Podcast

Questions and Answers

What are the three characteristics that equity investors in a VIE lack to possess a controlling financial interest?

What are the three characteristics that equity investors in a VIE lack to possess a controlling financial interest?

- Power to direct activities impacting economic performance; 2) Obligation to absorb expected losses; 3) Right to receive expected residual returns.

What distinguishes the primary beneficiary of a VIE from equity investors?

What distinguishes the primary beneficiary of a VIE from equity investors?

The primary beneficiary has the power to direct significant activities and the obligation to absorb significant losses or receive benefits.

Why is it inconsequential for the primary beneficiary to own voting shares in a VIE?

Why is it inconsequential for the primary beneficiary to own voting shares in a VIE?

Because the ability to exercise control does not solely depend on equity ownership; control may arise from other rights and obligations.

What role do a VIE's governing documents play in determining control?

What role do a VIE's governing documents play in determining control?

How did Twin Peaks intend to use the electric generating plant it acquired?

How did Twin Peaks intend to use the electric generating plant it acquired?

What financial implications did Twin Peaks' credit rating have on its acquisition financing?

What financial implications did Twin Peaks' credit rating have on its acquisition financing?

What is the significance of having an enterprise with a controlling financial interest in a VIE?

What is the significance of having an enterprise with a controlling financial interest in a VIE?

Why is determining the primary beneficiary of a VIE crucial for financial reporting?

Why is determining the primary beneficiary of a VIE crucial for financial reporting?

What are the two primary conditions that must be met for Twin Peaks Electric Company to consolidate Power Finance Company?

What are the two primary conditions that must be met for Twin Peaks Electric Company to consolidate Power Finance Company?

What indicates that Power Finance qualifies as a Variable Interest Entity (VIE)?

What indicates that Power Finance qualifies as a Variable Interest Entity (VIE)?

What must Twin Peaks demonstrate to be considered the primary beneficiary of Power Finance?

What must Twin Peaks demonstrate to be considered the primary beneficiary of Power Finance?

How does Twin Peaks’s financial arrangement with Power Finance reflect the risks associated with VIE status?

How does Twin Peaks’s financial arrangement with Power Finance reflect the risks associated with VIE status?

What specific characteristic of Power Finance's equity investments indicates low risk for investors?

What specific characteristic of Power Finance's equity investments indicates low risk for investors?

Why is the 10 percent benchmark for equity investment significant in determining VIE status?

Why is the 10 percent benchmark for equity investment significant in determining VIE status?

What financial structure can indicate a lack of sufficient equity for a company and its potential classification as a VIE?

What financial structure can indicate a lack of sufficient equity for a company and its potential classification as a VIE?

In the context of Power Finance, what are the implications of Twin Peaks enjoying residual profits?

In the context of Power Finance, what are the implications of Twin Peaks enjoying residual profits?

What must be eliminated in each subsequent consolidation due to the lack of outside party transactions?

What must be eliminated in each subsequent consolidation due to the lack of outside party transactions?

What difficulty arises when a parent company purchases an affiliate's debt instruments from an outside party?

What difficulty arises when a parent company purchases an affiliate's debt instruments from an outside party?

After a parent company acquires its affiliate's debt, how is this liability treated in consolidation?

After a parent company acquires its affiliate's debt, how is this liability treated in consolidation?

What constitutes a variable interest entity (VIE) and what are its common forms?

What constitutes a variable interest entity (VIE) and what are its common forms?

Who is considered the primary beneficiary of a variable interest entity?

Who is considered the primary beneficiary of a variable interest entity?

What amount did Alpha pay in excess due to periodic amortization during bond retirement?

What amount did Alpha pay in excess due to periodic amortization during bond retirement?

Identify two benefits of using a variable interest entity.

Identify two benefits of using a variable interest entity.

What is the initial measurement of subsidiary preferred stock not owned by the parent?

What is the initial measurement of subsidiary preferred stock not owned by the parent?

What percentage of Salida Company did Pinto Company acquire on July 1, 2023?

What percentage of Salida Company did Pinto Company acquire on July 1, 2023?

What limits the activities and decision-making in a variable interest entity?

What limits the activities and decision-making in a variable interest entity?

Explain the role of equity investors in a variable interest entity.

Explain the role of equity investors in a variable interest entity.

At acquisition, what was the fair value of the 10 percent noncontrolling interest in Salida Company?

At acquisition, what was the fair value of the 10 percent noncontrolling interest in Salida Company?

What must be included in the consolidated income statement after Salida Company’s acquisition?

What must be included in the consolidated income statement after Salida Company’s acquisition?

Why may a variable interest entity not be consolidated in financial reports prior to current requirements?

Why may a variable interest entity not be consolidated in financial reports prior to current requirements?

Describe the financial relationship during the consolidation of a variable interest entity.

Describe the financial relationship during the consolidation of a variable interest entity.

List two common activities associated with variable interest entities.

List two common activities associated with variable interest entities.

What are the two options Payton has at the end of the five-year agreement with Vincente?

What are the two options Payton has at the end of the five-year agreement with Vincente?

What is the market rate of annual interest agreed upon in the loan agreement between Vincente and Payton?

What is the market rate of annual interest agreed upon in the loan agreement between Vincente and Payton?

How does the agreement impact the status of Vincente as a variable interest entity (VIE) and Payton as its primary beneficiary?

