Podcast

Questions and Answers

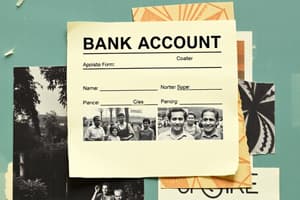

What are the mandatory documents required to create a bank account?

What are the mandatory documents required to create a bank account?

- Passport and driver's license

- Aadhaar Card and PAN Card (correct)

- Passport and ration card

- Driver's license and voter's ID

What is the purpose of a ration card in India?

What is the purpose of a ration card in India?

- To apply for a voter's ID

- To purchase subsidised food grain through the Public Distribution System (correct)

- To open a bank account

- To obtain a passport

What is the first step to open a bank account according to the text?

What is the first step to open a bank account according to the text?

- Fill in personal details in the bank account opening form

- Wait for the Bank to assess documents

- Submit KYC documents

- Visit the bank branch or apply online (correct)

Which organization has mandated Indian banks to require specific documents for opening a bank account?

Which organization has mandated Indian banks to require specific documents for opening a bank account?

How long do banks usually take for new account approvals?

How long do banks usually take for new account approvals?

Which personal details are required in the bank account opening form?

Which personal details are required in the bank account opening form?

Which documents are generally required as proof of identity when opening a new bank account?

Which documents are generally required as proof of identity when opening a new bank account?

What is the primary purpose of submitting KYC documents when opening a bank account?

What is the primary purpose of submitting KYC documents when opening a bank account?

Why do banks request applicants to commit to the basic terms and conditions of the bank in the account opening form?

Why do banks request applicants to commit to the basic terms and conditions of the bank in the account opening form?

What is the main reason M/s Saraswathi Trading Enterprises wants a working capital facility of Rs.50 lakhs?

What is the main reason M/s Saraswathi Trading Enterprises wants a working capital facility of Rs.50 lakhs?

Which financial ratio provides an insight into the firm's ability to cover its current liabilities with its current assets?

Which financial ratio provides an insight into the firm's ability to cover its current liabilities with its current assets?

What is the primary reason why financial parameters alone may not provide a comprehensive view of a firm's overall business position?

What is the primary reason why financial parameters alone may not provide a comprehensive view of a firm's overall business position?

In the context provided, which of the following documents can be accepted as identity proof but not as address proof?

In the context provided, which of the following documents can be accepted as identity proof but not as address proof?

When a firm's Turnover Ratio is high, what does this indicate?

When a firm's Turnover Ratio is high, what does this indicate?

Which financial indicator assesses the relationship between a firm's debts and its shareholders' equity?

Which financial indicator assesses the relationship between a firm's debts and its shareholders' equity?

What is the significance of owning premises for a business seeking working capital?

What is the significance of owning premises for a business seeking working capital?

'Total Net Worth' in financial statements primarily refers to:

'Total Net Worth' in financial statements primarily refers to:

How does a high Debt-Equity Ratio affect a firm's financial health?

How does a high Debt-Equity Ratio affect a firm's financial health?

If a firm uses its assets efficiently resulting in a high Turnover Ratio, what effect does this have on its liquidity position?

If a firm uses its assets efficiently resulting in a high Turnover Ratio, what effect does this have on its liquidity position?