Podcast

Questions and Answers

The beginning inventory of Kesten Tires and Battery Supply was P 165,256.13 and the total purchases amounted to P ______.

The beginning inventory of Kesten Tires and Battery Supply was P 165,256.13 and the total purchases amounted to P ______.

110,901.45

The cost of goods sold for Kesten Tires and Battery Supply was P ______.

The cost of goods sold for Kesten Tires and Battery Supply was P ______.

177,614.95

The gross profit for Kristen Angel Dept. Store was P ______.

The gross profit for Kristen Angel Dept. Store was P ______.

2,171,357.87

The total operating expenses for Kristen Angel Dept. Store were P ______.

The total operating expenses for Kristen Angel Dept. Store were P ______.

Net profit for Kristen Angel Dept. Store was P ______.

Net profit for Kristen Angel Dept. Store was P ______.

Flashcards

Cost of Goods Sold (COGS)

Cost of Goods Sold (COGS)

The direct costs attributable to the production of goods sold during a specific period.

Gross Profit

Gross Profit

The difference between net sales and the cost of goods sold.

Operating Expenses

Operating Expenses

All the expenses incurred in running the business (excluding COGS).

Net Profit (or Net Income)

Net Profit (or Net Income)

Signup and view all the flashcards

Inventory

Inventory

Signup and view all the flashcards

Study Notes

Disclaimer

- This learning material belongs to La Consolacion College Tanauan.

- Any reproduction or redistribution, except for personal, non-commercial use, is prohibited.

- Printed or downloaded extracts are allowed for personal use, with proper acknowledgement.

- Copying to individual third parties is permitted, also with proper acknowledgement.

- Distribution or commercial exploitation is not allowed.

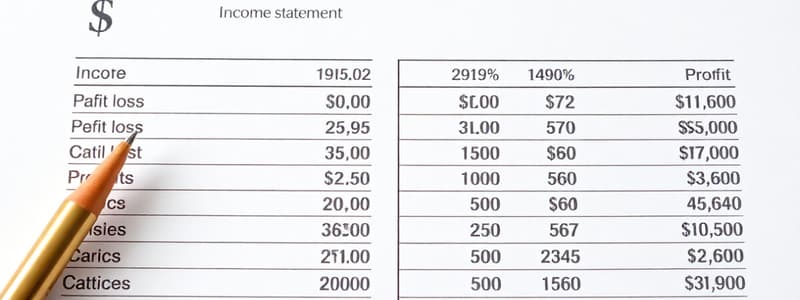

Income Statement

- Profit is the difference between the invested amount and the monetary gain.

Profit and Loss

- Gross: Total amount without deductions.

- Net: Remaining amount after deductions.

- Gross Sales: Amount received from goods sold.

- Net Sales: Gross sales minus refunds and allowances.

- Returns, Allowances, and Discounts: Payments to customers for returned merchandise, defective goods, or price adjustments.

Formulas

- Gross Profit = Net Sales - Cost of Goods Sold

- Net Sales = Gross Sales - Refunds and Allowances

- Net Profit = Gross Profit - Operating Expenses

- Available Goods = Beginning Inventory + Purchases

- Cost of Goods Sold = Available Goods - Ending Inventory

Cost of Goods Sold

- Cost of Goods Sold (COGS) or Buying Price: Actual amount paid for items, including buying expenses.

- Inventory: Itemized list of goods on hand.

- Gross Profit: Net sales minus cost of goods sold.

- Net Profit: Gross profit minus all selling expenses.

- Operating/Overhead Expenses: Expenses during product sales (wages, utilities, rent, transportation, commissions).

Losses

- Losses occur when losses exceed desired profits.

- Loss: Deduction in the value of investment.

Gross Loss and Net Loss

- Gross Loss = Cost of Goods Sold - Net Sales

- Net Loss = Gross Loss + Operating Expenses

- Gross Loss = Greater Sales than Net Sales

- Net Loss = Adding gross and operating expenses or selling expenses

Example 1

- Initial Merchandise Inventory (May 1): P 165,256.13

- Purchases (after May 1): P 100,901.45

- Ending Inventory (July 31): P 98,542.63

- Cost of Goods Sold: P 177,614.95

Example 2

-

Total Sales (December): P 5,976,418.12

-

Cost of Goods (December): P 2,324,080.25

-

Salaries/Wages: P 170,910.83

-

Rent: P 350,000

-

Light & Water Bills: P 418,265.34

-

Miscellaneous Expenses: P 120,450.25

-

Other Merchandise (December): P 1,480,980.00

-

Calculations for gross profit, operating expenses, and net profit are present in the document.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.

Related Documents

Description

This quiz covers the key concepts of profit and loss, including the definitions of gross and net figures, as well as how to calculate them using relevant formulas. You will explore income statements, sales figures, and the importance of deductions such as refunds and allowances.