How does the agreement impact the status of Vincente as a variable interest entity (VIE) and Payton as its primary beneficiary?

What was the fair value of Vincente's common stock estimated by Payton, and what is the significance of the $125,000 difference?

What was the fair value of Vincente's common stock estimated by Payton, and what is the significance of the $125,000 difference?

What must be eliminated during the consolidation process of a VIE with its primary beneficiary?

What must be eliminated during the consolidation process of a VIE with its primary beneficiary?

What enhanced disclosures are required for an enterprise that holds a variable interest in a VIE?

What enhanced disclosures are required for an enterprise that holds a variable interest in a VIE?

What is the estimated remaining life of the patented technology for which the $125,000 difference in value was attributed?

What is the estimated remaining life of the patented technology for which the $125,000 difference in value was attributed?

What financial management fee is Vincente obligated to pay Payton annually based on sales?

What financial management fee is Vincente obligated to pay Payton annually based on sales?

Study Notes

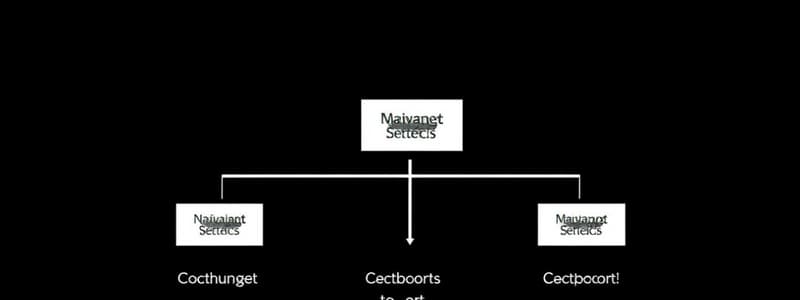

Variable Interest Entities (VIEs)

- VIEs are often established for valid business purposes, set up as separate legal entities like trusts, joint ventures, partnerships, or corporations.

- VIEs may lack independent management or employees.

- VIE activities include:

- Transferring financial assets

- Leasing

- Hedging financial instruments

- Research and development

- VIEs may offer benefits:

- Lower interest rates

- Low-cost asset financing

- Governing agreements limit VIE activities and decision-making.

Primary Beneficiary

- The entity creating the VIE might not own any of its voting stock.

- The primary beneficiary exercises control over the VIE through governance documents or contractual agreements.

- The primary beneficiary must consolidate the VIE's assets, liabilities, revenues, expenses, and noncontrolling interest in its financial statements.

Characteristics of VIEs

- VIEs possess assets, liabilities, and investors with equity interests.

- Activities are strictly limited.

- Equity investors may have a minor role, solely allowing the VIE to function as a legal entity.

- Investors receive a small rate of return due to minimal economic risk.

- Equity investors lack one or more of the following characteristics of a controlling financial interest:

- Power to direct activities through voting rights or similar rights.

- Obligation to absorb expected losses.

- Right to receive expected residual returns.

Identification of Primary Beneficiary

- An enterprise with a variable interest and a controlling financial interest in a VIE is the primary beneficiary and holds:

- Power to direct VIE's activities impacting its economic performance

- Obligation to absorb significant losses or right to receive benefits from the VIE

- The primary beneficiary absorbs a significant portion of the VIE's losses or receives a significant share of its residual returns, or both.

- The lack of voting shares doesn't negate control, as it doesn't impact decision-making power.

- Determining control requires examining the VIE's governing documents and identifying who bears the risk.

Consolidation of a Primary Beneficiary & VIE

- When consolidating a VIE, two conditions must be met:

- The VIE must qualify as a VIE:

- Inability to secure financing without additional support.

- Lack of risk of losses or entitlement to residual returns.

- The enterprise must qualify as the primary beneficiary:

- Power to direct activities.

- Obligation to absorb losses or right to receive returns.

- The VIE must qualify as a VIE:

- Consolidate the VIE with its primary beneficiary in a similar manner to consolidation based on voting interests.

- Eliminate intra-entity transactions between the primary beneficiary and the VIE.

- Allocate the VIE's net income considering the contractual arrangements between the primary beneficiary and other variable interest holders.

Disclosure Requirements for VIEs

- Enterprises holding a variable interest in a VIE must disclose:

- VIE's nature, purpose, size, and activities.

- Judgments and assumptions made in determining consolidation or disclosure requirements.

Debt Acquisition from Outside Party

- Acquiring an affiliate's debt from an outside party impacts consolidation.

- From a consolidated viewpoint, the parent reacquires its own bonds when purchasing all or part of outstanding subsidiary bonds.

- This liability is effectively retired at the debt reacquisition date.

- Subsequent interest payments become intra-entity cash transfers.

Consolidated Statement of Cash Flows

Include the noncontrolling interest in the consolidated statement of cash flows:

- Report the noncontrolling interest acquisition as a cash outflow in the financing activities section.

- Allocate the cash flow generated by the subsidiary to controlling and noncontrolling interest.

- Adjust the equity portion of the consolidated statement of cash flows to reflect the noncontrolling interest.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.

Related Documents

Description

This quiz explores the concept of Variable Interest Entities (VIEs), their purpose, characteristics, and the role of the primary beneficiary. Learn about how VIEs are structured and their impacts on financial reporting and decision-making. Test your knowledge on this important business and accounting topic.