Podcast

Questions and Answers

What was the acquisition cost of Mobileye by Intel in 2017?

What was the acquisition cost of Mobileye by Intel in 2017?

In which industry did the Intel-Mobileye merger primarily take place?

In which industry did the Intel-Mobileye merger primarily take place?

Which year did Intel acquire Mobileye?

Which year did Intel acquire Mobileye?

What was a notable significance of the Intel-Mobileye merger?

What was a notable significance of the Intel-Mobileye merger?

Signup and view all the answers

Which company was acquired by Intel?

Which company was acquired by Intel?

Signup and view all the answers

What was the revenue of Mobileye in 2016?

What was the revenue of Mobileye in 2016?

Signup and view all the answers

What was the increase in Mobileye’s revenue percentage from 2016 to 2017?

What was the increase in Mobileye’s revenue percentage from 2016 to 2017?

Signup and view all the answers

What was Intel's net income in 2017 after the merger?

What was Intel's net income in 2017 after the merger?

Signup and view all the answers

What was the approximate Price-to-Earnings (P/E) ratio of Mobileye before the merger?

What was the approximate Price-to-Earnings (P/E) ratio of Mobileye before the merger?

Signup and view all the answers

What was the total revenue of Intel in 2016?

What was the total revenue of Intel in 2016?

Signup and view all the answers

What was the initial financial impact of Mobileye’s integration for Intel?

What was the initial financial impact of Mobileye’s integration for Intel?

Signup and view all the answers

What did Mobileye’s integration primarily contribute to for Intel?

What did Mobileye’s integration primarily contribute to for Intel?

Signup and view all the answers

What is implied about the market after Mobileye's integration with Intel?

What is implied about the market after Mobileye's integration with Intel?

Signup and view all the answers

How did the long-term benefits of the integration compare to the costs?

How did the long-term benefits of the integration compare to the costs?

Signup and view all the answers

Which statement best describes the integration's effect on Intel's future?

Which statement best describes the integration's effect on Intel's future?

Signup and view all the answers

Study Notes

Student Names and University Numbers

- Al-Yaman Sultan Aljabour: 2239604, Seat 46

- Mirna Emad Haddad: 2230350, Seat 24

- Mohammed Abdullah Lahad Al-Othman: 2232233, Seat 38

- Moamen Mohammed Ahmad Al-Shawabkeh: 2236375, Seat 42

- Aida Naser Alimat: 2334952, Seat 48

- Bahaauddin Fadi Ali Al-Subaihat: 2130401, Seat 8

- Osama Mahmoud Saeed Yousef: 2236637, Seat 43

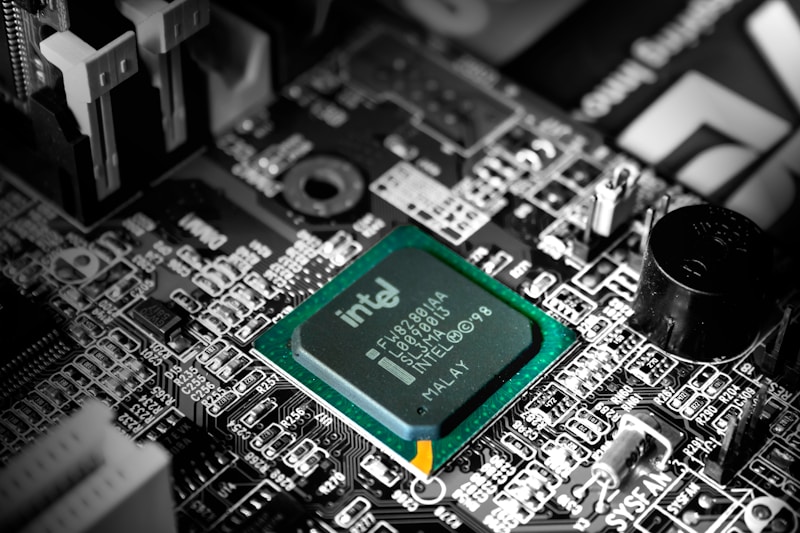

Intel Acquires Mobileye

- Intel Corporation acquired Mobileye, an Israeli autonomous driving technology company, in 2017.

- This was a landmark deal marking Intel's entry into the autonomous vehicle market.

- Mobileye was established in 1999, known for advanced driver-assistance systems (ADAS) and autonomous driving solutions.

- Intel, known for microprocessors, expanded its interests in data-centric technologies.

- The primary motivations for the acquisition included diversifying Intel's business and establishing a leading position in the autonomous vehicle industry.

- Mobileye's expertise in computer vision and sensor technology was crucial.

- The deal was valued at approximately $15.3 billion, a significant transaction in the automotive technology sector.

- Intel paid a 34% premium over Mobileye's stock price.

- The transaction involved purchasing 84% of Mobileye's outstanding shares.

- Stakeholders included Mobileye's founders, employees, and shareholders, along with Intel executive leadership and board members.

Financial Analysis of the Merger

- Mobileye reported $358 million in annual revenue and a gross margin exceeding 70% before the acquisition.

- Intel anticipated immediate value addition to its data-centric business.

- Post-acquisition, goodwill represented a major portion of the acquisition cost reflecting Intel's expectations of future synergies and market leadership.

- Short-term increases in operating expenses occurred due to integration efforts, but long-term profitability was projected.

Impact and Strategic Implications

- The acquisition solidified Intel's presence in the autonomous vehicle market, giving it a competitive edge against rivals such as Nvidia and Qualcomm.

- The deal leveraged Mobileye's advanced technologies with Intel's processing capabilities, positioning it as a primary player in self-driving systems.

- Intel expanded its market reach by targeting automakers and technology companies seeking integrated autonomous driving solutions.

Accounting Treatment

- The transaction followed the purchase method under U.S. GAAP and IFRS.

- Assets and liabilities were revalued at fair market value upon acquisition including adjustments to inventory, deferred revenue, and legal contingencies.

- Goodwill emerged as a significant part of the purchase price reflecting the anticipated future synergies, brand strength, and technological advancements.

- Intangible assets included proprietary technology, customer relationships, and trade names.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.

Related Documents

Description

This quiz explores Intel's acquisition of Mobileye, detailing the significance of this landmark deal in 2017. It examines Mobileye's history, its role in autonomous driving technology, and how the acquisition reflects Intel's strategic shift towards data-centric technologies. Test your knowledge on the motivations and implications of this acquisition.