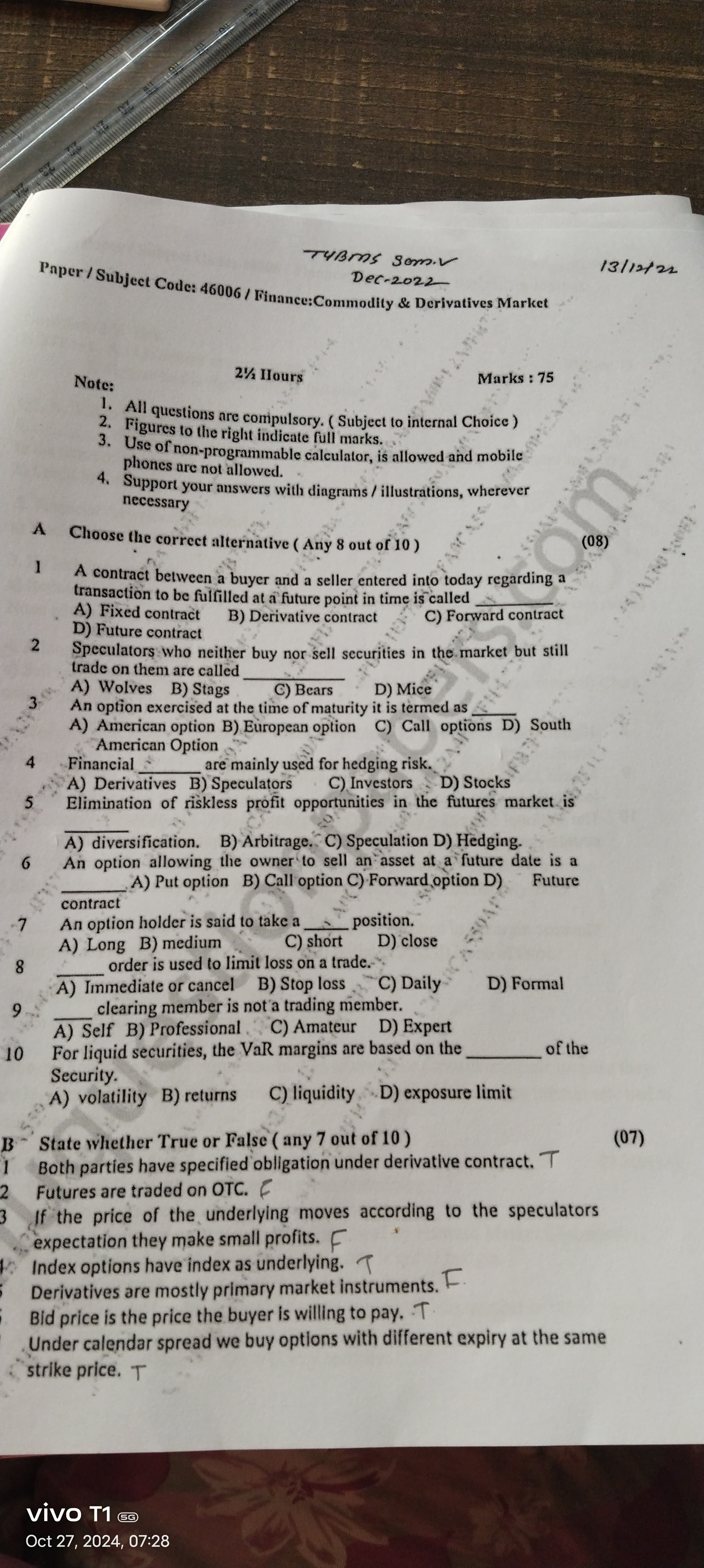

1. A contract between a buyer and a seller entered into today regarding a transaction to be fulfilled at a future point in time is called A) Fixed contract B) Derivative contract C... 1. A contract between a buyer and a seller entered into today regarding a transaction to be fulfilled at a future point in time is called A) Fixed contract B) Derivative contract C) Forward contract. 2. Speculators who neither buy nor sell securities in the market but still trade on them are called A) Wolves B) Stags C) Bears D) Mice. 3. An option exercised at the time of maturity is termed as A) American option B) European option C) Call options D) South American Option. 4. Financial __________ are mainly used for hedging risk. A) Derivatives B) Speculators C) Investors D) Stocks. 5. Elimination of riskless profit opportunities in the futures market is A) diversification B) Arbitrage C) Speculation D) Hedging. 6. An option allowing the owner to sell an asset at a future date is a __________ contract: A) Put option B) Call option C) Forward option D) Future contract. 7. An option holder is said to take a _____ position: A) Long B) medium C) short D) close. 8. __________ order is used to limit loss on a trade: A) Immediate or cancel B) Stop loss C) Daily D) Formal. 9. __________ clearing member is not a trading member: A) Self B) Professional C) Amateur D) Expert. 10. For liquid securities, the VaR margins are based on the __________ of the Security: A) volatility B) returns C) liquidity D) exposure limit.

Understand the Problem

The question appears to be derived from an exam paper related to finance, specifically focusing on the Commodity and Derivatives Market. It includes multiple-choice questions and true/false statements that test knowledge in this area.

Answer

1) Forward contract, 2) Stags, 3) European option, 4) Derivatives, 5) Arbitrage, 6) Put option, 7) Long, 8) Stop loss, 9) Professional, 10) Volatility.

The final answer is: 1) Forward contract, 2) Stags, 3) European option, 4) Derivatives, 5) Arbitrage, 6) Put option, 7) Long, 8) Stop loss, 9) Professional, 10) Volatility.

Answer for screen readers

The final answer is: 1) Forward contract, 2) Stags, 3) European option, 4) Derivatives, 5) Arbitrage, 6) Put option, 7) Long, 8) Stop loss, 9) Professional, 10) Volatility.

More Information

Forward contracts are agreements for future transactions. Stags are speculators who don't own shares but aim for IPOs. European options can only be exercised at maturity, and derivatives are common for hedging.

Tips

Common mistake: confusing American and European options. Remember, European options can only be exercised at expiration.

Sources

- Forward Contracts vs. Futures Contracts - investopedia.com

- MCQs on Stock Exchange - byjus.com

AI-generated content may contain errors. Please verify critical information