Podcast

Questions and Answers

Hawalanders are always responsible for fulfilling their obligations and using funds for customers' benefit.

Hawalanders are always responsible for fulfilling their obligations and using funds for customers' benefit.

False (B)

The hawala system is regulated by a central authority to prevent fraudulent practices.

The hawala system is regulated by a central authority to prevent fraudulent practices.

False (B)

The value of transfer through the hawala system is not affected by fluctuations in exchange rates or other market conditions.

The value of transfer through the hawala system is not affected by fluctuations in exchange rates or other market conditions.

False (B)

The 2019 hawala case in the agricultural sector involved only Dutch potato and onion traders.

The 2019 hawala case in the agricultural sector involved only Dutch potato and onion traders.

The surveyed agricultural product traders in the Netherlands reported accepting cash payments because of a well-functioning banking system with Mauritania.

The surveyed agricultural product traders in the Netherlands reported accepting cash payments because of a well-functioning banking system with Mauritania.

The investigation found that the companies involved in the hawala case were not used to launder criminal money.

The investigation found that the companies involved in the hawala case were not used to launder criminal money.

Underground banking involves making transactions through a formal banking system.

Underground banking involves making transactions through a formal banking system.

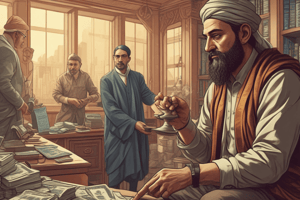

Hawala banking is a formal system of making transactions based on trust and government supervision.

Hawala banking is a formal system of making transactions based on trust and government supervision.

Hawala banking is a relatively new system of making transactions.

Hawala banking is a relatively new system of making transactions.

The main reasons for using Hawala banking are to follow government regulations and to reduce the speed of transactions.

The main reasons for using Hawala banking are to follow government regulations and to reduce the speed of transactions.